Calculate the breakeven point for each firm in terms of reve

Calculate the break-even point for each firm in terms of revenue. (Do not round intermediate calculations and round your final answers to the nearest whole dollar.)

What observations can you draw by examining the break-even point of each firm given that they earned an equal amount of operating income on identical sales volumes in 2012?

Calculate the amount of operating income (or loss) that you would expect each firm to report in 2013 if sales were to increase by 20%. (Losses should be indicated by minus sign. Do not round intermediate calculations.)

Calculate the amount of operating income (or loss) that you would expect each firm to report in 2013 if sales were to decrease by 20%. (Losses should be indicated by minus sign. Do not round intermediate calculations.)

Using the amounts computed in part c above, calculate the increase or decrease in the amount of operating income expected in 2013 from the amount reported in 2012.

Explain why an equal percentage increase (or decrease) in sales for each firm would have such differing effects on operating income.

Calculate the ratio of contribution margin to operating income for each firm in 2012. (Hint: Divide contribution margin by operating income.) (Do not round intermediate calculations and round your final answers to 2 decimal places.)

Multiply the expected increase in sales of 20% for 2013 by the ratio of contribution margin to operating income for 2012 computed in part f for each firm. (Hint: Multiply your answer in part f by 0.2.) (Do not round intermediate calculations and round your final answers to 2 decimal places.)

Multiply your answer in part (g) by the 2012 operating income given in the problem. (Do not round intermediate calculations.)

Compare your answer in part h with your answer in part d. What conclusions can you draw about the effects of operating leverage from the steps you performed in parts f, g, and h?

rev: 12_12_2013_QC_42481

| HighTech, Inc., and OldTime Co. compete within the same industry and had the following operating results in 2012: |

Solution

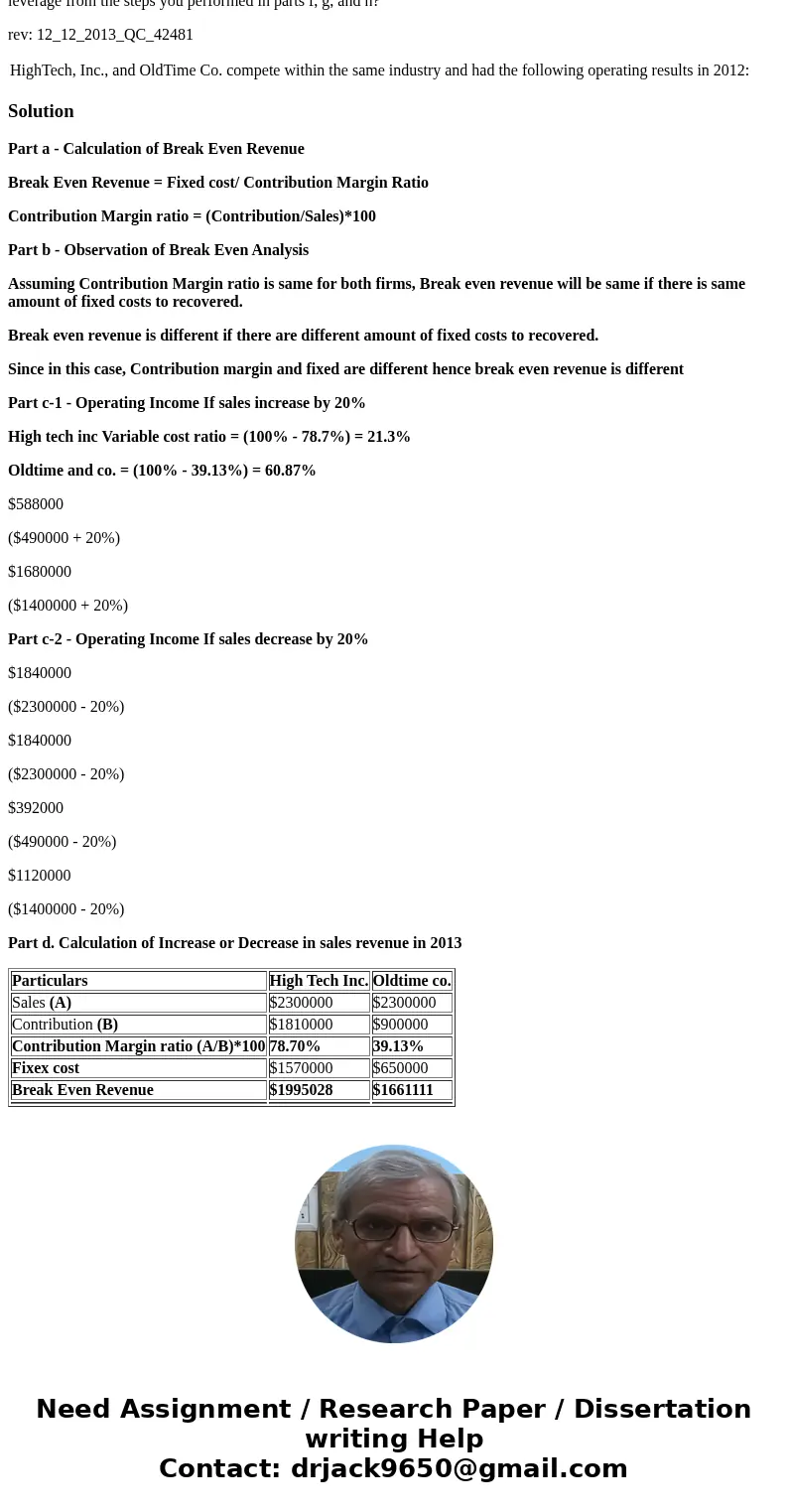

Part a - Calculation of Break Even Revenue

Break Even Revenue = Fixed cost/ Contribution Margin Ratio

Contribution Margin ratio = (Contribution/Sales)*100

Part b - Observation of Break Even Analysis

Assuming Contribution Margin ratio is same for both firms, Break even revenue will be same if there is same amount of fixed costs to recovered.

Break even revenue is different if there are different amount of fixed costs to recovered.

Since in this case, Contribution margin and fixed are different hence break even revenue is different

Part c-1 - Operating Income If sales increase by 20%

High tech inc Variable cost ratio = (100% - 78.7%) = 21.3%

Oldtime and co. = (100% - 39.13%) = 60.87%

$588000

($490000 + 20%)

$1680000

($1400000 + 20%)

Part c-2 - Operating Income If sales decrease by 20%

$1840000

($2300000 - 20%)

$1840000

($2300000 - 20%)

$392000

($490000 - 20%)

$1120000

($1400000 - 20%)

Part d. Calculation of Increase or Decrease in sales revenue in 2013

| Particulars | High Tech Inc. | Oldtime co. |

| Sales (A) | $2300000 | $2300000 |

| Contribution (B) | $1810000 | $900000 |

| Contribution Margin ratio (A/B)*100 | 78.70% | 39.13% |

| Fixex cost | $1570000 | $650000 |

| Break Even Revenue | $1995028 | $1661111 |

Homework Sourse

Homework Sourse