Consolidation at the end of the first year subsequent to dat

Consolidation at the end of the first year subsequent to date of acquisition-Equity method (purchase price equals book value) Assume that a parent company acquires its subsidiary on January 1, 2016, by exchanging 40,000 shares of its $1 par value Common Stock, with a market value on the acquisition date of $27 per share, for all of the outstanding voting shares of the acquiree. You have been charged with preparing the consolidation of these two companies at the end of the first year On the acquisition date, all of the subsidiary\'s assets and liabilities had fair values equaling their book values. Following are financial statements of the parent and its subsidiary for the year ended December 31, 2016 Parent Subsidiary Parent Subsidiary Balance sheet Income statement Sales Cost of goods sold Gross profit Equity income Operating expenses $ 2,960,000 $1,675,000 Assets (2,072,000) (1,008,000) Cash $ 696,920 432,880 378,880 349,760 574,240 500,640 888,000 667,000 Accounts receivable 230,200 -Inventory (562,400) (436,800) Equity investment 1,279,920 $555,800 $230,200 Property, plant & equipment 2,170,240 926,240 Net income $5,100,200 $2,209,520 Statement of retained earnings BOY retained earnings Net income 1,881,600 868,000 Liabilities and stockholders\' equity 555,800 230,200 Accounts payable (112,160) 30,280) Accrued liabilities s 2325,240 $1,067,920 Long-term liabilities $216,640 160,160 257,520 209,440 560,000 414,400 112,000 1,886,400 00,000 2,325,240 1,067,920 $5,100,200 $2,209,520 Dividends Ending retained earnings Common stock APIC Retained earnings

