9781259726705 Qs 35 Prepaid deferred expenses adjustments P1

Solution

1-

beginning balance

4700

closing balance in prepaid insurance

900

amount of insurance expired or insurance expense during the year

4700-900

3800

date

explanation

debit

credit

31-Dec

insurance expense

3800

prepaid insurance

3800

2-

beginning balance

5890

amount of insurance expired or insurance expense during the year

1040

closing balance in prepaid insurance

4850

date

explanation

debit

credit

31-Dec

insurance expense

1040

prepaid insurance

1040

3-

balance in prepaid rent

24000

less rent expense

(24000*4/24)

4000

closing balance in prepaid rent

24000-4000

20000

date

explanation

debit

credit

31-Dec

rent expense

4000

prepaid rent

4000

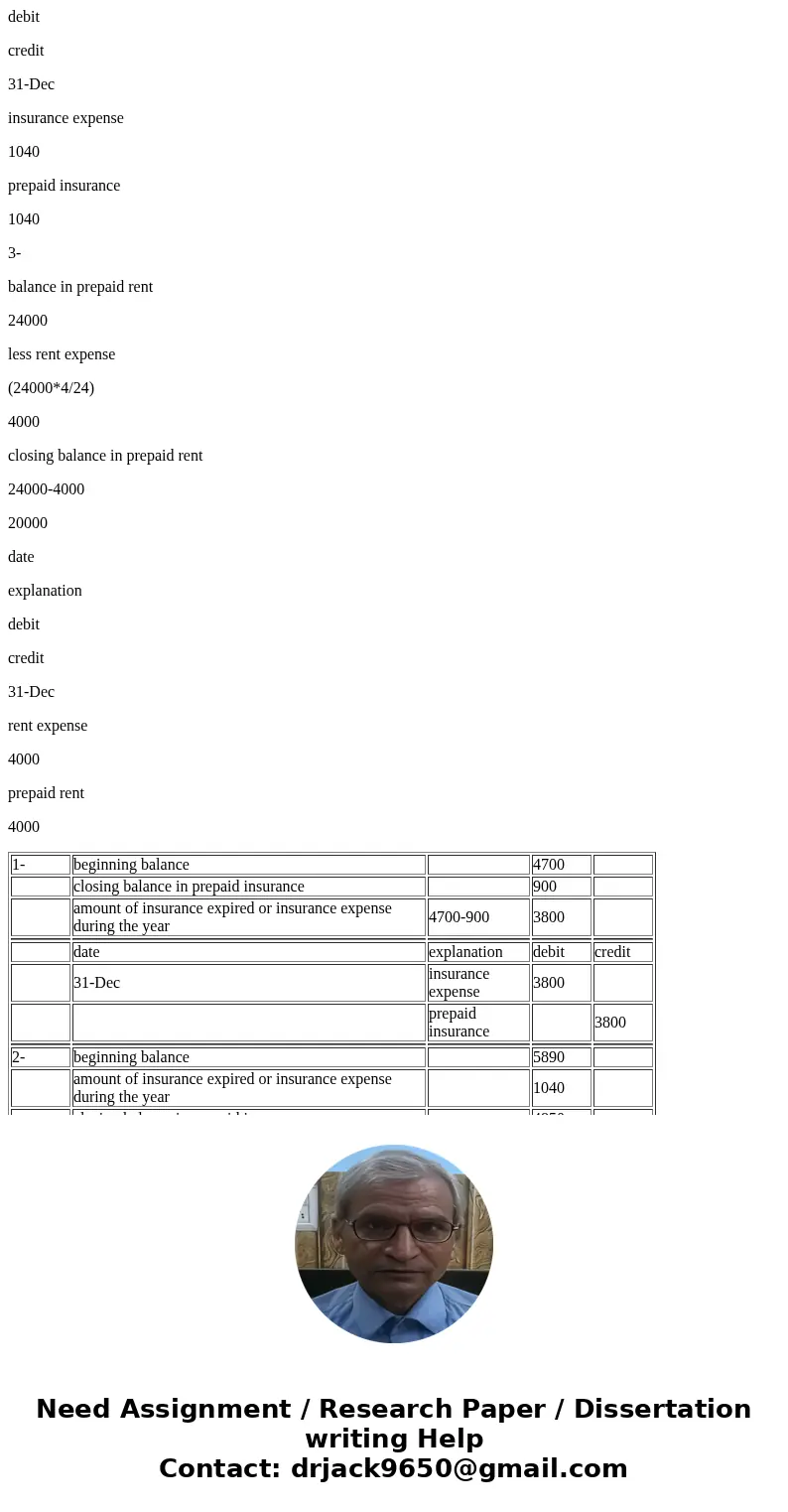

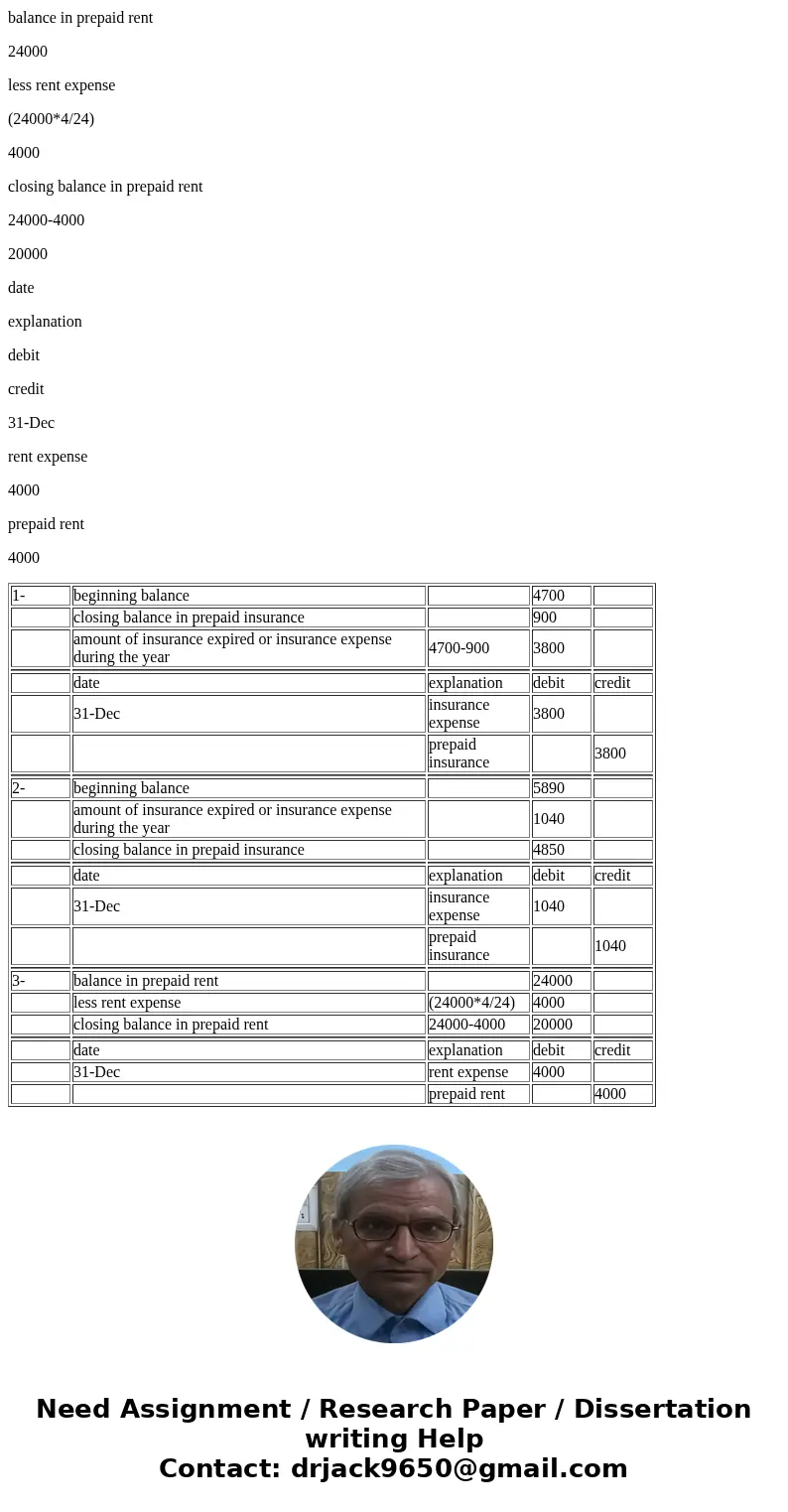

| 1- | beginning balance | 4700 | ||

| closing balance in prepaid insurance | 900 | |||

| amount of insurance expired or insurance expense during the year | 4700-900 | 3800 | ||

| date | explanation | debit | credit | |

| 31-Dec | insurance expense | 3800 | ||

| prepaid insurance | 3800 | |||

| 2- | beginning balance | 5890 | ||

| amount of insurance expired or insurance expense during the year | 1040 | |||

| closing balance in prepaid insurance | 4850 | |||

| date | explanation | debit | credit | |

| 31-Dec | insurance expense | 1040 | ||

| prepaid insurance | 1040 | |||

| 3- | balance in prepaid rent | 24000 | ||

| less rent expense | (24000*4/24) | 4000 | ||

| closing balance in prepaid rent | 24000-4000 | 20000 | ||

| date | explanation | debit | credit | |

| 31-Dec | rent expense | 4000 | ||

| prepaid rent | 4000 |

Homework Sourse

Homework Sourse