A project requires 178077 of equipment that is classified as

A project requires $178,077 of equipment that is classified as 7-year property. What is the book value of this asset at the end of year 5 given the following MACRS depreciation allowances, starting with year one: 14.29, 24.49, 17.49, 12.49, 8.93, 8.92, 8.93, and 4.46 percent?

Enter your answer rounded off to two decimal points.

Solution

Depreaciation is the reduction in value of an asset over time due to wear and tear, obsolence and other factors.

Depreciation can be calculated through various methods one of which is MACRS - MACRS stands for modified accelerated cost recovery system. It is current system allowed to calculate tax deductions on account of depreciation for depreciable assets (other than intangible assets) in US.

There are two sub-system of MACRS: the general depreciation system (GDS) and alternate depreciation system (ADS). GDS is the most relevant and is used for most assets.

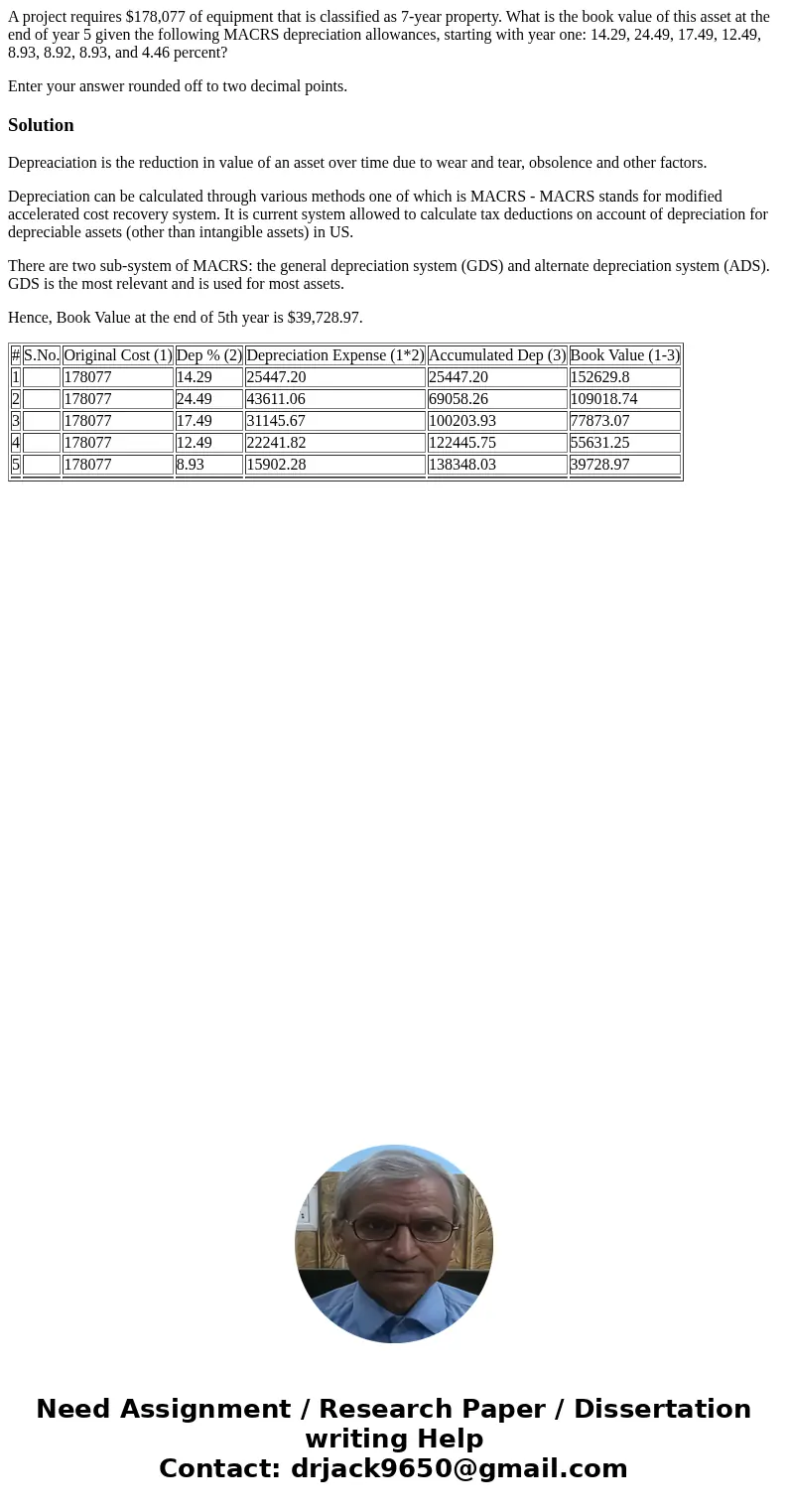

Hence, Book Value at the end of 5th year is $39,728.97.

| # | S.No. | Original Cost (1) | Dep % (2) | Depreciation Expense (1*2) | Accumulated Dep (3) | Book Value (1-3) |

| 1 | 178077 | 14.29 | 25447.20 | 25447.20 | 152629.8 | |

| 2 | 178077 | 24.49 | 43611.06 | 69058.26 | 109018.74 | |

| 3 | 178077 | 17.49 | 31145.67 | 100203.93 | 77873.07 | |

| 4 | 178077 | 12.49 | 22241.82 | 122445.75 | 55631.25 | |

| 5 | 178077 | 8.93 | 15902.28 | 138348.03 | 39728.97 | |

Homework Sourse

Homework Sourse