Frey Corp is experiencing rapid growth Dividends are expecte

Solution

Assume Dividend of year 1 be “x”

Year

Event

Cash flow

Present Value Factor @10%

Discounted Cash flow

1

Dividend on Year1

Assumption

x

0.9091

0.9091x

2

Dividend on Year 2

X+30% growth

1.3x

0.8264

1.07432x

3

Dividend on Year 3

1.3 x + 30% growth

1.69x

0.7513

1.269697x

4

Dividend on Year 4

1.69+20% growth

2.028x

0.6830

1.385124x

4

Price on Year 4

Refer note 1

53.742x

0.6830

36.705786

41.344027x

Price on Year 0 = 41.344027x

76 = 41.344027x

X = 76/41.344027 = 1.84

Projected dividend of year 1 (coming year) = 1.84

Note 1:

Price of year 4 = Dividend on year 4*(1+growth rate)/Required return – Growth rate

= 2.028x*(1+0.06)/0.10-0.06

=2.028x*(1.06)/0.04

=2.14968x/0.04

=53.742x

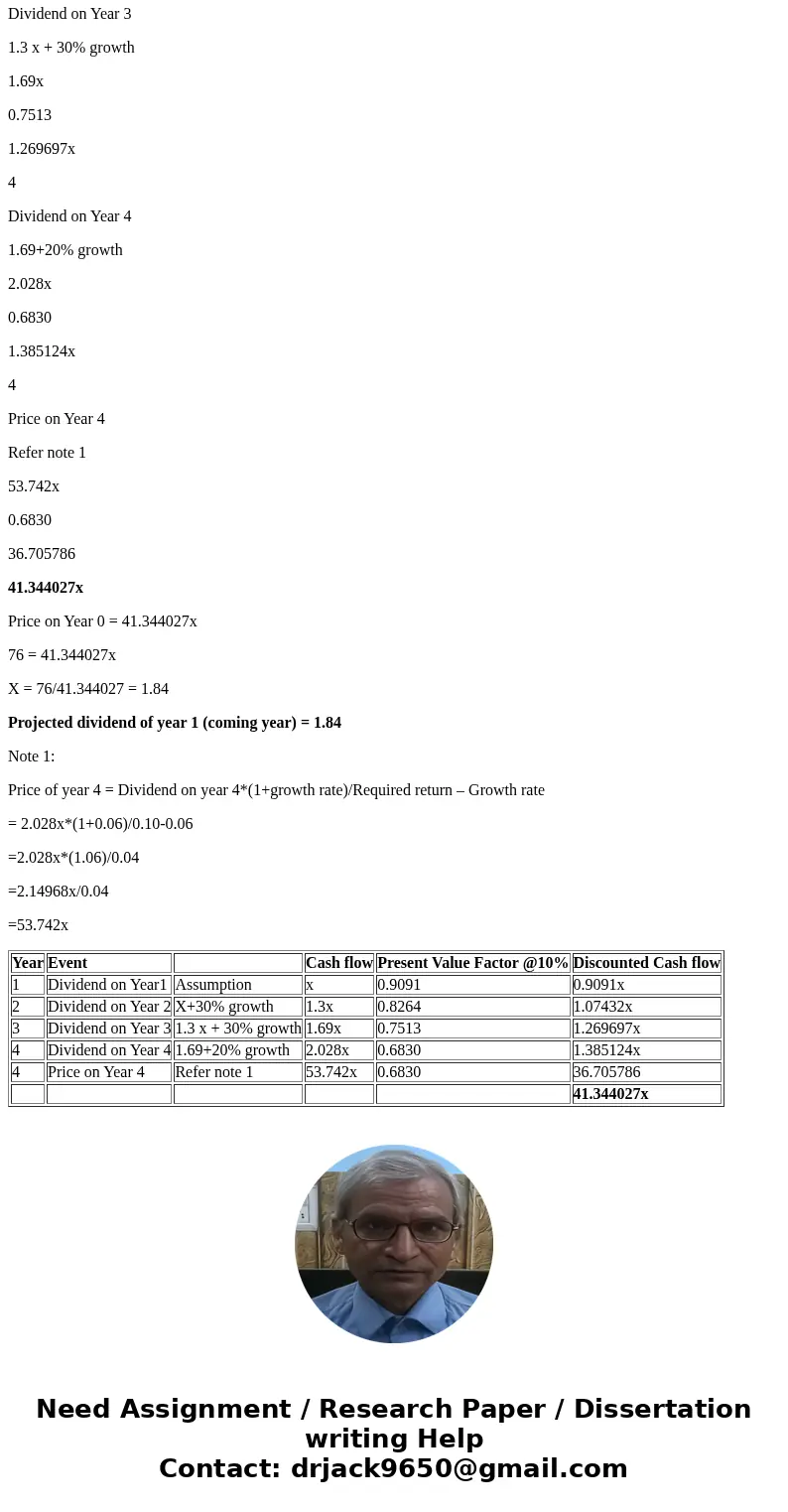

| Year | Event | Cash flow | Present Value Factor @10% | Discounted Cash flow | |

| 1 | Dividend on Year1 | Assumption | x | 0.9091 | 0.9091x |

| 2 | Dividend on Year 2 | X+30% growth | 1.3x | 0.8264 | 1.07432x |

| 3 | Dividend on Year 3 | 1.3 x + 30% growth | 1.69x | 0.7513 | 1.269697x |

| 4 | Dividend on Year 4 | 1.69+20% growth | 2.028x | 0.6830 | 1.385124x |

| 4 | Price on Year 4 | Refer note 1 | 53.742x | 0.6830 | 36.705786 |

| 41.344027x |

Homework Sourse

Homework Sourse