FarCry Industries a maker of telecommunications equipment ha

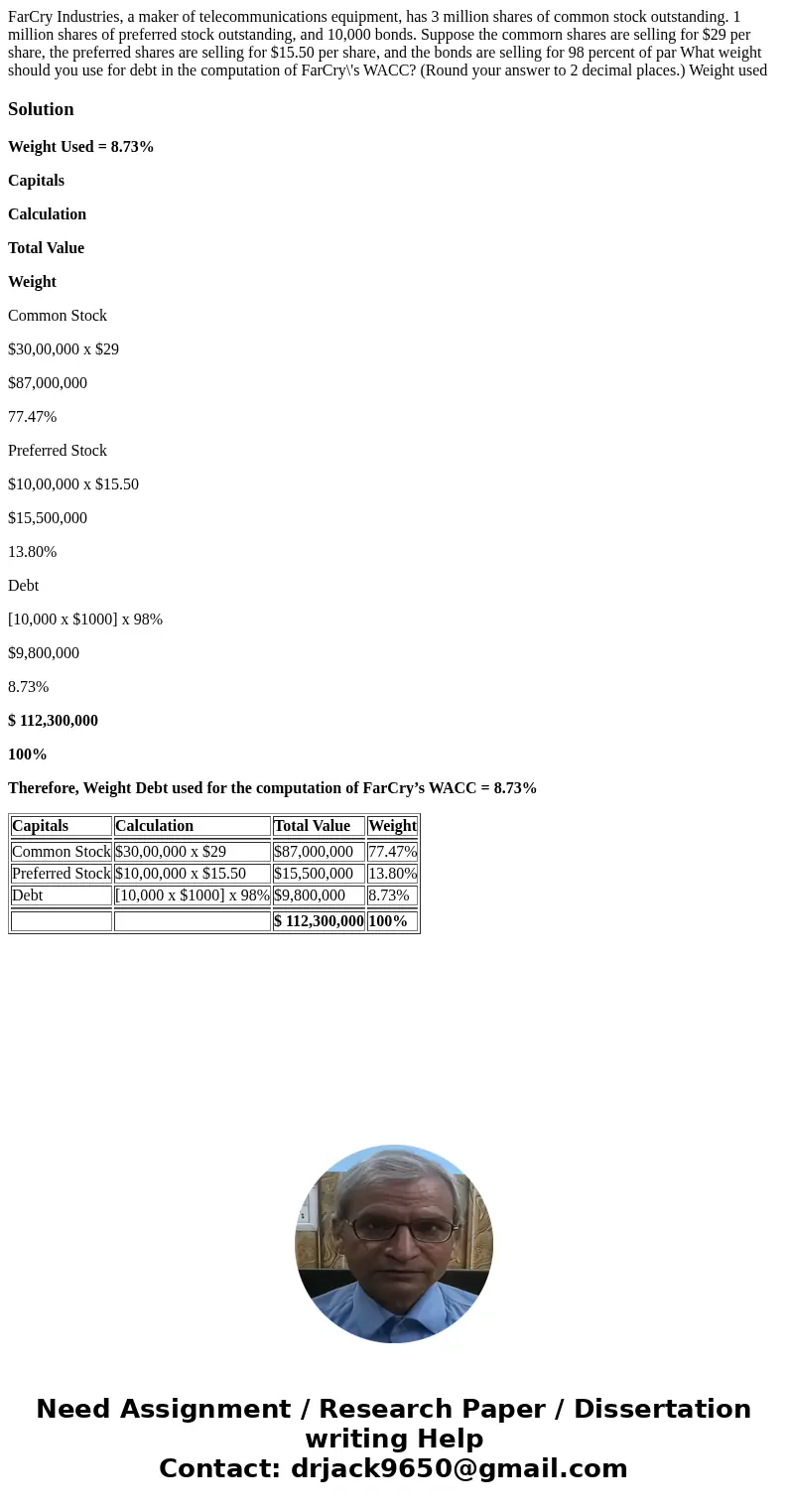

FarCry Industries, a maker of telecommunications equipment, has 3 million shares of common stock outstanding. 1 million shares of preferred stock outstanding, and 10,000 bonds. Suppose the commorn shares are selling for $29 per share, the preferred shares are selling for $15.50 per share, and the bonds are selling for 98 percent of par What weight should you use for debt in the computation of FarCry\'s WACC? (Round your answer to 2 decimal places.) Weight used

Solution

Weight Used = 8.73%

Capitals

Calculation

Total Value

Weight

Common Stock

$30,00,000 x $29

$87,000,000

77.47%

Preferred Stock

$10,00,000 x $15.50

$15,500,000

13.80%

Debt

[10,000 x $1000] x 98%

$9,800,000

8.73%

$ 112,300,000

100%

Therefore, Weight Debt used for the computation of FarCry’s WACC = 8.73%

| Capitals | Calculation | Total Value | Weight |

| Common Stock | $30,00,000 x $29 | $87,000,000 | 77.47% |

| Preferred Stock | $10,00,000 x $15.50 | $15,500,000 | 13.80% |

| Debt | [10,000 x $1000] x 98% | $9,800,000 | 8.73% |

| $ 112,300,000 | 100% |

Homework Sourse

Homework Sourse