Growl Co issued 16year bonds a year ago at a coupon rate of

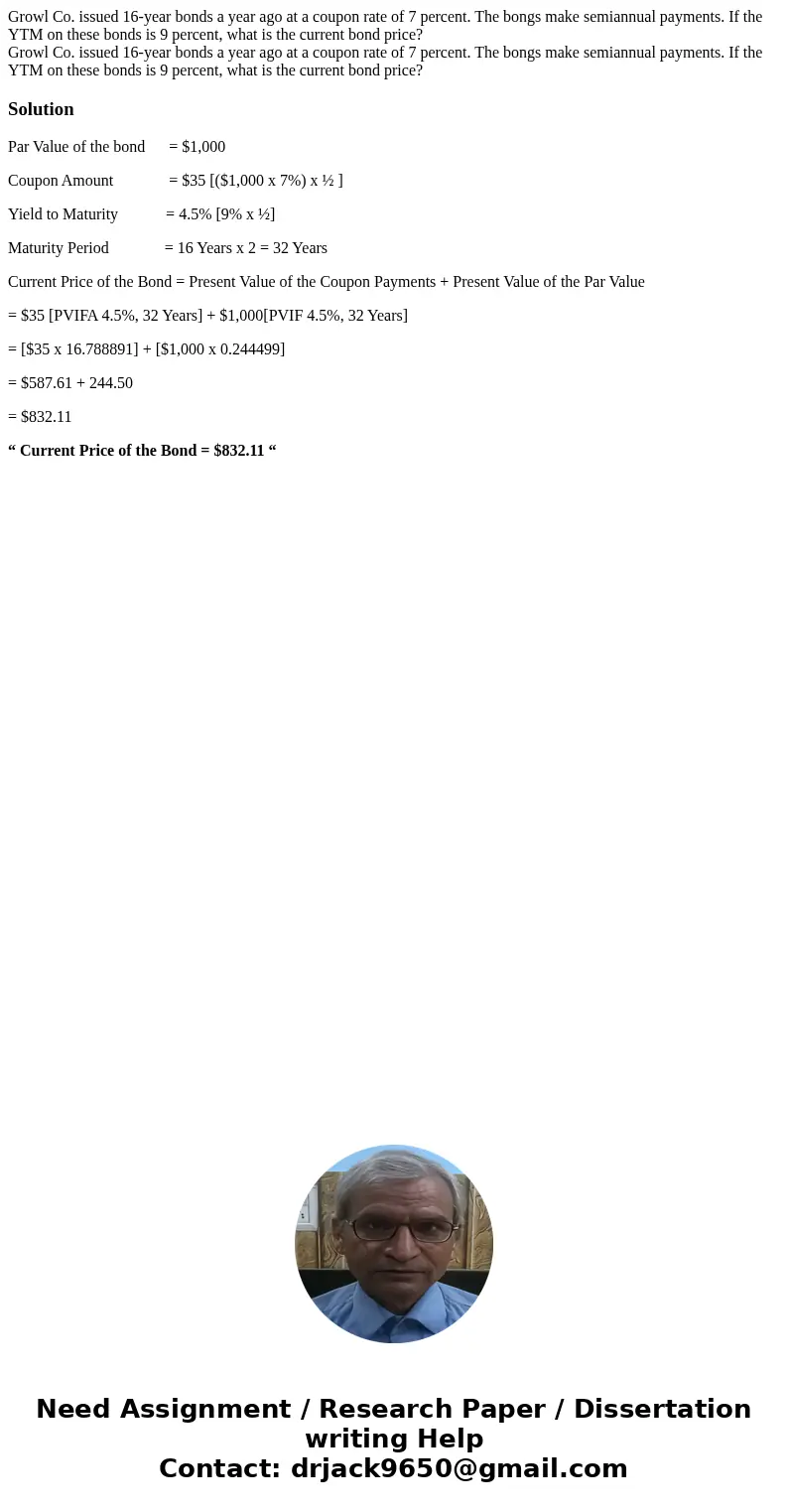

Growl Co. issued 16-year bonds a year ago at a coupon rate of 7 percent. The bongs make semiannual payments. If the YTM on these bonds is 9 percent, what is the current bond price?

Growl Co. issued 16-year bonds a year ago at a coupon rate of 7 percent. The bongs make semiannual payments. If the YTM on these bonds is 9 percent, what is the current bond price?

Solution

Par Value of the bond = $1,000

Coupon Amount = $35 [($1,000 x 7%) x ½ ]

Yield to Maturity = 4.5% [9% x ½]

Maturity Period = 16 Years x 2 = 32 Years

Current Price of the Bond = Present Value of the Coupon Payments + Present Value of the Par Value

= $35 [PVIFA 4.5%, 32 Years] + $1,000[PVIF 4.5%, 32 Years]

= [$35 x 16.788891] + [$1,000 x 0.244499]

= $587.61 + 244.50

= $832.11

“ Current Price of the Bond = $832.11 “

Homework Sourse

Homework Sourse