An income producing asset costing 190000 is being depreciate

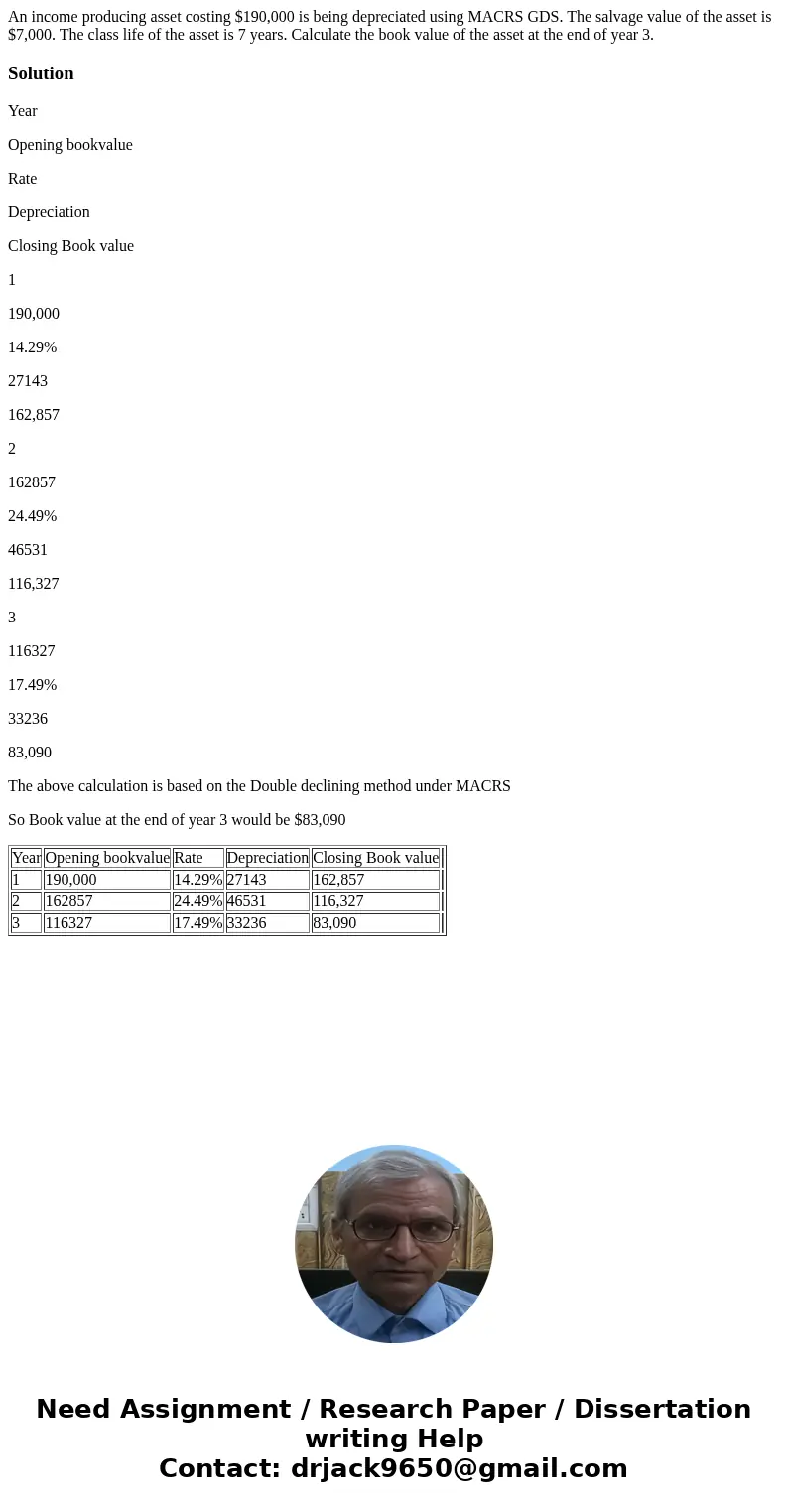

An income producing asset costing $190,000 is being depreciated using MACRS GDS. The salvage value of the asset is $7,000. The class life of the asset is 7 years. Calculate the book value of the asset at the end of year 3.

Solution

Year

Opening bookvalue

Rate

Depreciation

Closing Book value

1

190,000

14.29%

27143

162,857

2

162857

24.49%

46531

116,327

3

116327

17.49%

33236

83,090

The above calculation is based on the Double declining method under MACRS

So Book value at the end of year 3 would be $83,090

| Year | Opening bookvalue | Rate | Depreciation | Closing Book value | |

| 1 | 190,000 | 14.29% | 27143 | 162,857 | |

| 2 | 162857 | 24.49% | 46531 | 116,327 | |

| 3 | 116327 | 17.49% | 33236 | 83,090 |

Homework Sourse

Homework Sourse