If a leased asset were scrapped from a continuing CCA pool a

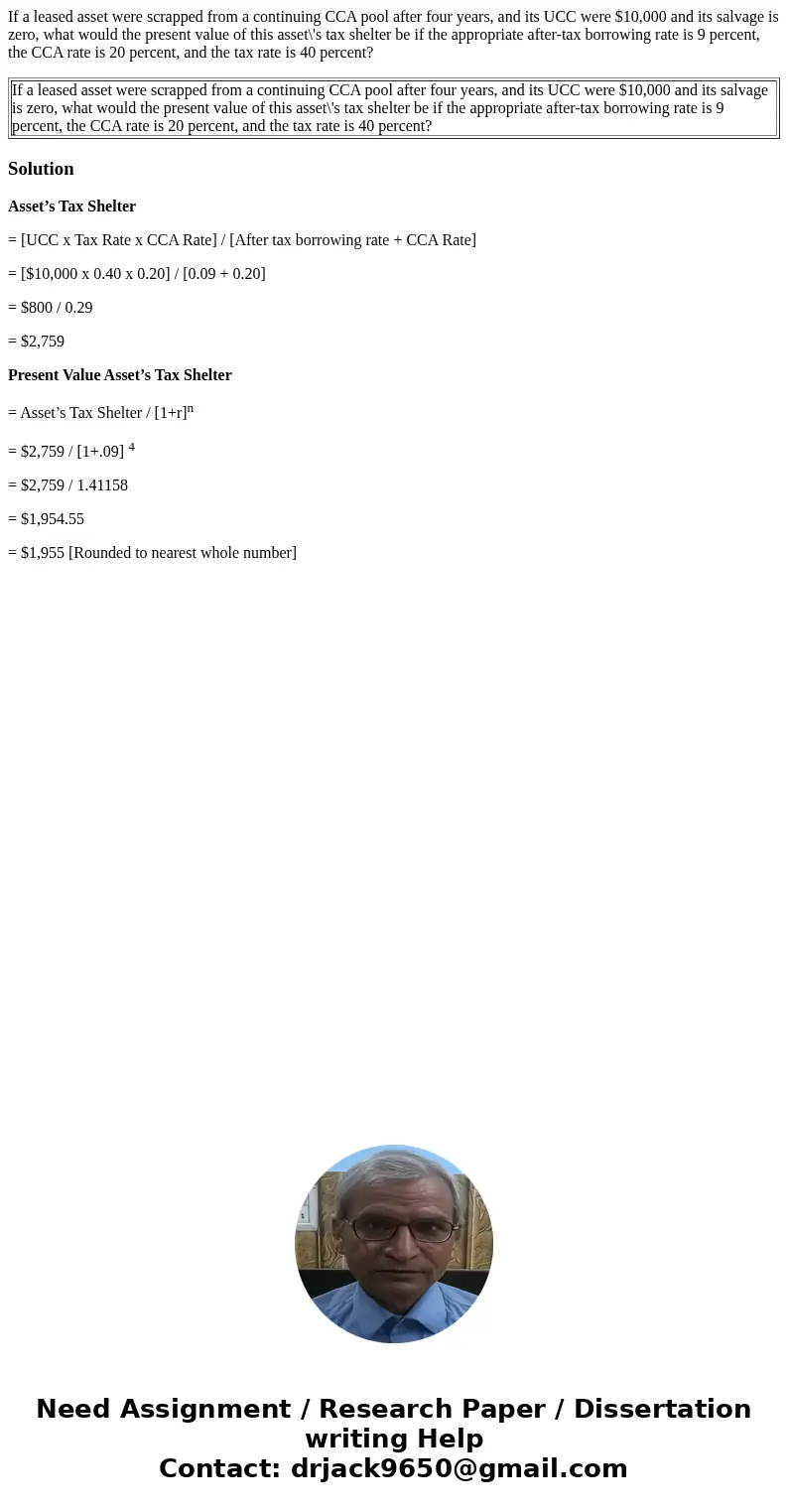

If a leased asset were scrapped from a continuing CCA pool after four years, and its UCC were $10,000 and its salvage is zero, what would the present value of this asset\'s tax shelter be if the appropriate after-tax borrowing rate is 9 percent, the CCA rate is 20 percent, and the tax rate is 40 percent?

| If a leased asset were scrapped from a continuing CCA pool after four years, and its UCC were $10,000 and its salvage is zero, what would the present value of this asset\'s tax shelter be if the appropriate after-tax borrowing rate is 9 percent, the CCA rate is 20 percent, and the tax rate is 40 percent? |

Solution

Asset’s Tax Shelter

= [UCC x Tax Rate x CCA Rate] / [After tax borrowing rate + CCA Rate]

= [$10,000 x 0.40 x 0.20] / [0.09 + 0.20]

= $800 / 0.29

= $2,759

Present Value Asset’s Tax Shelter

= Asset’s Tax Shelter / [1+r]n

= $2,759 / [1+.09] 4

= $2,759 / 1.41158

= $1,954.55

= $1,955 [Rounded to nearest whole number]

Homework Sourse

Homework Sourse