Exercise 17o shown below appear in the general ledger of Her

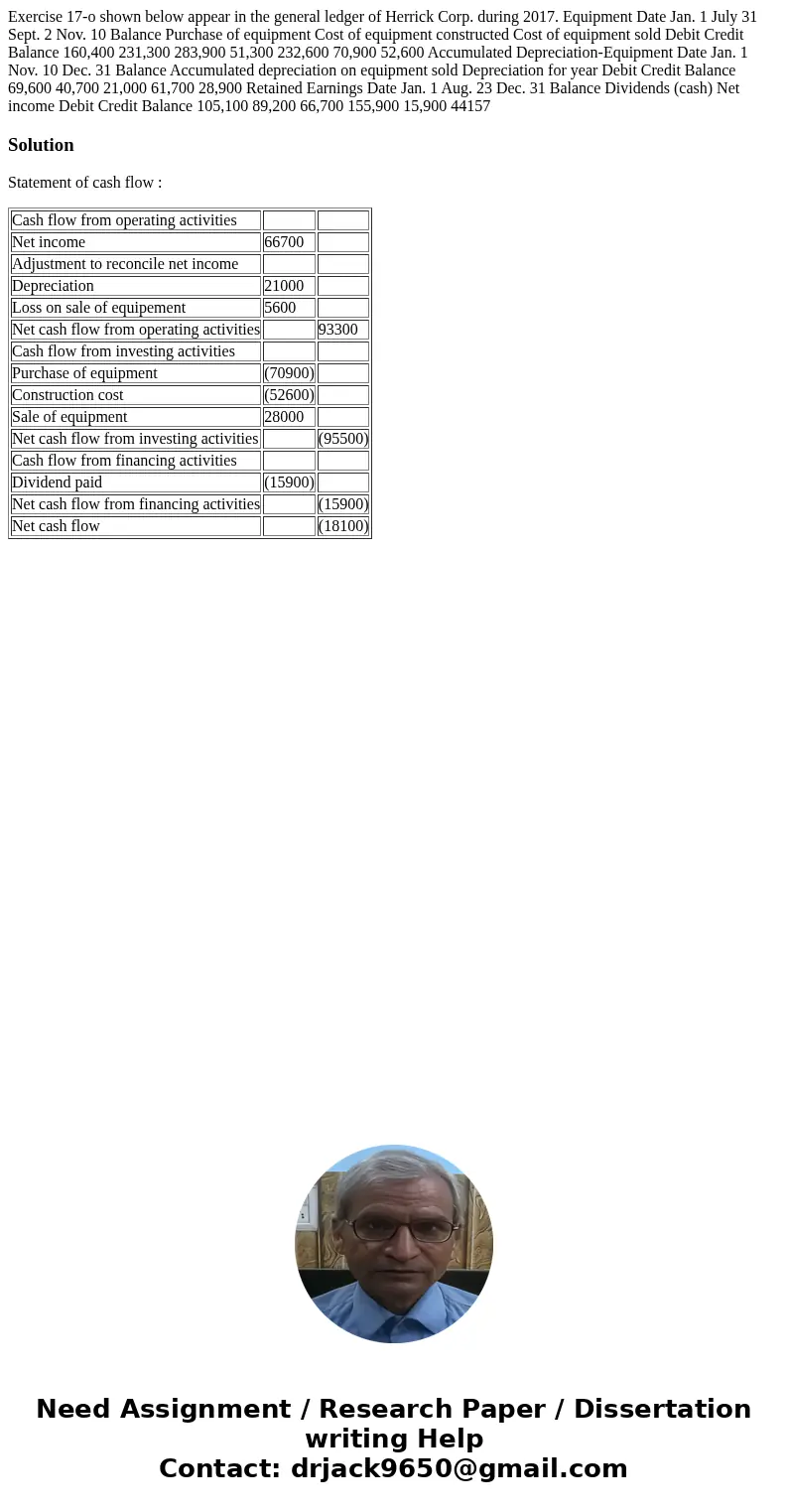

Exercise 17-o shown below appear in the general ledger of Herrick Corp. during 2017. Equipment Date Jan. 1 July 31 Sept. 2 Nov. 10 Balance Purchase of equipment Cost of equipment constructed Cost of equipment sold Debit Credit Balance 160,400 231,300 283,900 51,300 232,600 70,900 52,600 Accumulated Depreciation-Equipment Date Jan. 1 Nov. 10 Dec. 31 Balance Accumulated depreciation on equipment sold Depreciation for year Debit Credit Balance 69,600 40,700 21,000 61,700 28,900 Retained Earnings Date Jan. 1 Aug. 23 Dec. 31 Balance Dividends (cash) Net income Debit Credit Balance 105,100 89,200 66,700 155,900 15,900 44157

Solution

Statement of cash flow :

| Cash flow from operating activities | ||

| Net income | 66700 | |

| Adjustment to reconcile net income | ||

| Depreciation | 21000 | |

| Loss on sale of equipement | 5600 | |

| Net cash flow from operating activities | 93300 | |

| Cash flow from investing activities | ||

| Purchase of equipment | (70900) | |

| Construction cost | (52600) | |

| Sale of equipment | 28000 | |

| Net cash flow from investing activities | (95500) | |

| Cash flow from financing activities | ||

| Dividend paid | (15900) | |

| Net cash flow from financing activities | (15900) | |

| Net cash flow | (18100) |

Homework Sourse

Homework Sourse