Colah Company purchased 17 million of Jackson Inc 5 bonds at

Solution

1.Colah’s Journal Entry (Amount in $)

Date

Particular

Debit

Credit

Purchase of Bonds

Jul 1, 2018

Investment In Bond

1,700,000

To Cash

1,700,000

Interest Received on Bonds

Dec 31, 2018

Cash

42,500

To Interest on Investment

42,500

Fair Value Adjustment of Bonds

Dec 31, 2018

Fair Value Adjustment in Investment

270,000

To Unrealised Gain

270,000

Interest received and due for first half

Jun 30, 2019

Cash

42,500

Prepaid Interest on Investment

42,500

To Interest on Investment

85,000

Bonds Sold

Jul 1, 2019

Cash

1530,000

Interest Income

42,500

Loss on Sale of Investment

440,000

To Investment

1,700,000

To Fair Value adjustment in Investment

270,000

To Prepaid Interest on Investment

42,500

2.Colah’s Income statement (Amount in $)

Particular

2018

2019

Net Income

42,500

42,500

Other Comprehensive Income:

Add: Unrealised gain

2,70,000

Less: Loss on sale of Investment

-440,000

Comprehensive Income

312,500

-397,500

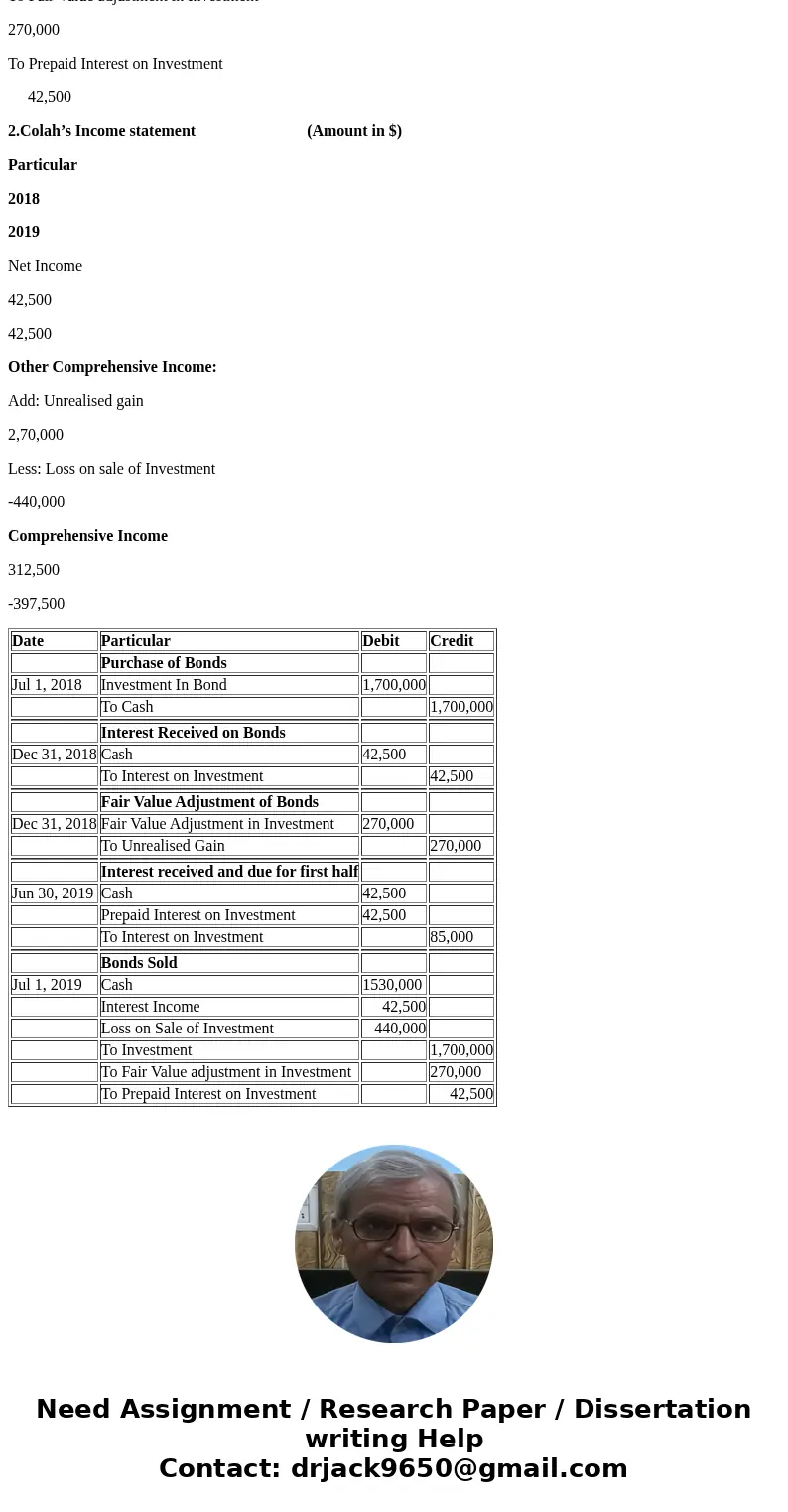

| Date | Particular | Debit | Credit |

| Purchase of Bonds | |||

| Jul 1, 2018 | Investment In Bond | 1,700,000 | |

| To Cash | 1,700,000 | ||

| Interest Received on Bonds | |||

| Dec 31, 2018 | Cash | 42,500 | |

| To Interest on Investment | 42,500 | ||

| Fair Value Adjustment of Bonds | |||

| Dec 31, 2018 | Fair Value Adjustment in Investment | 270,000 | |

| To Unrealised Gain | 270,000 | ||

| Interest received and due for first half | |||

| Jun 30, 2019 | Cash | 42,500 | |

| Prepaid Interest on Investment | 42,500 | ||

| To Interest on Investment | 85,000 | ||

| Bonds Sold | |||

| Jul 1, 2019 | Cash | 1530,000 | |

| Interest Income | 42,500 | ||

| Loss on Sale of Investment | 440,000 | ||

| To Investment | 1,700,000 | ||

| To Fair Value adjustment in Investment | 270,000 | ||

| To Prepaid Interest on Investment | 42,500 |

Homework Sourse

Homework Sourse