Miller Corporation has a premium bond making semiannual paym

Solution

Price of Miller corporation

Using present value function in M S Excel

pv(rate,nper,pmt,fv,type) = rate =9/2 =4.5% nper =17*2 =34 pmt = 1000*11%/2 = 55 fv = 1000 type = 0

PV(4.5%,34,55,1000)

($1,172.47)

Price of Modigliani corporation bond

Using present value function in M S Excel

pv(rate,nper,pmt,fv,type) = rate =11/2 =5.5% nper =17*2 =34 pmt = 1000*9%/2 = 45 fv = 1000 type = 0

PV(5.5%,34,45,1000)

($847.63)

Price of bond

Miller corporation

Year

Using PV function in MS excel

1

pv(rate,nper,pmt,fv,type) = rate =9/2 =4.5% nper =16*2 =32 pmt = 1000*11%/2 = 55 fv = 1000 type = 0

PV(4.5%,32,55,1000)

($1,167.89)

6

pv(rate,nper,pmt,fv,type) = rate =9/2 =4.5% nper =11*2 =22 pmt = 1000*11%/2 = 55 fv = 1000 type = 0

PV(4.5%,22,55,1000)

($1,137.84)

11

pv(rate,nper,pmt,fv,type) = rate =9/2 =4.5% nper =6*2 =12 pmt = 1000*11%/2 = 55 fv = 1000 type = 0

PV(4.5%,12,55,1000)

($1,091.19)

15

pv(rate,nper,pmt,fv,type) = rate =9/2 =4.5% nper =2*2 =4 pmt = 1000*11%/2 = 55 fv = 1000 type = 0

PV(4.5%,4,55,1000)

($1,035.88)

17

pv(rate,nper,pmt,fv,type) = rate =9/2 =4.5% nper =0*2 =0 pmt = 1000*11%/2 = 55 fv = 1000 type = 0

PV(4.5%,0,55,1000)

($1,000.00)

Price of bond

Modigliani corporation

Year

Using PV function in MS excel

1

pv(rate,nper,pmt,fv,type) = rate =11/2 =5.5% nper =16*2 =32 pmt = 1000*9%/2 = 45 fv = 1000 type = 0

PV(5.5%,32,45,1000)

($850.96)

6

pv(rate,nper,pmt,fv,type) = rate =11/2 =5.5% nper =11*2 =22 pmt = 1000*9%/2 = 45 fv = 1000 type = 0

PV(5.5%,22,45,1000)

($874.17)

11

pv(rate,nper,pmt,fv,type) = rate =11/2 =5.5% nper =6*2 =12 pmt = 1000*9%/2 = 45 fv = 1000 type = 0

PV(5.5%,12,45,1000)

($913.81)

15

pv(rate,nper,pmt,fv,type) = rate =11/2 =5.5% nper =2*2 =4 pmt = 1000*9%/2 = 45 fv = 1000 type = 0

PV(5.5%,4,45,1000)

($964.95)

17

pv(rate,nper,pmt,fv,type) = rate =11/2 =5.5% nper =0*2 = 0 pmt = 1000*9%/2 = 45 fv = 1000 type = 0

PV(5.5%,0,45,1000)

($1,000.00)