Solution

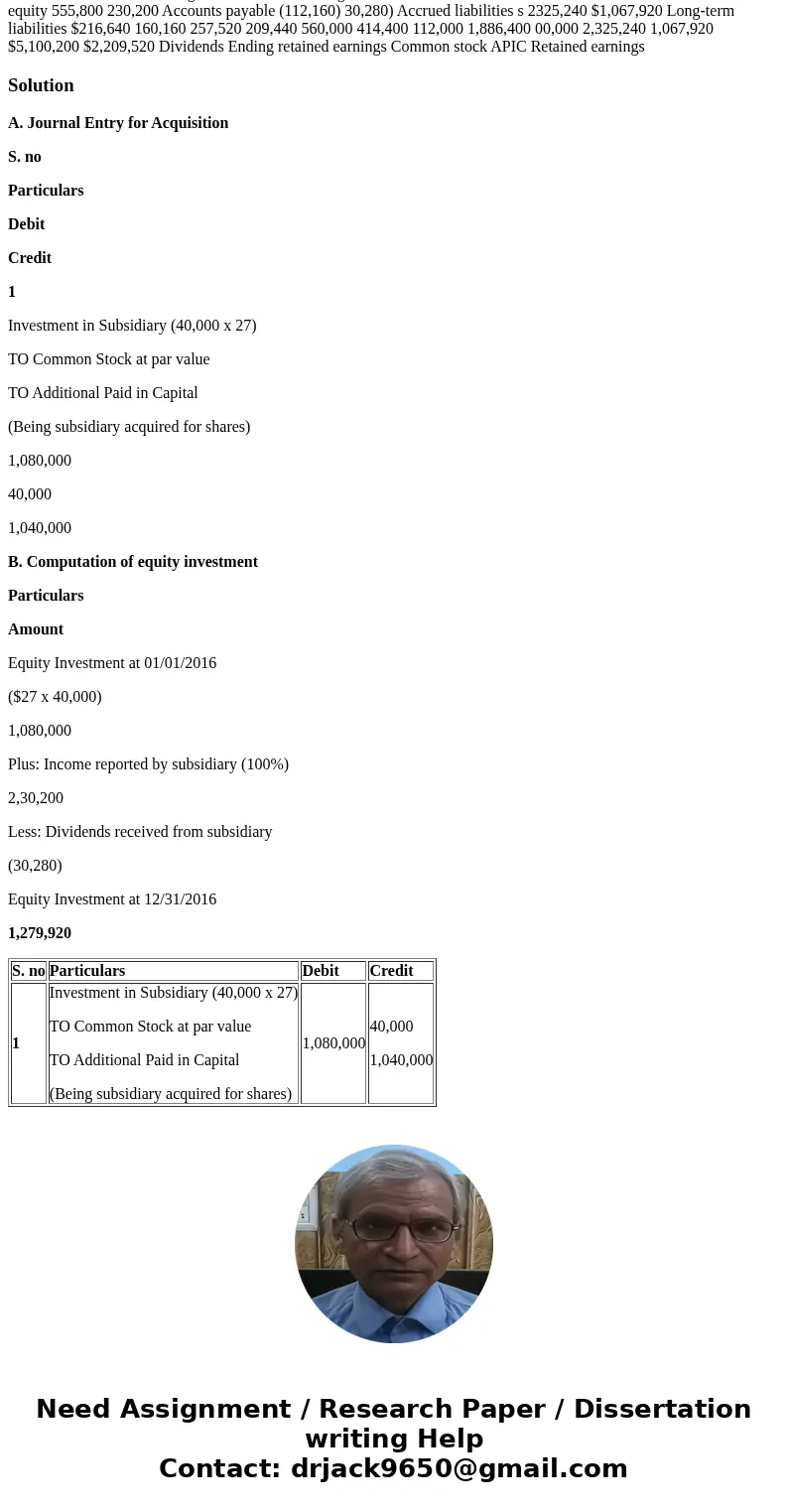

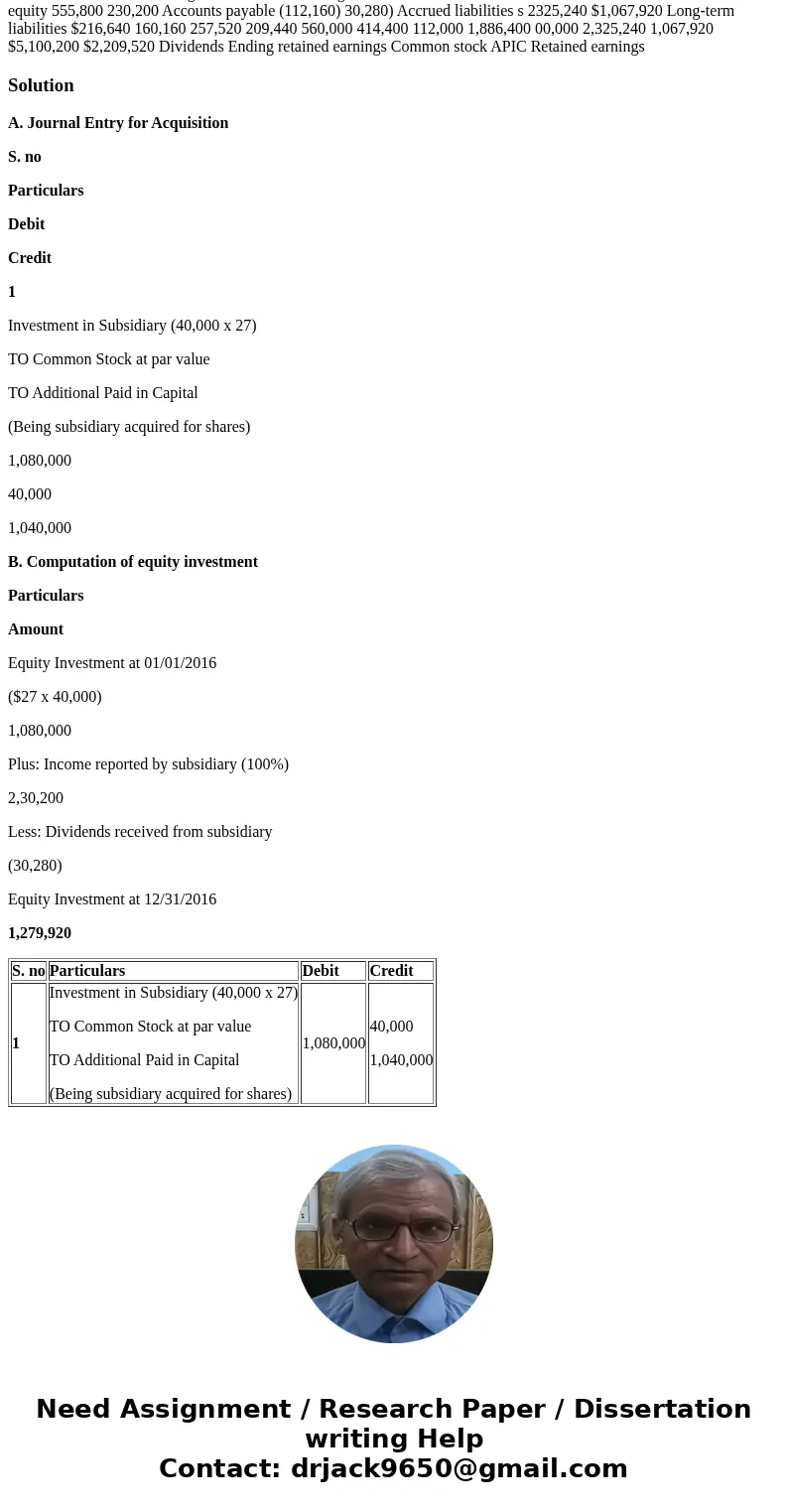

A. Journal Entry for Acquisition

S. no

Particulars

Debit

Credit

1

Investment in Subsidiary (40,000 x 27)

TO Common Stock at par value

TO Additional Paid in Capital

(Being subsidiary acquired for shares)

1,080,000

40,000

1,040,000

B. Computation of equity investment

Particulars

Amount

Equity Investment at 01/01/2016

($27 x 40,000)

1,080,000

Plus: Income reported by subsidiary (100%)

2,30,200

Less: Dividends received from subsidiary

(30,280)

Equity Investment at 12/31/2016

1,279,920

| S. no | Particulars | Debit | Credit |

| 1 | Investment in Subsidiary (40,000 x 27) TO Common Stock at par value TO Additional Paid in Capital (Being subsidiary acquired for shares) | 1,080,000 | 40,000 1,040,000 |

Homework Sourse

Homework Sourse