we are evaluating a project that costs 690000 has a five yea

we are evaluating a project that costs $690,000, has a five year life, and no salvage value. Assume that straightline to zero over the life of the project. sales are projected at 71,000 units per year. price per unit is $75, variable cost per unit is $38 and fixed costs are $790,000 per year. The tax rate is 35%, and we require a return of 15% on this project Calculate the best case and wore case npv figures

Solution

Answer

Existing Case

Selling price = $75

Variable Cost = $38

Units

71000

Sales

5,325,000

Variable Cost

2,698,000

Fixed Cost

790,000

Depreciation

138,000

EBT

1,699,000

Tax @35%

594,650

Net income

1,104,350

Depreciation

138,000

Net Cash Flow

1,242,350

Year

Annual Cash Inflow

PVF @15%

PV

1

1,242,350

0.870

1,080,304.35

2

1,242,350

0.756

939,395.09

3

1,242,350

0.658

816,865.29

4

1,242,350

0.572

710,317.64

5

1,242,350

0.497

617,667.52

Present Value of Cash Inflows

4,164,549.89

NPV = Present Value of Cash Inflows – Initial Cash Outflow

= 4,164,549.89 - $690,000

NPV (Existing) = $3,474,549

In Best and Worst case, the Units sold, Sale price, Variable Cost and Fixed Cost all are affected.

In Worst Case

In this the Sale price and Unit Decreases and Variable Cost and Fixed Cost increases.

So I am assuming 20% effect, i.e. 20% decrease in Sale Price and Units.

And, 20% Increase in Variable Cost and Fixed Cost.

New Sale Price = 75 – 20% = $60

New Variable Cost = 38 + 20% = $30.4

Units

56,800

Sales (56,800 * $60)

3,408,000.0

Variable Cost (56,800 * $38)

2,590,080.0

Fixed Cost

948,000.0

Depreciation (790,000 + 20%)

138,000.0

EBT

(268,080.0)

Tax @35%

(93,828.0)

Net income

(174,252.0)

Depreciation

138,000.0

Net Cash Flow

(36,252.0)

Year

Annual Cash Inflow

PVF @15%

PV

1

(36,252.0)

0.870

(31,523.48)

2

(36,252.0)

0.756

(27,411.72)

3

(36,252.0)

0.658

(23,836.28)

4

(36,252.0)

0.572

(20,727.20)

5

(36,252.0)

0.497

(18,023.65)

Present Value of Cash Inflows

(121,522.33)

NPV = Present Value of Cash Inflows – Initial Cash Outflow

= (121,522.33) - $690,000

NPV (Worst) = ($811,522.33)

In Best Case

In this the Sale price and Unit Increases and Variable Cost and Fixed Cost Decreases.

So I am assuming 20% effect, i.e. 20% Increase in Sale Price and Units.

And, 20% Decrease in Variable Cost and Fixed Cost.

New Sale Price = 75 + 20% = $90

New Variable Cost = 38 - 20% = $30.4

Units

85,200

Sales(85,200 * $90)

7,668,000.0

Variable Cost (85,200 * $30.4)

2,590,080.0

Fixed Cost (790,000 – 20%)

