Can you please explain step by step on how to do this questi

***Can you please explain step by step on how to do this question*** and please show formulas used so I can understand how to do it on my own. thank you.

A three-year bond provides a coupon of 8% semiannually and has a cash price of 104. What is the bond’s yield?

Solution

YTM is the rate of return that the investor receives if he holds the bond till maturity.

We can calculate YTM using excel or trial and error method.

Using excel to calculate YTM helps save time and it also provide accurate answer.

Annual coupon = 100 * 0.08 = 8 or $4 per semi annual

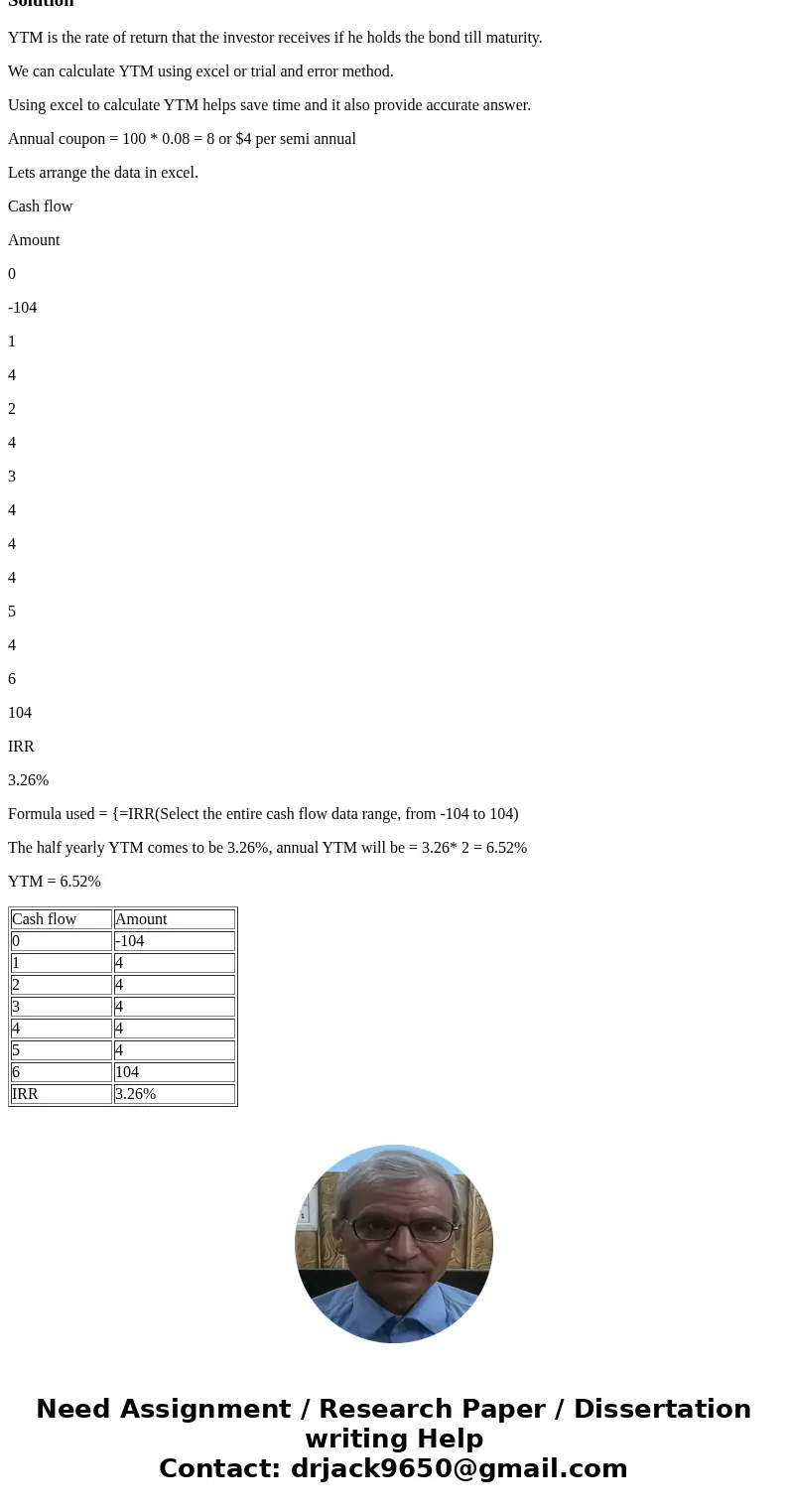

Lets arrange the data in excel.

Cash flow

Amount

0

-104

1

4

2

4

3

4

4

4

5

4

6

104

IRR

3.26%

Formula used = {=IRR(Select the entire cash flow data range, from -104 to 104)

The half yearly YTM comes to be 3.26%, annual YTM will be = 3.26* 2 = 6.52%

YTM = 6.52%

| Cash flow | Amount |

| 0 | -104 |

| 1 | 4 |

| 2 | 4 |

| 3 | 4 |

| 4 | 4 |

| 5 | 4 |

| 6 | 104 |

| IRR | 3.26% |

Homework Sourse

Homework Sourse