Please make this chart and fill it out with formulas thank y

Please make this chart and fill it out with formula\'s! thank you so much!

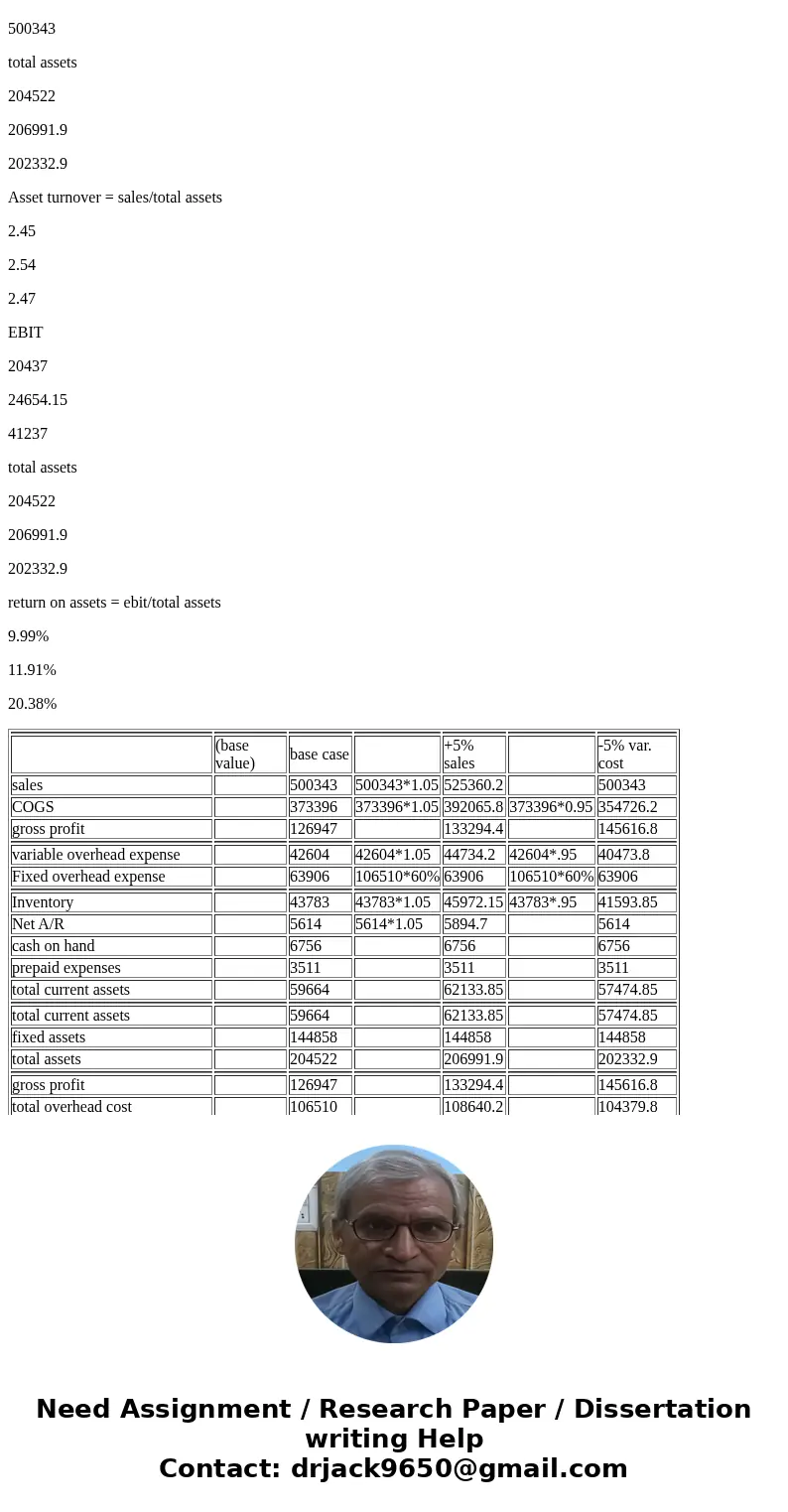

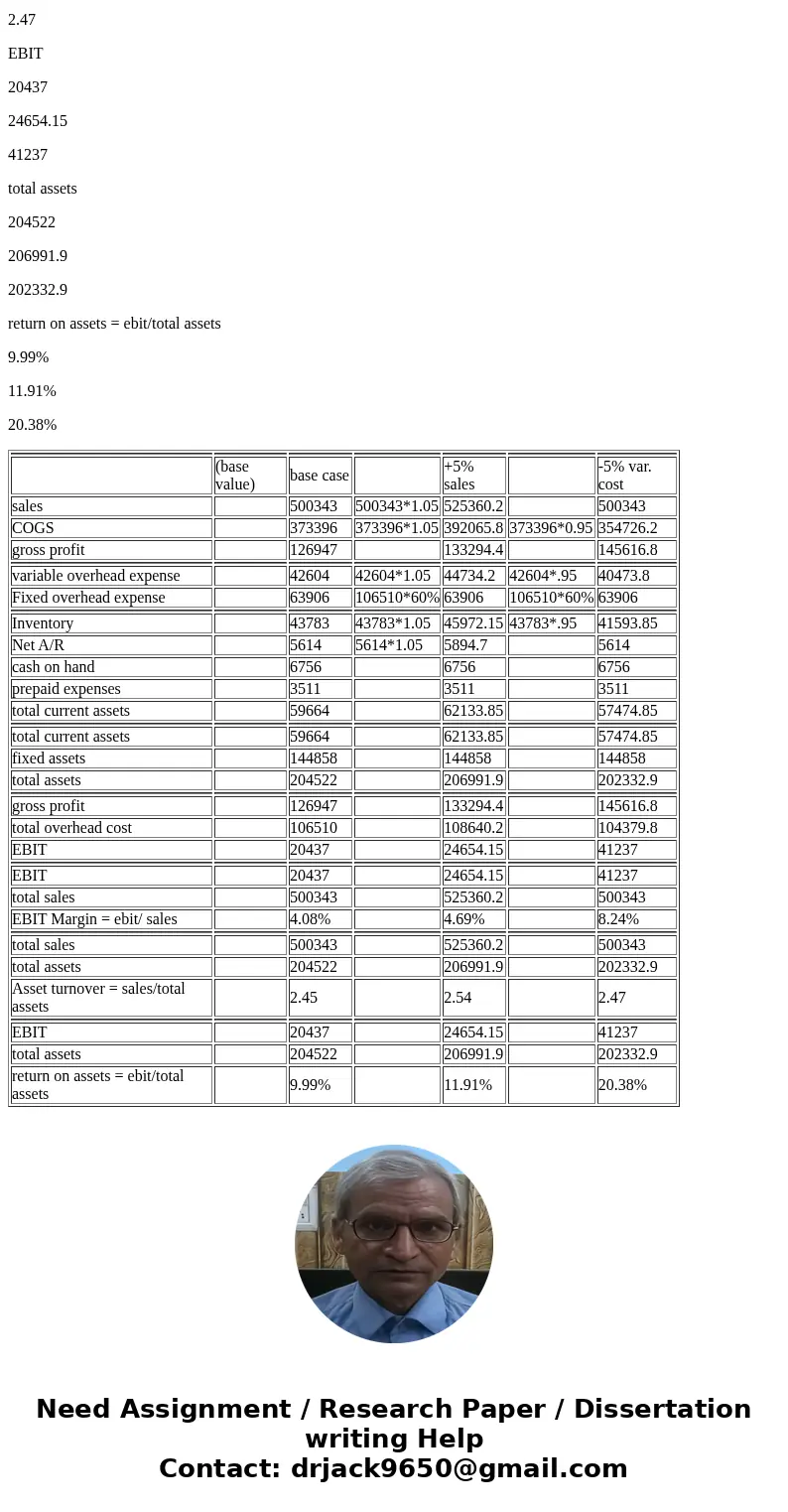

HOMEWORK PROBLEM Sales $500,343 Total Overhead Expenses-$106, 510 (40% Variable, 60% Fixed) Cost of Goods Sold $373,396 Inventory on Hand $43,783 Net Accounts Receivable $5,614 Cash-on-Hand $6,756 Fixed Assets $144,858 Prepaid Expenses $3,511 Note: All dollar figures are in millions. Create spreadsheet to calculate EBIT $, EBIT Margin %, Asset Turnover %, and Return on Assets 96. 1. If there is a 5% increase in sales, recalculate metrics. (remember, COGS and variable overhead expense increase correspondingly, and assume that Inventory and Net A/R increase correspondingly as we 2. If there is 5% decrease in cost (COGS + variable OH), recalculate metrics. Assume that COGS and Inventory decrease proportionally. 3.Solution

(base value)

base case

+5% sales

-5% var. cost

sales

500343

500343*1.05

525360.2

500343

COGS

373396

373396*1.05

392065.8

373396*0.95

354726.2

gross profit

126947

133294.4

145616.8

variable overhead expense

42604

42604*1.05

44734.2

42604*.95

