Suppose a company retains 60 of its earnings for reinvesting

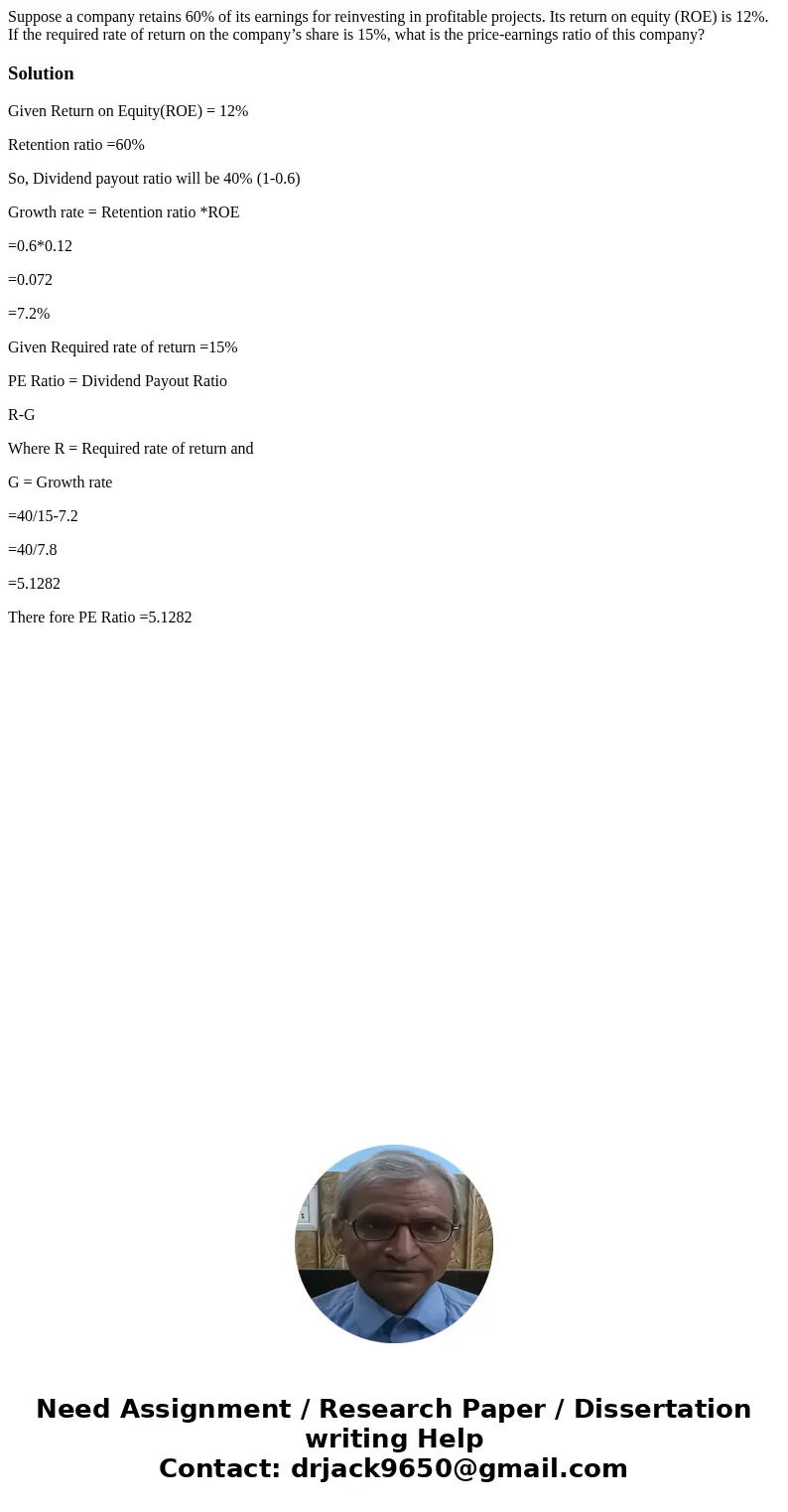

Suppose a company retains 60% of its earnings for reinvesting in profitable projects. Its return on equity (ROE) is 12%. If the required rate of return on the company’s share is 15%, what is the price-earnings ratio of this company?

Solution

Given Return on Equity(ROE) = 12%

Retention ratio =60%

So, Dividend payout ratio will be 40% (1-0.6)

Growth rate = Retention ratio *ROE

=0.6*0.12

=0.072

=7.2%

Given Required rate of return =15%

PE Ratio = Dividend Payout Ratio

R-G

Where R = Required rate of return and

G = Growth rate

=40/15-7.2

=40/7.8

=5.1282

There fore PE Ratio =5.1282

Homework Sourse

Homework Sourse