ri File Edit View History Bookmarks Window Help ter 6 assign

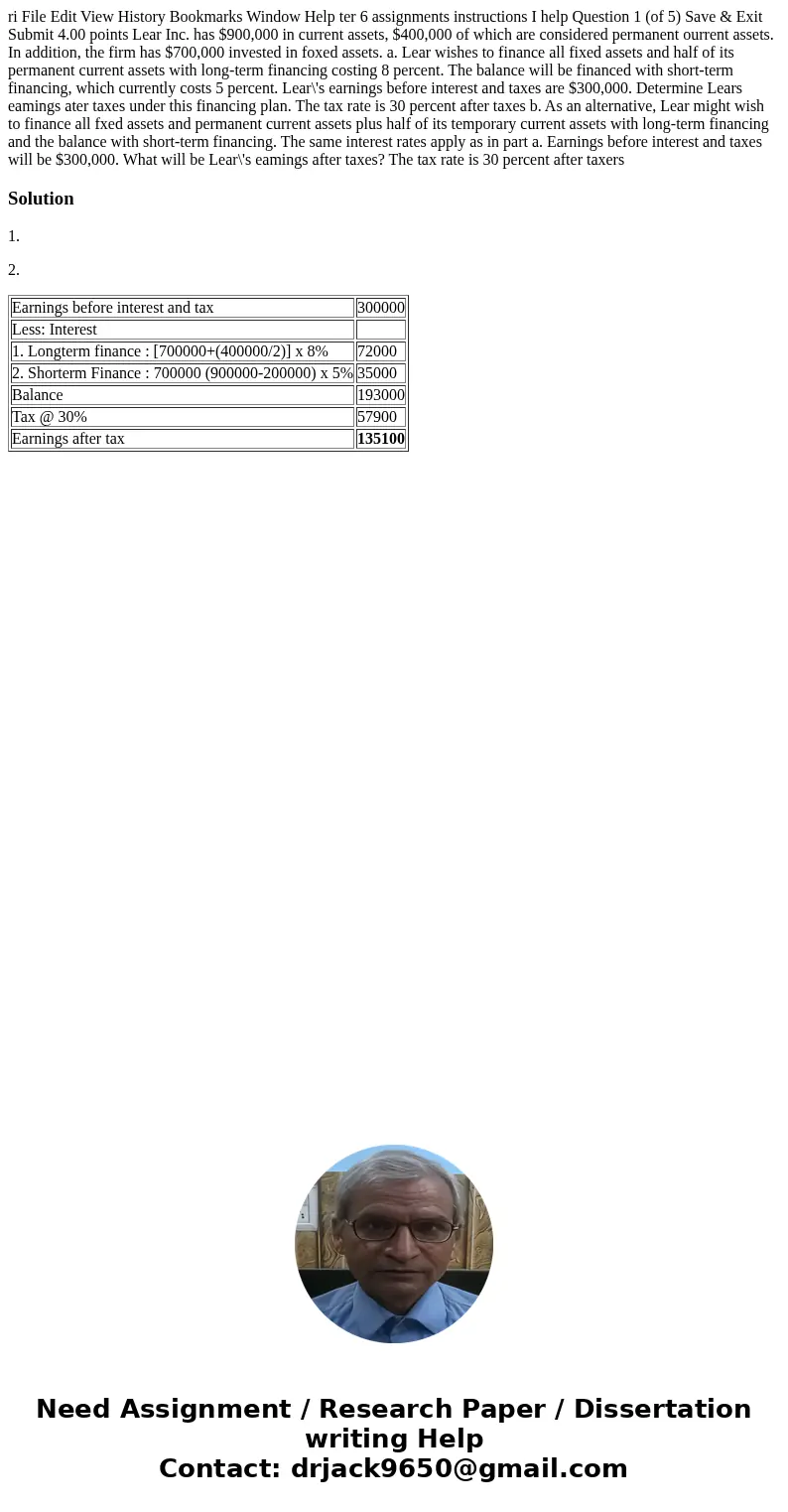

ri File Edit View History Bookmarks Window Help ter 6 assignments instructions I help Question 1 (of 5) Save & Exit Submit 4.00 points Lear Inc. has $900,000 in current assets, $400,000 of which are considered permanent ourrent assets. In addition, the firm has $700,000 invested in foxed assets. a. Lear wishes to finance all fixed assets and half of its permanent current assets with long-term financing costing 8 percent. The balance will be financed with short-term financing, which currently costs 5 percent. Lear\'s earnings before interest and taxes are $300,000. Determine Lears eamings ater taxes under this financing plan. The tax rate is 30 percent after taxes b. As an alternative, Lear might wish to finance all fxed assets and permanent current assets plus half of its temporary current assets with long-term financing and the balance with short-term financing. The same interest rates apply as in part a. Earnings before interest and taxes will be $300,000. What will be Lear\'s eamings after taxes? The tax rate is 30 percent after taxers

Solution

1.

2.

| Earnings before interest and tax | 300000 |

| Less: Interest | |

| 1. Longterm finance : [700000+(400000/2)] x 8% | 72000 |

| 2. Shorterm Finance : 700000 (900000-200000) x 5% | 35000 |

| Balance | 193000 |

| Tax @ 30% | 57900 |

| Earnings after tax | 135100 |

Homework Sourse

Homework Sourse