40473.8

Fixed overhead expense

63906

106510*60%

63906

106510*60%

63906

Inventory

43783

43783*1.05

45972.15

43783*.95

41593.85

Net A/R

5614

5614*1.05

5894.7

5614

cash on hand

6756

6756

6756

prepaid expenses

3511

3511

3511

total current assets

59664

62133.85

57474.85

total current assets

59664

62133.85

57474.85

fixed assets

144858

144858

144858

total assets

204522

206991.9

202332.9

gross profit

126947

133294.4

145616.8

total overhead cost

106510

108640.2

104379.8

EBIT

20437

24654.15

41237

EBIT

20437

24654.15

41237

total sales

500343

525360.2

500343

EBIT Margin = ebit/ sales

4.08%

4.69%

8.24%

total sales

500343

525360.2

500343

total assets

204522

206991.9

202332.9

Asset turnover = sales/total assets

2.45

2.54

2.47

EBIT

20437

24654.15

41237

total assets

204522

206991.9

202332.9

return on assets = ebit/total assets

9.99%

11.91%

20.38%

| (base value) | base case | +5% sales | -5% var. cost | |||

| sales | 500343 | 500343*1.05 | 525360.2 | 500343 | ||

| COGS | 373396 | 373396*1.05 | 392065.8 | 373396*0.95 | 354726.2 | |

| gross profit | 126947 | 133294.4 | 145616.8 | |||

| variable overhead expense | 42604 | 42604*1.05 | 44734.2 | 42604*.95 | 40473.8 | |

