Computing SumoftheYearsDigits Depreciation The company acqui

Computing Sum-of-the-Years\'-Digits Depreciation

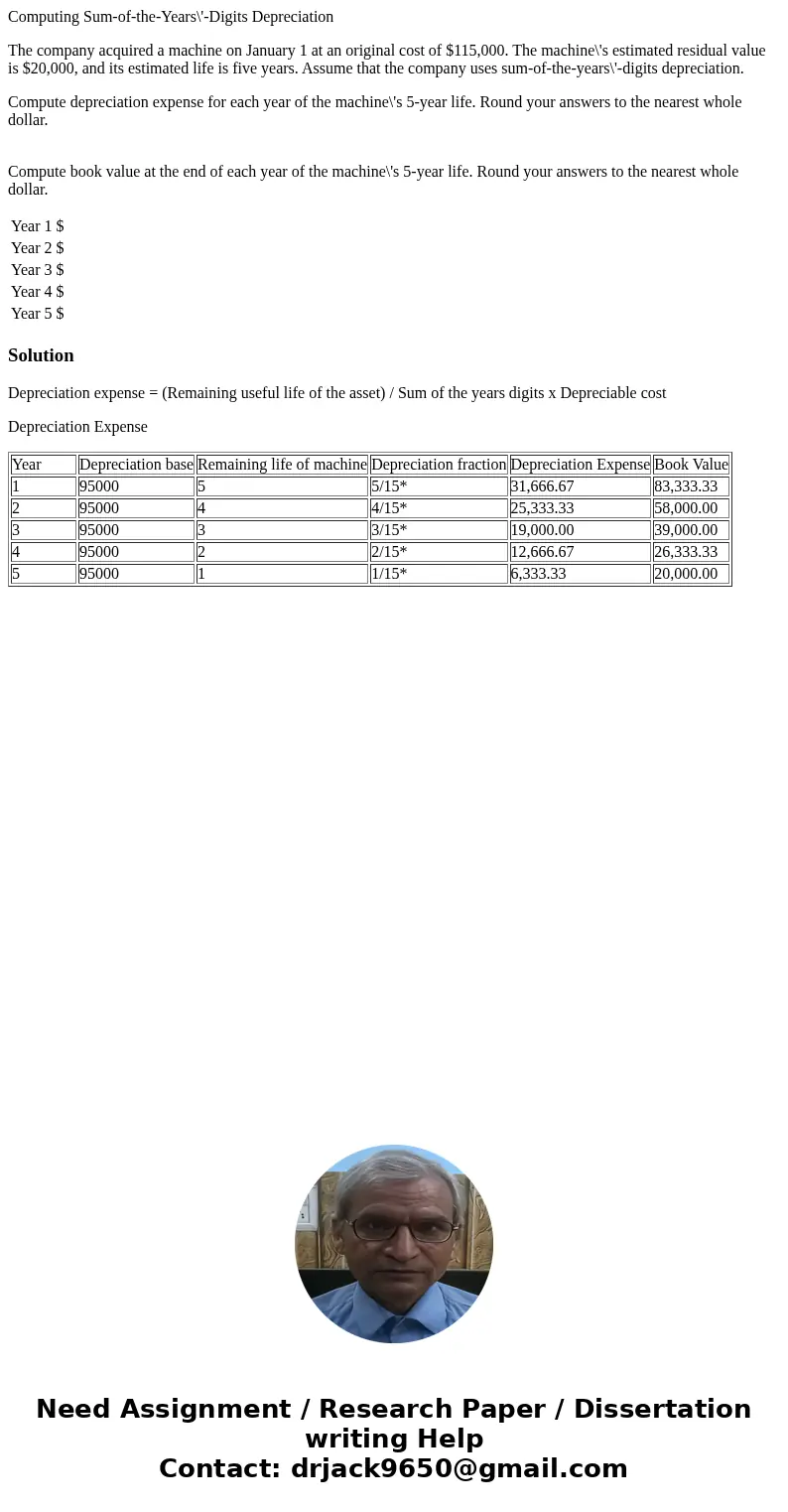

The company acquired a machine on January 1 at an original cost of $115,000. The machine\'s estimated residual value is $20,000, and its estimated life is five years. Assume that the company uses sum-of-the-years\'-digits depreciation.

Compute depreciation expense for each year of the machine\'s 5-year life. Round your answers to the nearest whole dollar.

Compute book value at the end of each year of the machine\'s 5-year life. Round your answers to the nearest whole dollar.

| Year 1 | $ |

| Year 2 | $ |

| Year 3 | $ |

| Year 4 | $ |

| Year 5 | $ |

Solution

Depreciation expense = (Remaining useful life of the asset) / Sum of the years digits x Depreciable cost

Depreciation Expense

| Year | Depreciation base | Remaining life of machine | Depreciation fraction | Depreciation Expense | Book Value |

| 1 | 95000 | 5 | 5/15* | 31,666.67 | 83,333.33 |

| 2 | 95000 | 4 | 4/15* | 25,333.33 | 58,000.00 |

| 3 | 95000 | 3 | 3/15* | 19,000.00 | 39,000.00 |

| 4 | 95000 | 2 | 2/15* | 12,666.67 | 26,333.33 |

| 5 | 95000 | 1 | 1/15* | 6,333.33 | 20,000.00 |

Homework Sourse

Homework Sourse