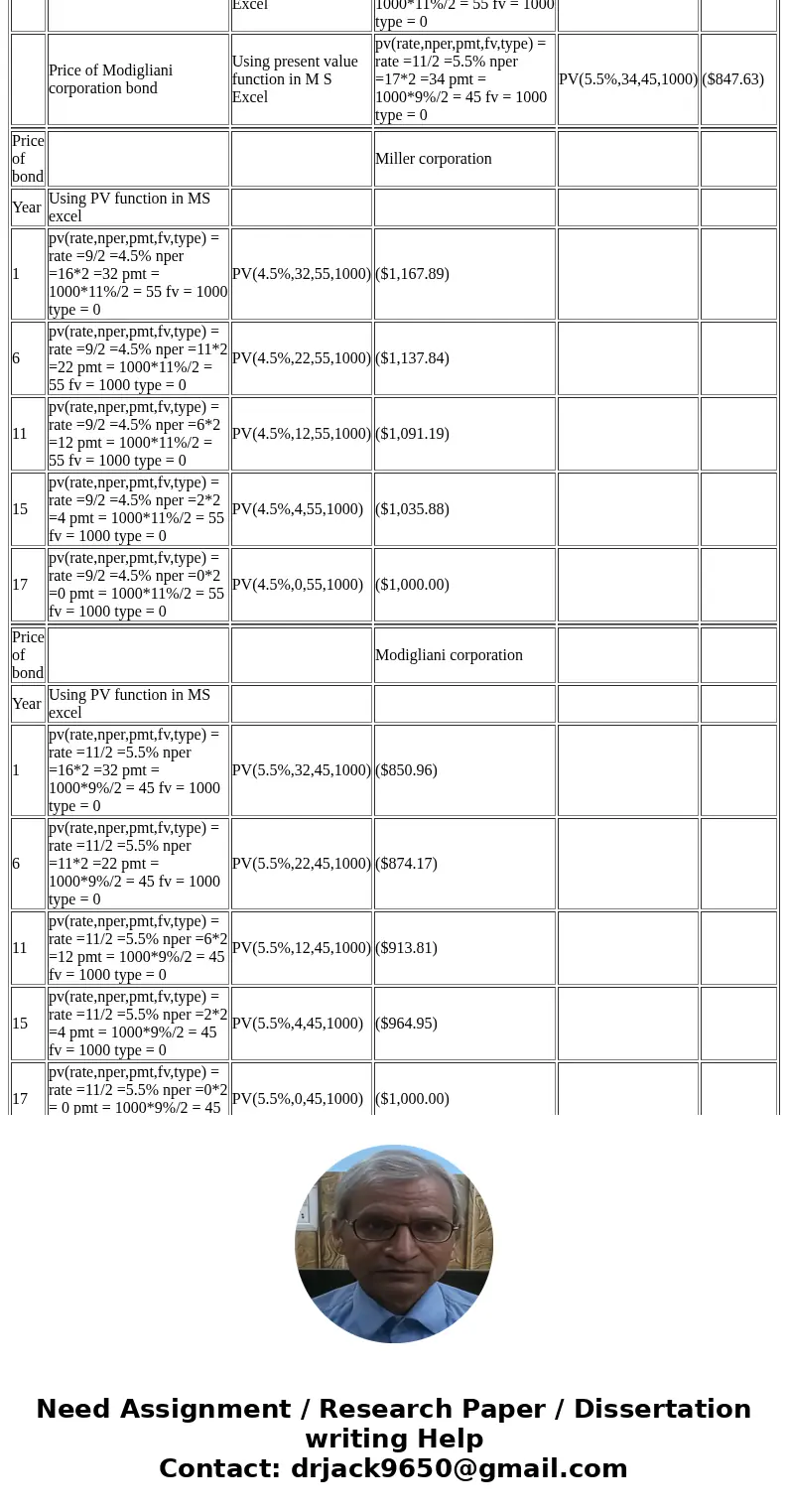

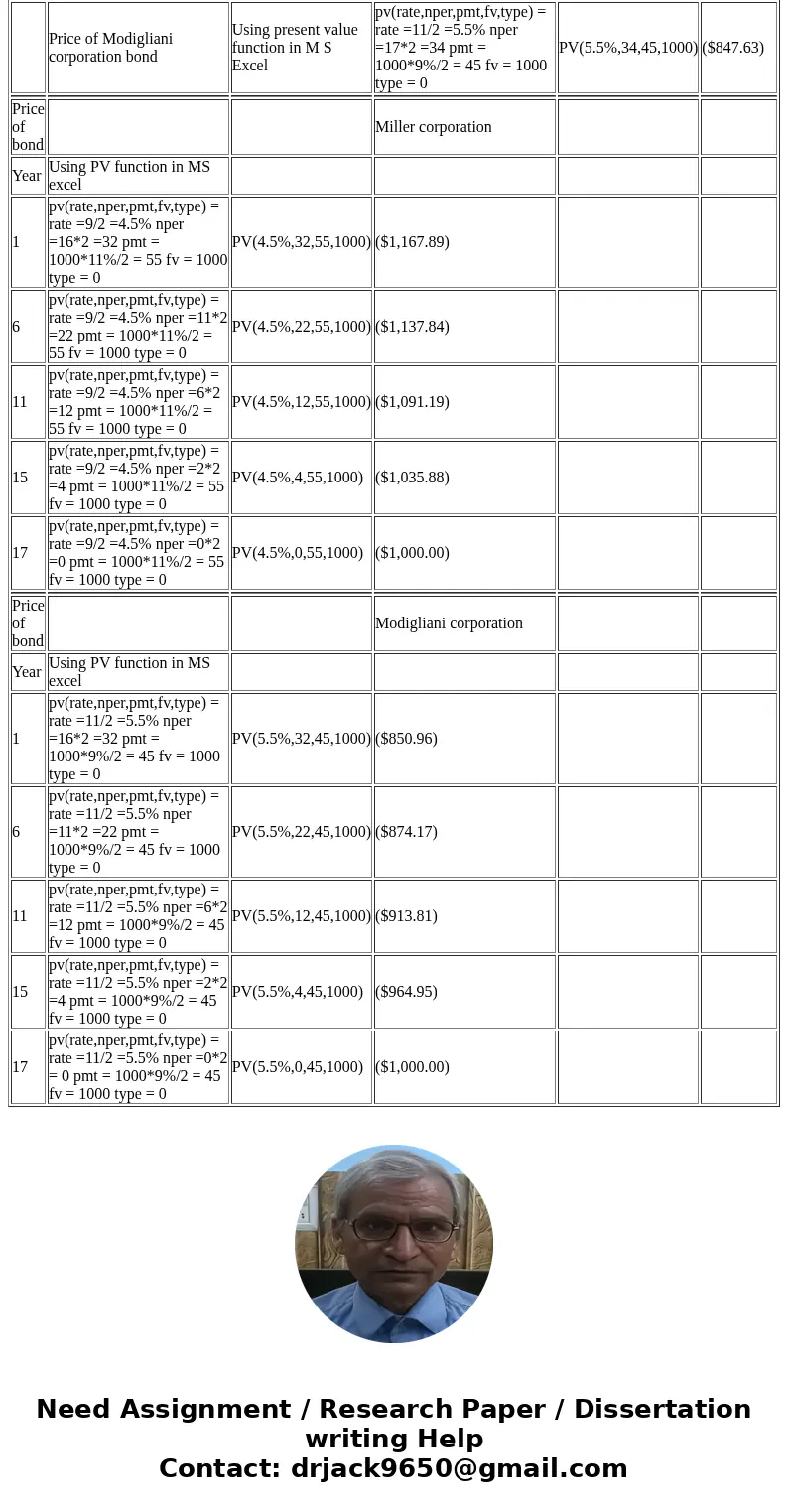

| Price of Miller corporation | Using present value function in M S Excel | pv(rate,nper,pmt,fv,type) = rate =9/2 =4.5% nper =17*2 =34 pmt = 1000*11%/2 = 55 fv = 1000 type = 0 | PV(4.5%,34,55,1000) | ($1,172.47) | |

| Price of Modigliani corporation bond | Using present value function in M S Excel | pv(rate,nper,pmt,fv,type) = rate =11/2 =5.5% nper =17*2 =34 pmt = 1000*9%/2 = 45 fv = 1000 type = 0 | PV(5.5%,34,45,1000) | ($847.63) | |

| Price of bond | Miller corporation | ||||

| Year | Using PV function in MS excel | ||||

| 1 | pv(rate,nper,pmt,fv,type) = rate =9/2 =4.5% nper =16*2 =32 pmt = 1000*11%/2 = 55 fv = 1000 type = 0 | PV(4.5%,32,55,1000) | ($1,167.89) | ||

| 6 | pv(rate,nper,pmt,fv,type) = rate =9/2 =4.5% nper =11*2 =22 pmt = 1000*11%/2 = 55 fv = 1000 type = 0 | PV(4.5%,22,55,1000) | ($1,137.84) | ||

| 11 | pv(rate,nper,pmt,fv,type) = rate =9/2 =4.5% nper =6*2 =12 pmt = 1000*11%/2 = 55 fv = 1000 type = 0 | PV(4.5%,12,55,1000) | ($1,091.19) | ||

