mke 0 ezt o mheducationcomhmtpx 03565205695222583 1515543749

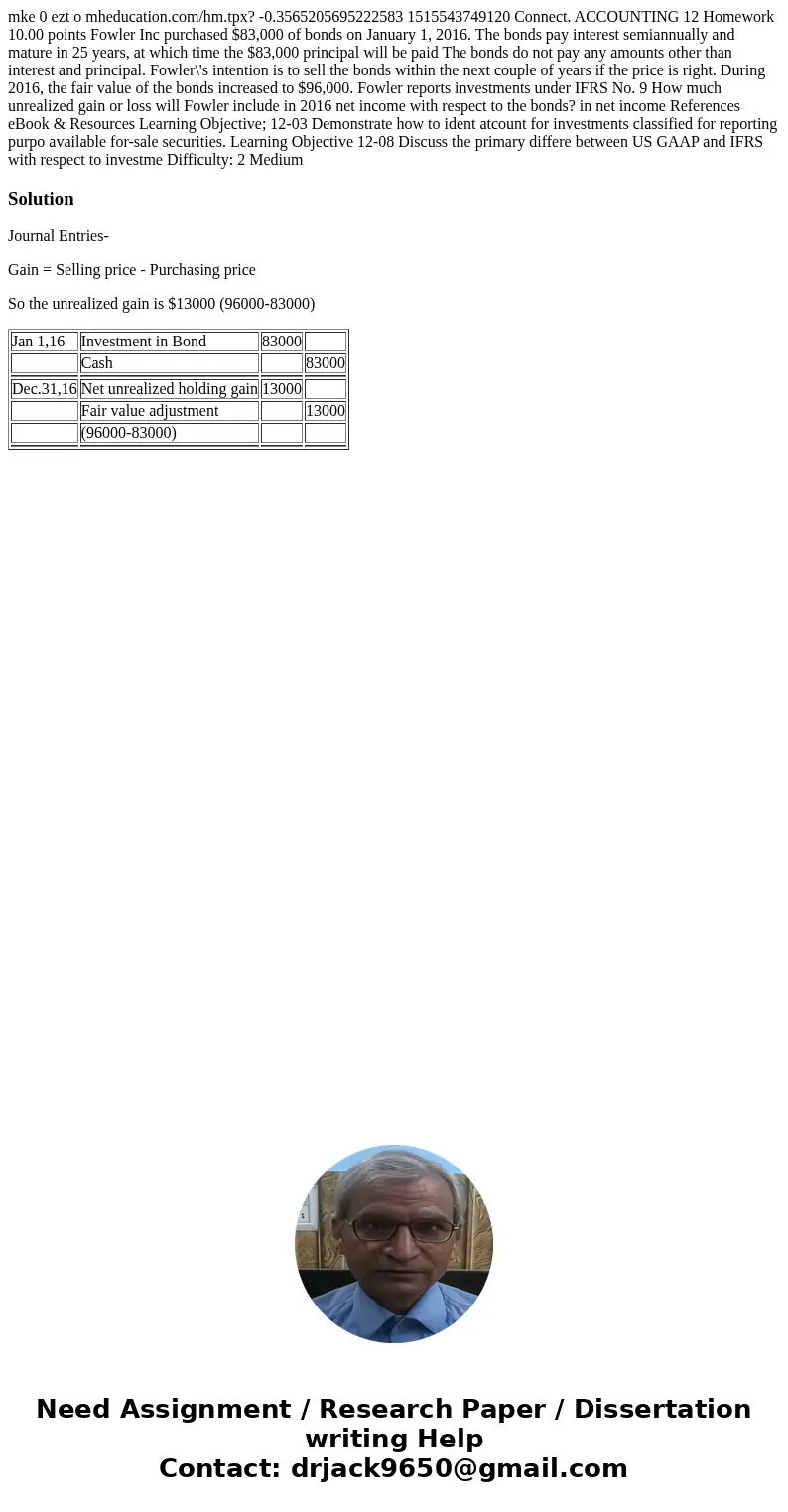

mke 0 ezt o mheducation.com/hm.tpx? -0.3565205695222583 1515543749120 Connect. ACCOUNTING 12 Homework 10.00 points Fowler Inc purchased $83,000 of bonds on January 1, 2016. The bonds pay interest semiannually and mature in 25 years, at which time the $83,000 principal will be paid The bonds do not pay any amounts other than interest and principal. Fowler\'s intention is to sell the bonds within the next couple of years if the price is right. During 2016, the fair value of the bonds increased to $96,000. Fowler reports investments under IFRS No. 9 How much unrealized gain or loss will Fowler include in 2016 net income with respect to the bonds? in net income References eBook & Resources Learning Objective; 12-03 Demonstrate how to ident atcount for investments classified for reporting purpo available for-sale securities. Learning Objective 12-08 Discuss the primary differe between US GAAP and IFRS with respect to investme Difficulty: 2 Medium

Solution

Journal Entries-

Gain = Selling price - Purchasing price

So the unrealized gain is $13000 (96000-83000)

| Jan 1,16 | Investment in Bond | 83000 | |

| Cash | 83000 | ||

| Dec.31,16 | Net unrealized holding gain | 13000 | |

| Fair value adjustment | 13000 | ||

| (96000-83000) | |||

Homework Sourse

Homework Sourse