Provide the financial anaylsis for PepsiCo for 201112 and co

Provide the financial anaylsis for PepsiCo for 2011-12 and compare the two. Please show work for ROA (return on assests), ROI (return on investment), Current Ratio, Quick Ratio, working captial, debit ratio, gross profit margins. Please use the attched numbers.

EXHIBIT 7 PepsiCos Recent Income Statements (in millions of S) 2012 2011 2010 2009 Revenue ther Revenue, Total 65,492.0 66,504.0 P 57,838.0 43,251.0 0.0 0.0 0.0 A M Total Revenue 65,492.0 66,504.0 57838.0 43.2510 Cost of Revenue, Total 31291.0 31 593.0 26,575.0 20,3510 ota Gross Profit 342010 34,911.0 31263.0 22,900.0 Selling/General Administrative Expenses, Total24,675.0 24,433.0 2700 15,489.0 Research & Development 0.0 0 0 388.0 Depreciation/Amortization 119.0 133.0 117.0 Interest Expense Income)Net Operating 0.0 0.0 0,0 0.0 Unusual Expense (Income) 295.0 712.0 1,044.0 0.0 Other Operating Expenses, Total 0.0 0.0 0,0 r Operating Income 9,112.0 - 9,633.0 8332.0 6,959.0 Interest Income (Expense ), Net Non-Operating 0 0 (.0 0.0 0.0 Gain (Loss) on sale of Assets 0.0 CEO 0.0 0.0 ts Other, Net 0.0 0 .0 0.0 0.0 0 0 Income Before Tax Income Tax, Total 8304.0 8,834.0 8,23207045.0 2,090.0 2,372.0 1,894.0 1,879.0 Income After Tax 6,214.0 6,4620 6,338.0 Minosity Interest Equity In Affiliates. US . GAAP adjustment -(36.0). 0.0 (19.0) 0.0 0.0 0.0 (18.0) 0,0 0.0 5,166.0 24.0 0.0 0.0 Net Income Before Extra Items Total Extraordinary Items 6,178.0 0.0 6,443.0 0.0 6,320.0 5,142.0 0.0 Net Income 6,178.0 6,443.0 6,320.0 5,142.0Solution

