Your firm is considering purchasing an old office building w

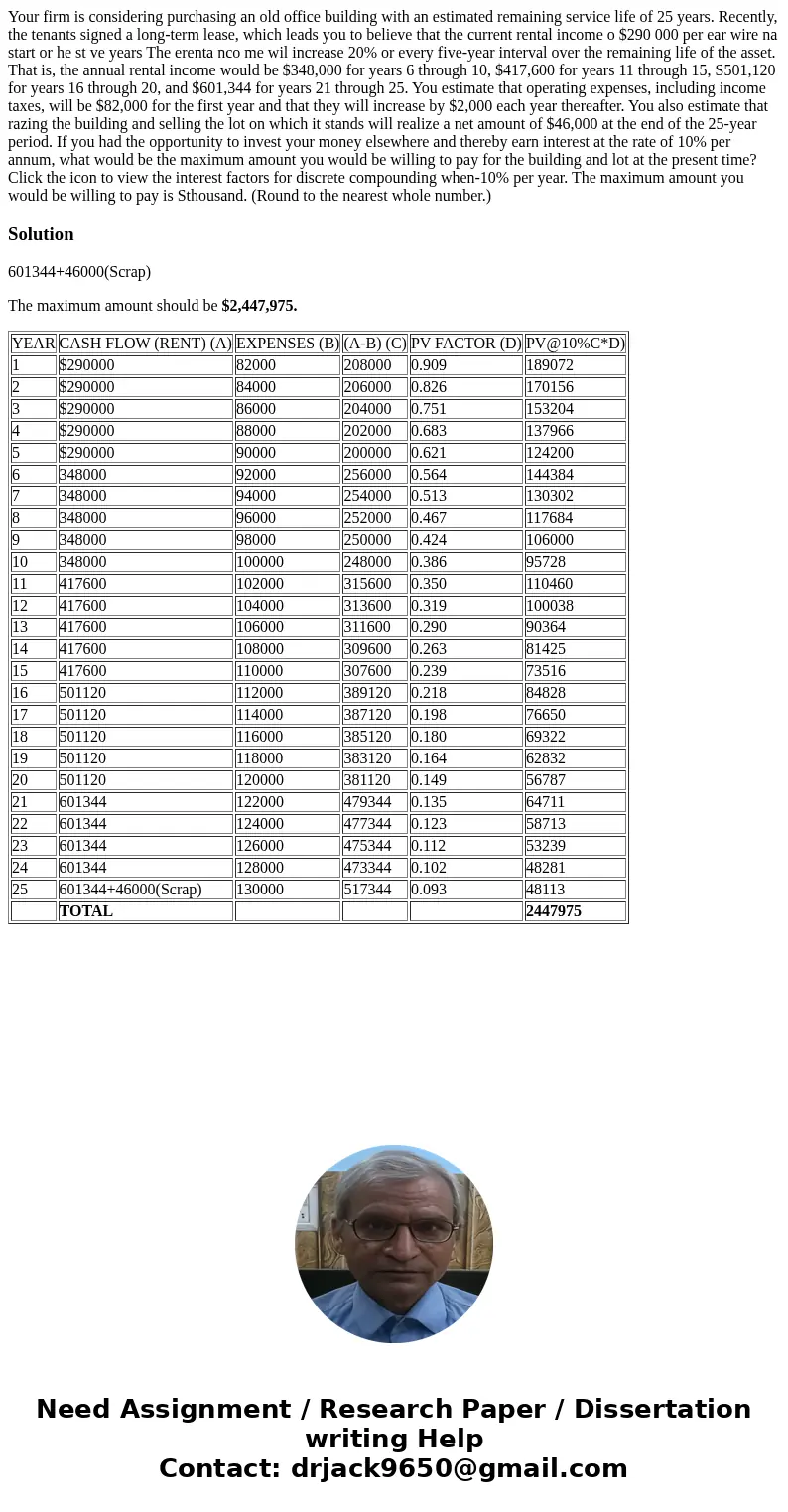

Your firm is considering purchasing an old office building with an estimated remaining service life of 25 years. Recently, the tenants signed a long-term lease, which leads you to believe that the current rental income o $290 000 per ear wire na start or he st ve years The erenta nco me wil increase 20% or every five-year interval over the remaining life of the asset. That is, the annual rental income would be $348,000 for years 6 through 10, $417,600 for years 11 through 15, S501,120 for years 16 through 20, and $601,344 for years 21 through 25. You estimate that operating expenses, including income taxes, will be $82,000 for the first year and that they will increase by $2,000 each year thereafter. You also estimate that razing the building and selling the lot on which it stands will realize a net amount of $46,000 at the end of the 25-year period. If you had the opportunity to invest your money elsewhere and thereby earn interest at the rate of 10% per annum, what would be the maximum amount you would be willing to pay for the building and lot at the present time? Click the icon to view the interest factors for discrete compounding when-10% per year. The maximum amount you would be willing to pay is Sthousand. (Round to the nearest whole number.)

Solution

601344+46000(Scrap)

The maximum amount should be $2,447,975.

| YEAR | CASH FLOW (RENT) (A) | EXPENSES (B) | (A-B) (C) | PV FACTOR (D) | PV@10%C*D) |

| 1 | $290000 | 82000 | 208000 | 0.909 | 189072 |

| 2 | $290000 | 84000 | 206000 | 0.826 | 170156 |

| 3 | $290000 | 86000 | 204000 | 0.751 | 153204 |

| 4 | $290000 | 88000 | 202000 | 0.683 | 137966 |

| 5 | $290000 | 90000 | 200000 | 0.621 | 124200 |

| 6 | 348000 | 92000 | 256000 | 0.564 | 144384 |

| 7 | 348000 | 94000 | 254000 | 0.513 | 130302 |

| 8 | 348000 | 96000 | 252000 | 0.467 | 117684 |

| 9 | 348000 | 98000 | 250000 | 0.424 | 106000 |

| 10 | 348000 | 100000 | 248000 | 0.386 | 95728 |

| 11 | 417600 | 102000 | 315600 | 0.350 | 110460 |

| 12 | 417600 | 104000 | 313600 | 0.319 | 100038 |

| 13 | 417600 | 106000 | 311600 | 0.290 | 90364 |

| 14 | 417600 | 108000 | 309600 | 0.263 | 81425 |

| 15 | 417600 | 110000 | 307600 | 0.239 | 73516 |

| 16 | 501120 | 112000 | 389120 | 0.218 | 84828 |

| 17 | 501120 | 114000 | 387120 | 0.198 | 76650 |

| 18 | 501120 | 116000 | 385120 | 0.180 | 69322 |

| 19 | 501120 | 118000 | 383120 | 0.164 | 62832 |

| 20 | 501120 | 120000 | 381120 | 0.149 | 56787 |

| 21 | 601344 | 122000 | 479344 | 0.135 | 64711 |

| 22 | 601344 | 124000 | 477344 | 0.123 | 58713 |

| 23 | 601344 | 126000 | 475344 | 0.112 | 53239 |

| 24 | 601344 | 128000 | 473344 | 0.102 | 48281 |

| 25 | 601344+46000(Scrap) | 130000 | 517344 | 0.093 | 48113 |

| TOTAL | 2447975 |

Homework Sourse

Homework Sourse