On March 31 2018 Brodie Corporation acquired bonds with a pa

On March 31, 2018, Brodie Corporation acquired bonds with a par value of $300,000 for $313,650. The bonds are due December 31, 2023, carry a 9% annual interest rate, pay interest on June 30 and December 31, and are being held to maturity. The accrued interest is included in the acquisition price of the bonds. Brodie uses straight-line amortization.

Required:

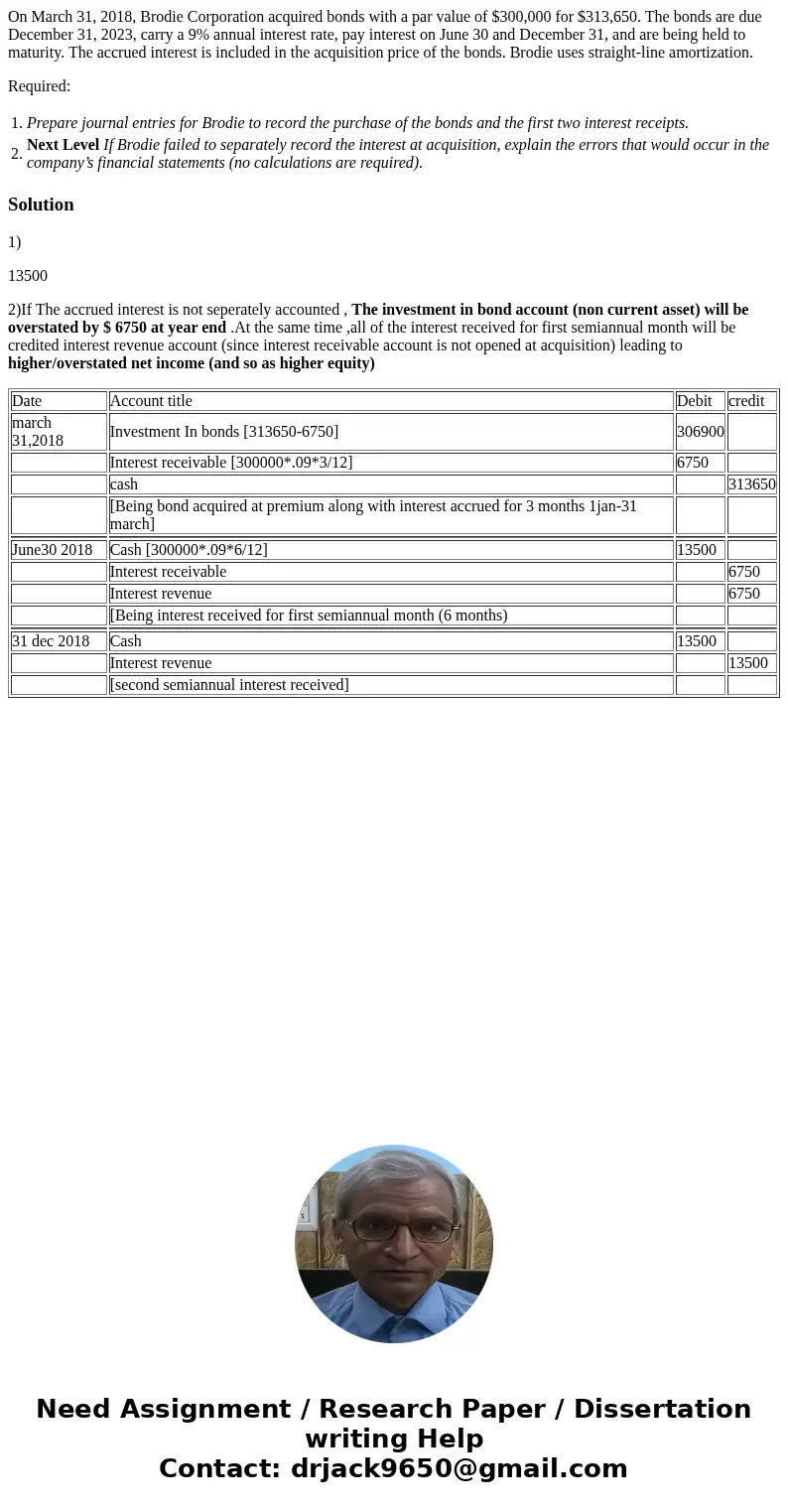

| 1. | Prepare journal entries for Brodie to record the purchase of the bonds and the first two interest receipts. |

| 2. | Next Level If Brodie failed to separately record the interest at acquisition, explain the errors that would occur in the company’s financial statements (no calculations are required). |

Solution

1)

13500

2)If The accrued interest is not seperately accounted , The investment in bond account (non current asset) will be overstated by $ 6750 at year end .At the same time ,all of the interest received for first semiannual month will be credited interest revenue account (since interest receivable account is not opened at acquisition) leading to higher/overstated net income (and so as higher equity)

| Date | Account title | Debit | credit |

| march 31,2018 | Investment In bonds [313650-6750] | 306900 | |

| Interest receivable [300000*.09*3/12] | 6750 | ||

| cash | 313650 | ||

| [Being bond acquired at premium along with interest accrued for 3 months 1jan-31 march] | |||

| June30 2018 | Cash [300000*.09*6/12] | 13500 | |

| Interest receivable | 6750 | ||

| Interest revenue | 6750 | ||

| [Being interest received for first semiannual month (6 months) | |||

| 31 dec 2018 | Cash | 13500 | |

| Interest revenue | 13500 | ||

| [second semiannual interest received] |

Homework Sourse

Homework Sourse