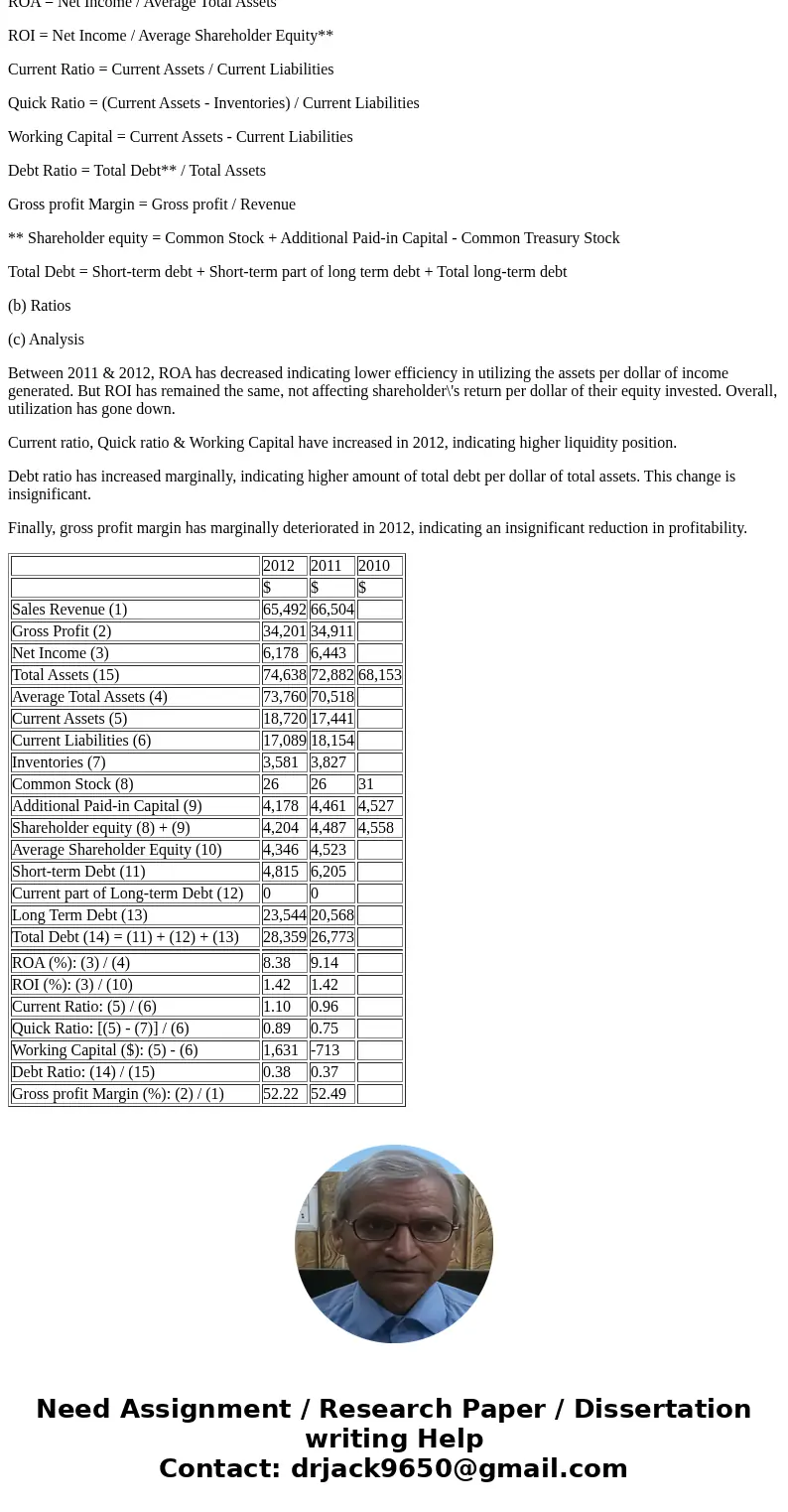

(a) Formulas:

ROA = Net Income / Average Total Assets

ROI = Net Income / Average Shareholder Equity**

Current Ratio = Current Assets / Current Liabilities

Quick Ratio = (Current Assets - Inventories) / Current Liabilities

Working Capital = Current Assets - Current Liabilities

Debt Ratio = Total Debt** / Total Assets

Gross profit Margin = Gross profit / Revenue

** Shareholder equity = Common Stock + Additional Paid-in Capital - Common Treasury Stock

Total Debt = Short-term debt + Short-term part of long term debt + Total long-term debt

(b) Ratios

(c) Analysis

Between 2011 & 2012, ROA has decreased indicating lower efficiency in utilizing the assets per dollar of income generated. But ROI has remained the same, not affecting shareholder\'s return per dollar of their equity invested. Overall, utilization has gone down.

Current ratio, Quick ratio & Working Capital have increased in 2012, indicating higher liquidity position.

Debt ratio has increased marginally, indicating higher amount of total debt per dollar of total assets. This change is insignificant.

Finally, gross profit margin has marginally deteriorated in 2012, indicating an insignificant reduction in profitability.

| 2012 | 2011 | 2010 | |

| $ | $ | $ | |

| Sales Revenue (1) | 65,492 | 66,504 | |

| Gross Profit (2) | 34,201 | 34,911 | |

| Net Income (3) | 6,178 | 6,443 | |

| Total Assets (15) | 74,638 | 72,882 | 68,153 |

| Average Total Assets (4) | 73,760 | 70,518 | |

| Current Assets (5) | 18,720 | 17,441 | |

| Current Liabilities (6) | 17,089 | 18,154 | |

| Inventories (7) | 3,581 | 3,827 | |

| Common Stock (8) | 26 | 26 | 31 |

| Additional Paid-in Capital (9) | 4,178 | 4,461 | 4,527 |

| Shareholder equity (8) + (9) | 4,204 | 4,487 | 4,558 |

| Average Shareholder Equity (10) | 4,346 | 4,523 | |

| Short-term Debt (11) | 4,815 | 6,205 | |

| Current part of Long-term Debt (12) | 0 | 0 | |

| Long Term Debt (13) | 23,544 | 20,568 | |

| Total Debt (14) = (11) + (12) + (13) | 28,359 | 26,773 | |

| ROA (%): (3) / (4) | 8.38 | 9.14 | |

| ROI (%): (3) / (10) | 1.42 | 1.42 | |

| Current Ratio: (5) / (6) | 1.10 | 0.96 | |

| Quick Ratio: [(5) - (7)] / (6) | 0.89 | 0.75 | |

| Working Capital ($): (5) - (6) | 1,631 | -713 | |

| Debt Ratio: (14) / (15) | 0.38 | 0.37 | |

| Gross profit Margin (%): (2) / (1) | 52.22 | 52.49 |

Homework Sourse

Homework Sourse