632,000.0

Depreciation

138,000.0

EBT

4,307,920.0

Tax @35%

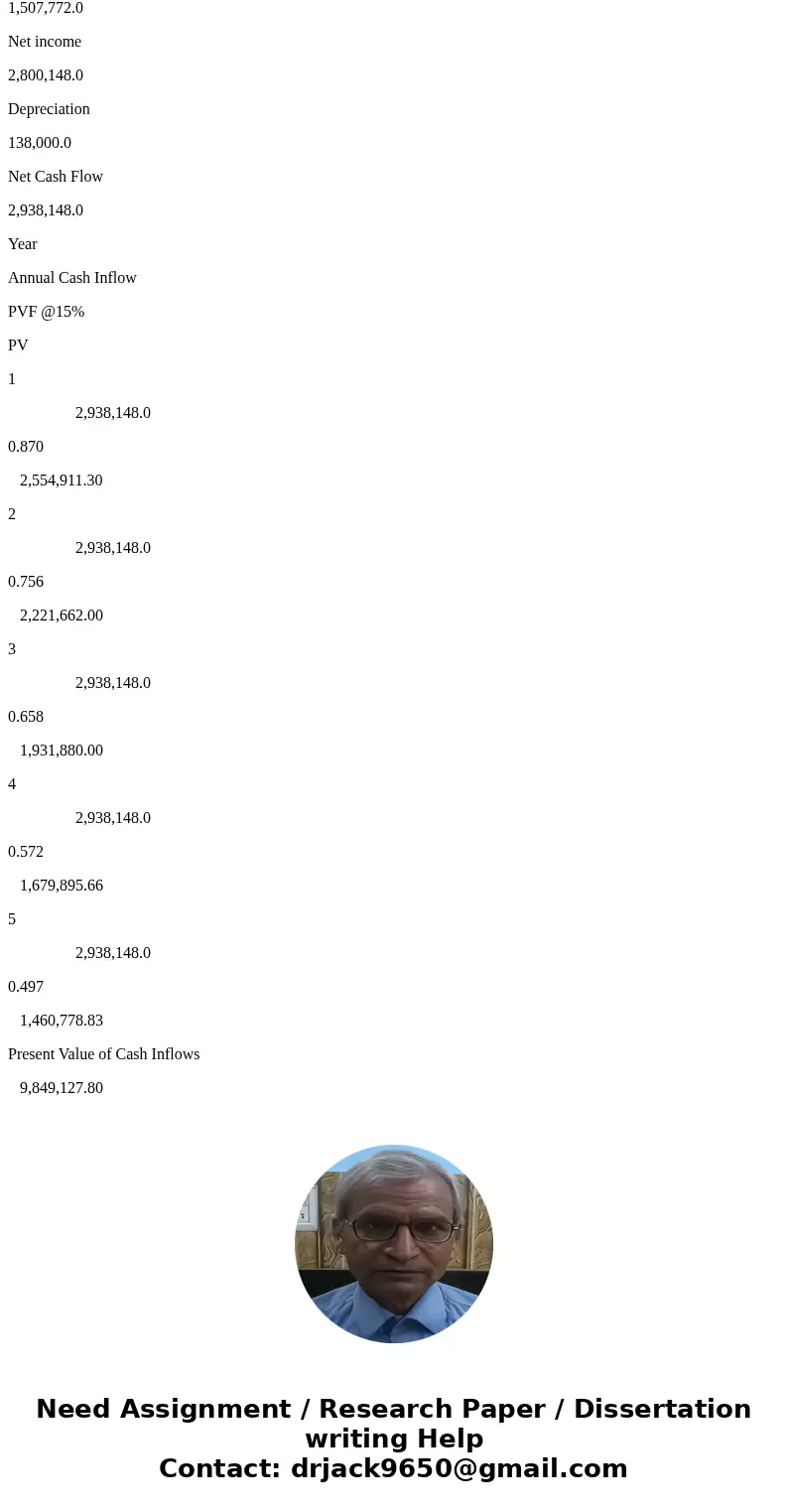

1,507,772.0

Net income

2,800,148.0

Depreciation

138,000.0

Net Cash Flow

2,938,148.0

Year

Annual Cash Inflow

PVF @15%

PV

1

2,938,148.0

0.870

2,554,911.30

2

2,938,148.0

0.756

2,221,662.00

3

2,938,148.0

0.658

1,931,880.00

4

2,938,148.0

0.572

1,679,895.66

5

2,938,148.0

0.497

1,460,778.83

Present Value of Cash Inflows