| Fixed overhead expense | 63906 | 106510*60% | 63906 | 106510*60% | 63906 | |

| Inventory | 43783 | 43783*1.05 | 45972.15 | 43783*.95 | 41593.85 | |

| Net A/R | 5614 | 5614*1.05 | 5894.7 | 5614 | ||

| cash on hand | 6756 | 6756 | 6756 | |||

| prepaid expenses | 3511 | 3511 | 3511 | |||

| total current assets | 59664 | 62133.85 | 57474.85 | |||

| total current assets | 59664 | 62133.85 | 57474.85 | |||

| fixed assets | 144858 | 144858 | 144858 | |||

| total assets | 204522 | 206991.9 | 202332.9 | |||

| gross profit | 126947 | 133294.4 | 145616.8 | |||

| total overhead cost | 106510 | 108640.2 | 104379.8 | |||

| EBIT | 20437 | 24654.15 | 41237 | |||

| EBIT | 20437 | 24654.15 | 41237 | |||

| total sales | 500343 | 525360.2 | 500343 | |||

| EBIT Margin = ebit/ sales | 4.08% | 4.69% | 8.24% | |||

| total sales | 500343 | 525360.2 | 500343 | |||

| total assets | 204522 | 206991.9 | 202332.9 | |||

| Asset turnover = sales/total assets | 2.45 | 2.54 | 2.47 | |||

| EBIT | 20437 | 24654.15 | 41237 | |||

| total assets | 204522 | 206991.9 | 202332.9 | |||

| return on assets = ebit/total assets | 9.99% | 11.91% | 20.38% |

Homework Sourse

Homework Sourse