A stock is expected to pay a dividend of 250 at the end of t

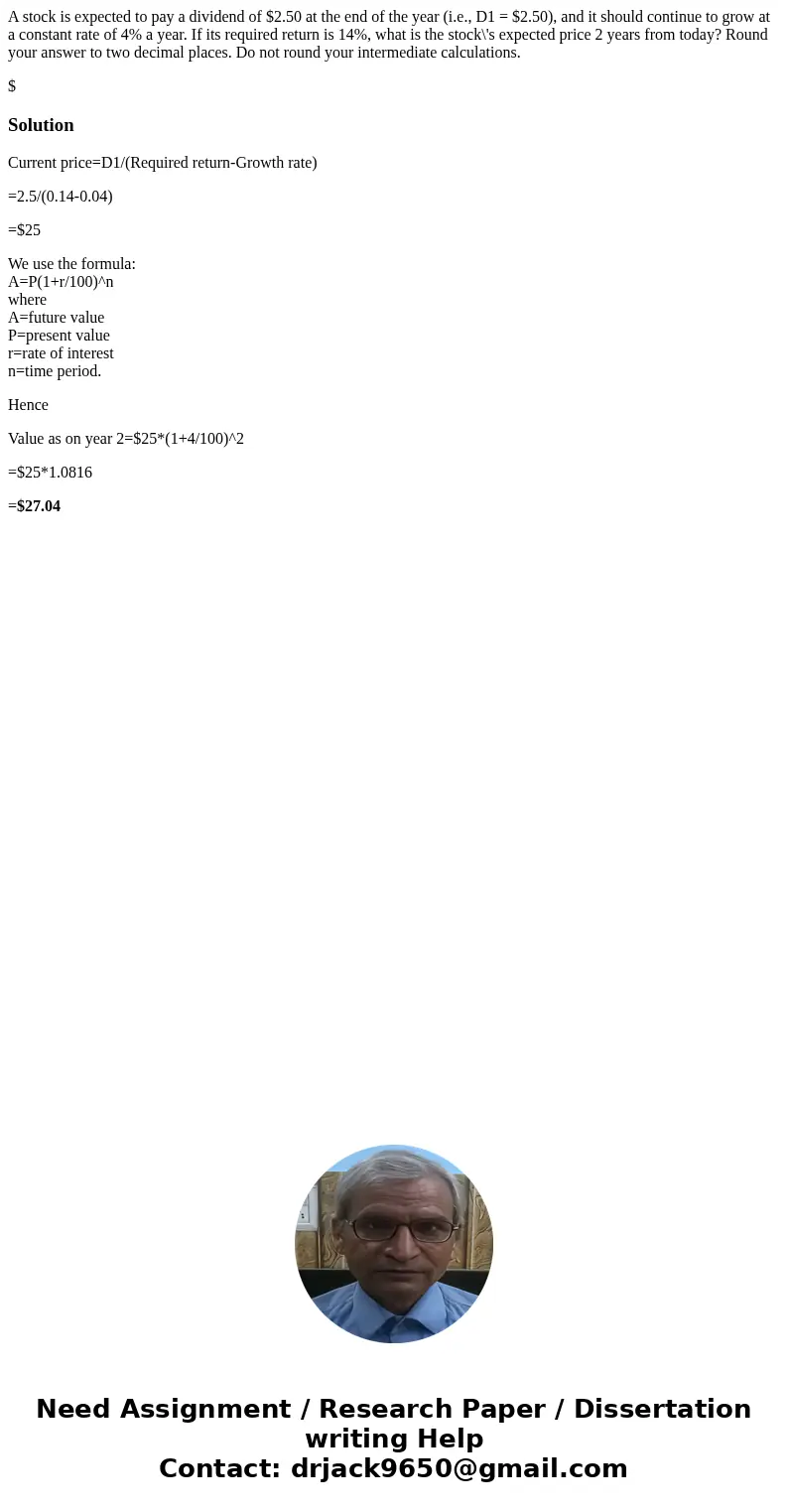

A stock is expected to pay a dividend of $2.50 at the end of the year (i.e., D1 = $2.50), and it should continue to grow at a constant rate of 4% a year. If its required return is 14%, what is the stock\'s expected price 2 years from today? Round your answer to two decimal places. Do not round your intermediate calculations.

$

Solution

Current price=D1/(Required return-Growth rate)

=2.5/(0.14-0.04)

=$25

We use the formula:

A=P(1+r/100)^n

where

A=future value

P=present value

r=rate of interest

n=time period.

Hence

Value as on year 2=$25*(1+4/100)^2

=$25*1.0816

=$27.04

Homework Sourse

Homework Sourse