9,849,127.80

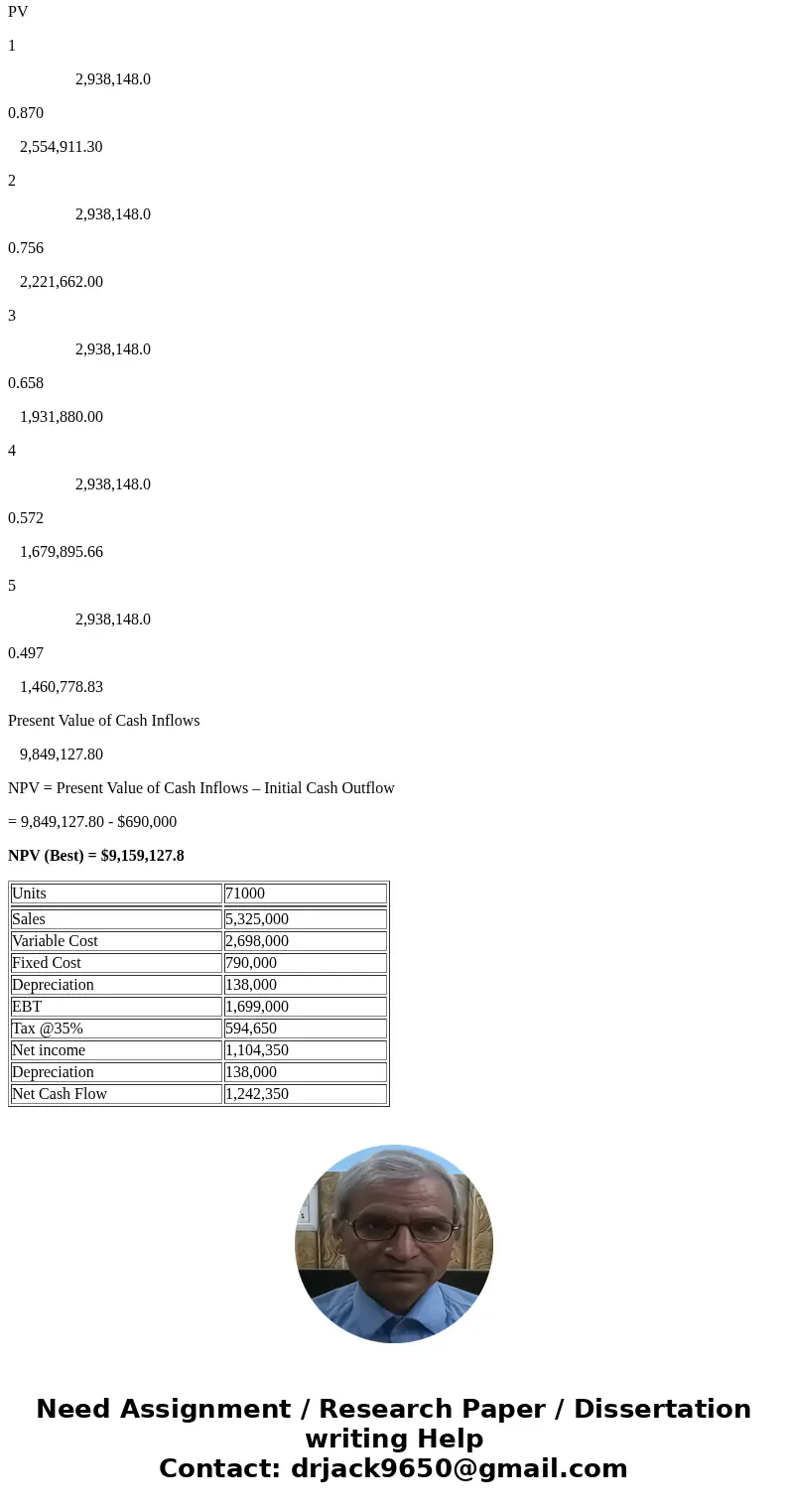

NPV = Present Value of Cash Inflows – Initial Cash Outflow

= 9,849,127.80 - $690,000

NPV (Best) = $9,159,127.8

| Units | 71000 |

| Sales | 5,325,000 |

| Variable Cost | 2,698,000 |

| Fixed Cost | 790,000 |

| Depreciation | 138,000 |

| EBT | 1,699,000 |

| Tax @35% | 594,650 |

| Net income | 1,104,350 |

| Depreciation | 138,000 |

| Net Cash Flow | 1,242,350 |

Homework Sourse

Homework Sourse