XYZ Company began operations in May 2018 by selling common s

XYZ Company began operations in May, 2018 by selling common stock to owners in exchange for $90,000 cash. During 2018, ABC Company entered into the following transactions: 1. On May 23, ABC Company purchased inventory for $50,000 cash. 2. On June 1, ABC Company purchased a three-year insurance policy for $23,400 cash. 3. On July 1, ABC Company received $49,500 cash from a customer for services to be performed over the next 18 months. 4. On August 1, ABC Company purchased equipment for $60,000 cash. The equipment was assigned a 10-year life and a $2,400 residual value. 5. On August 18, ABC Company sold one-half of the inventory that was purchased on May 23 to a customer for $44,000 cash. Calculate the amount of total assets that ABC Company would report in its December 31, 2018 balance sheet after all the above transactions are recorded and all necessary adjusting entries are made and posted.

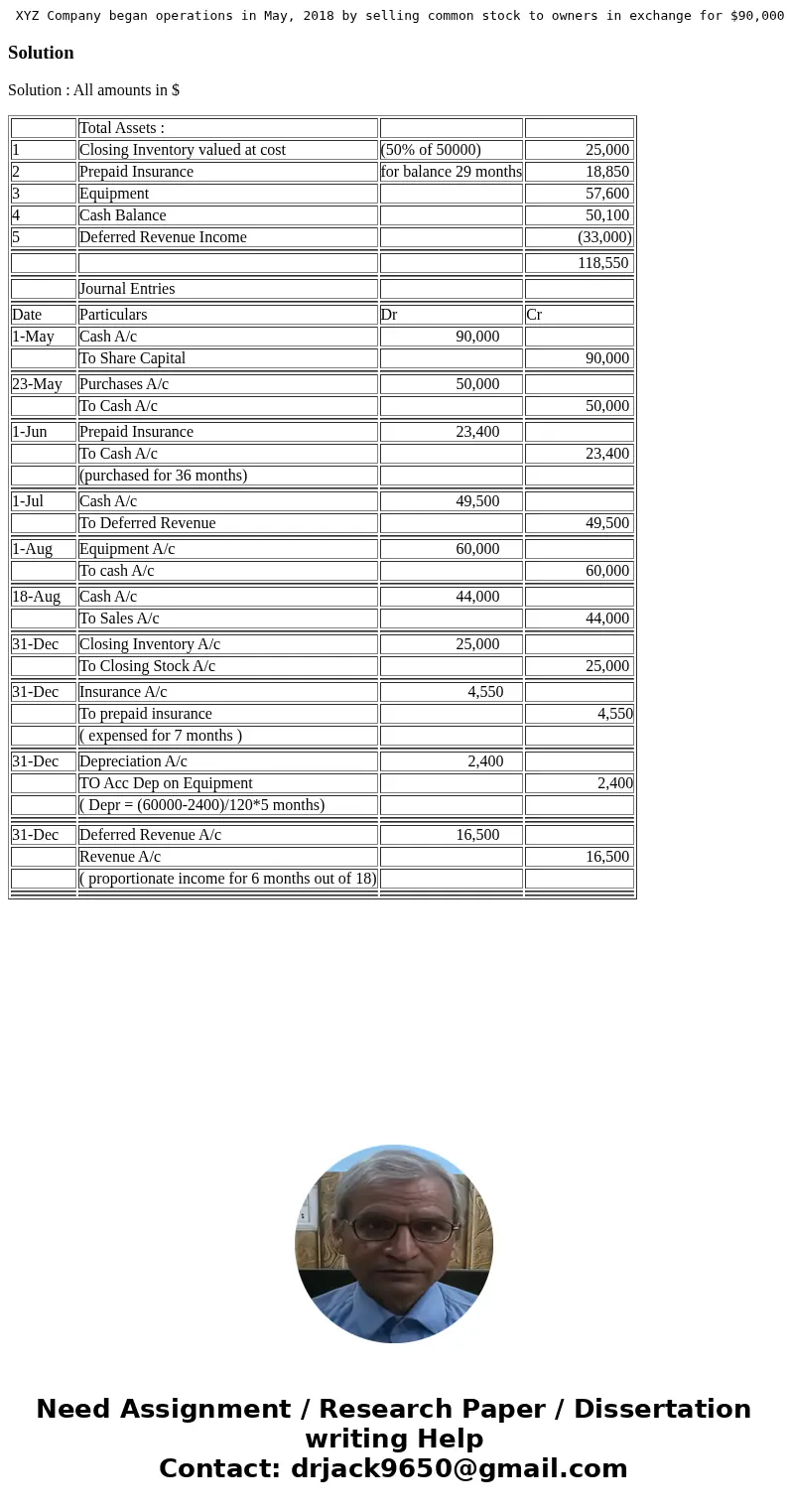

Solution

Solution : All amounts in $

| Total Assets : | |||

| 1 | Closing Inventory valued at cost | (50% of 50000) | 25,000 |

| 2 | Prepaid Insurance | for balance 29 months | 18,850 |

| 3 | Equipment | 57,600 | |

| 4 | Cash Balance | 50,100 | |

| 5 | Deferred Revenue Income | (33,000) | |

| 118,550 | |||

| Journal Entries | |||

| Date | Particulars | Dr | Cr |

| 1-May | Cash A/c | 90,000 | |

| To Share Capital | 90,000 | ||

| 23-May | Purchases A/c | 50,000 | |

| To Cash A/c | 50,000 | ||

| 1-Jun | Prepaid Insurance | 23,400 | |

| To Cash A/c | 23,400 | ||

| (purchased for 36 months) | |||

| 1-Jul | Cash A/c | 49,500 | |

| To Deferred Revenue | 49,500 | ||

| 1-Aug | Equipment A/c | 60,000 | |

| To cash A/c | 60,000 | ||

| 18-Aug | Cash A/c | 44,000 | |

| To Sales A/c | 44,000 | ||

| 31-Dec | Closing Inventory A/c | 25,000 | |

| To Closing Stock A/c | 25,000 | ||

| 31-Dec | Insurance A/c | 4,550 | |

| To prepaid insurance | 4,550 | ||

| ( expensed for 7 months ) | |||

| 31-Dec | Depreciation A/c | 2,400 | |

| TO Acc Dep on Equipment | 2,400 | ||

| ( Depr = (60000-2400)/120*5 months) | |||

| 31-Dec | Deferred Revenue A/c | 16,500 | |

| Revenue A/c | 16,500 | ||

| ( proportionate income for 6 months out of 18) | |||

Homework Sourse

Homework Sourse