| 15 | pv(rate,nper,pmt,fv,type) = rate =9/2 =4.5% nper =2*2 =4 pmt = 1000*11%/2 = 55 fv = 1000 type = 0 | PV(4.5%,4,55,1000) | ($1,035.88) | ||

| 17 | pv(rate,nper,pmt,fv,type) = rate =9/2 =4.5% nper =0*2 =0 pmt = 1000*11%/2 = 55 fv = 1000 type = 0 | PV(4.5%,0,55,1000) | ($1,000.00) | ||

| Price of bond | Modigliani corporation | ||||

| Year | Using PV function in MS excel | ||||

| 1 | pv(rate,nper,pmt,fv,type) = rate =11/2 =5.5% nper =16*2 =32 pmt = 1000*9%/2 = 45 fv = 1000 type = 0 | PV(5.5%,32,45,1000) | ($850.96) | ||

| 6 | pv(rate,nper,pmt,fv,type) = rate =11/2 =5.5% nper =11*2 =22 pmt = 1000*9%/2 = 45 fv = 1000 type = 0 | PV(5.5%,22,45,1000) | ($874.17) | ||

| 11 | pv(rate,nper,pmt,fv,type) = rate =11/2 =5.5% nper =6*2 =12 pmt = 1000*9%/2 = 45 fv = 1000 type = 0 | PV(5.5%,12,45,1000) | ($913.81) | ||

| 15 | pv(rate,nper,pmt,fv,type) = rate =11/2 =5.5% nper =2*2 =4 pmt = 1000*9%/2 = 45 fv = 1000 type = 0 | PV(5.5%,4,45,1000) | ($964.95) | ||

| 17 | pv(rate,nper,pmt,fv,type) = rate =11/2 =5.5% nper =0*2 = 0 pmt = 1000*9%/2 = 45 fv = 1000 type = 0 | PV(5.5%,0,45,1000) | ($1,000.00) |

Homework Sourse

Homework Sourse