Gordon Company sponsors a defined benefit pension plan The f

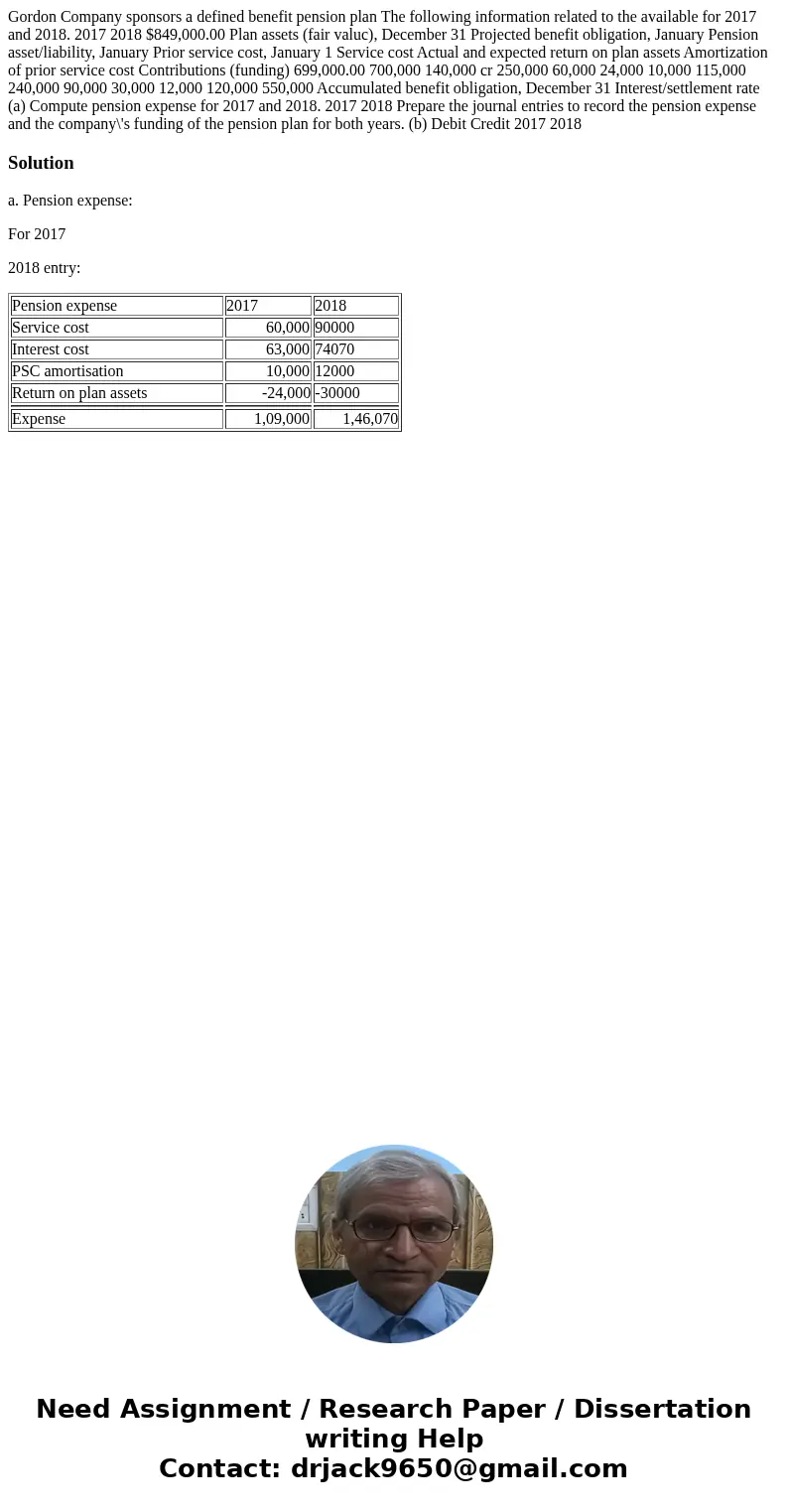

Gordon Company sponsors a defined benefit pension plan The following information related to the available for 2017 and 2018. 2017 2018 $849,000.00 Plan assets (fair valuc), December 31 Projected benefit obligation, January Pension asset/liability, January Prior service cost, January 1 Service cost Actual and expected return on plan assets Amortization of prior service cost Contributions (funding) 699,000.00 700,000 140,000 cr 250,000 60,000 24,000 10,000 115,000 240,000 90,000 30,000 12,000 120,000 550,000 Accumulated benefit obligation, December 31 Interest/settlement rate (a) Compute pension expense for 2017 and 2018. 2017 2018 Prepare the journal entries to record the pension expense and the company\'s funding of the pension plan for both years. (b) Debit Credit 2017 2018

Solution

a. Pension expense:

For 2017

2018 entry:

| Pension expense | 2017 | 2018 |

| Service cost | 60,000 | 90000 |

| Interest cost | 63,000 | 74070 |

| PSC amortisation | 10,000 | 12000 |

| Return on plan assets | -24,000 | -30000 |

| Expense | 1,09,000 | 1,46,070 |

Homework Sourse

Homework Sourse