Alhambra Aluminum Company a manufacturer of recyclable soda

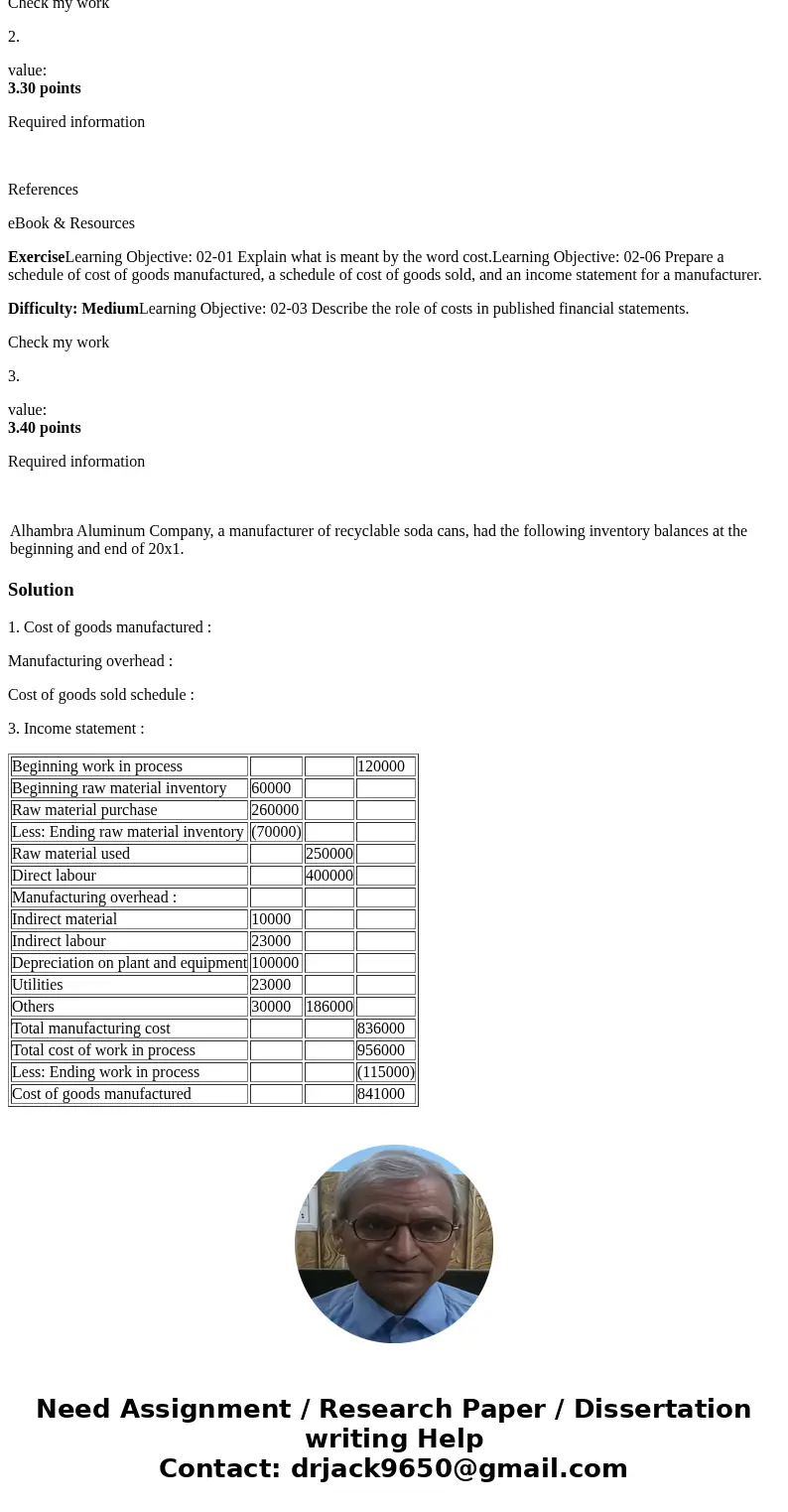

Alhambra Aluminum Company, a manufacturer of recyclable soda cans, had the following inventory balances at the beginning and end of 20x1.

During 20x1, the company purchased $260,000 of raw material and spent $400,000 for direct labor. Manufacturing overhead costs were as follows:

Sales revenue was $1,111,000 for the year. Selling and administrative expenses for the year amounted to $110,000. The firm\'s tax rate is 40 percent.

1.

value:

3.30 points

Required information

References

eBook & Resources

ExerciseLearning Objective: 02-01 Explain what is meant by the word cost.Learning Objective: 02-06 Prepare a schedule of cost of goods manufactured, a schedule of cost of goods sold, and an income statement for a manufacturer.

Difficulty: MediumLearning Objective: 02-03 Describe the role of costs in published financial statements.

Check my work

2.

value:

3.30 points

Required information

References

eBook & Resources

ExerciseLearning Objective: 02-01 Explain what is meant by the word cost.Learning Objective: 02-06 Prepare a schedule of cost of goods manufactured, a schedule of cost of goods sold, and an income statement for a manufacturer.

Difficulty: MediumLearning Objective: 02-03 Describe the role of costs in published financial statements.

Check my work

3.

value:

3.40 points

Required information

| Alhambra Aluminum Company, a manufacturer of recyclable soda cans, had the following inventory balances at the beginning and end of 20x1. |

Solution

1. Cost of goods manufactured :

Manufacturing overhead :

Cost of goods sold schedule :

3. Income statement :

| Beginning work in process | 120000 | ||

| Beginning raw material inventory | 60000 | ||

| Raw material purchase | 260000 | ||

| Less: Ending raw material inventory | (70000) | ||

| Raw material used | 250000 | ||

| Direct labour | 400000 | ||

| Manufacturing overhead : | |||

| Indirect material | 10000 | ||

| Indirect labour | 23000 | ||

| Depreciation on plant and equipment | 100000 | ||

| Utilities | 23000 | ||

| Others | 30000 | 186000 | |

| Total manufacturing cost | 836000 | ||

| Total cost of work in process | 956000 | ||

| Less: Ending work in process | (115000) | ||

| Cost of goods manufactured | 841000 |

Homework Sourse

Homework Sourse