The common stock of Auto Deliveries sells for 2816 a share T

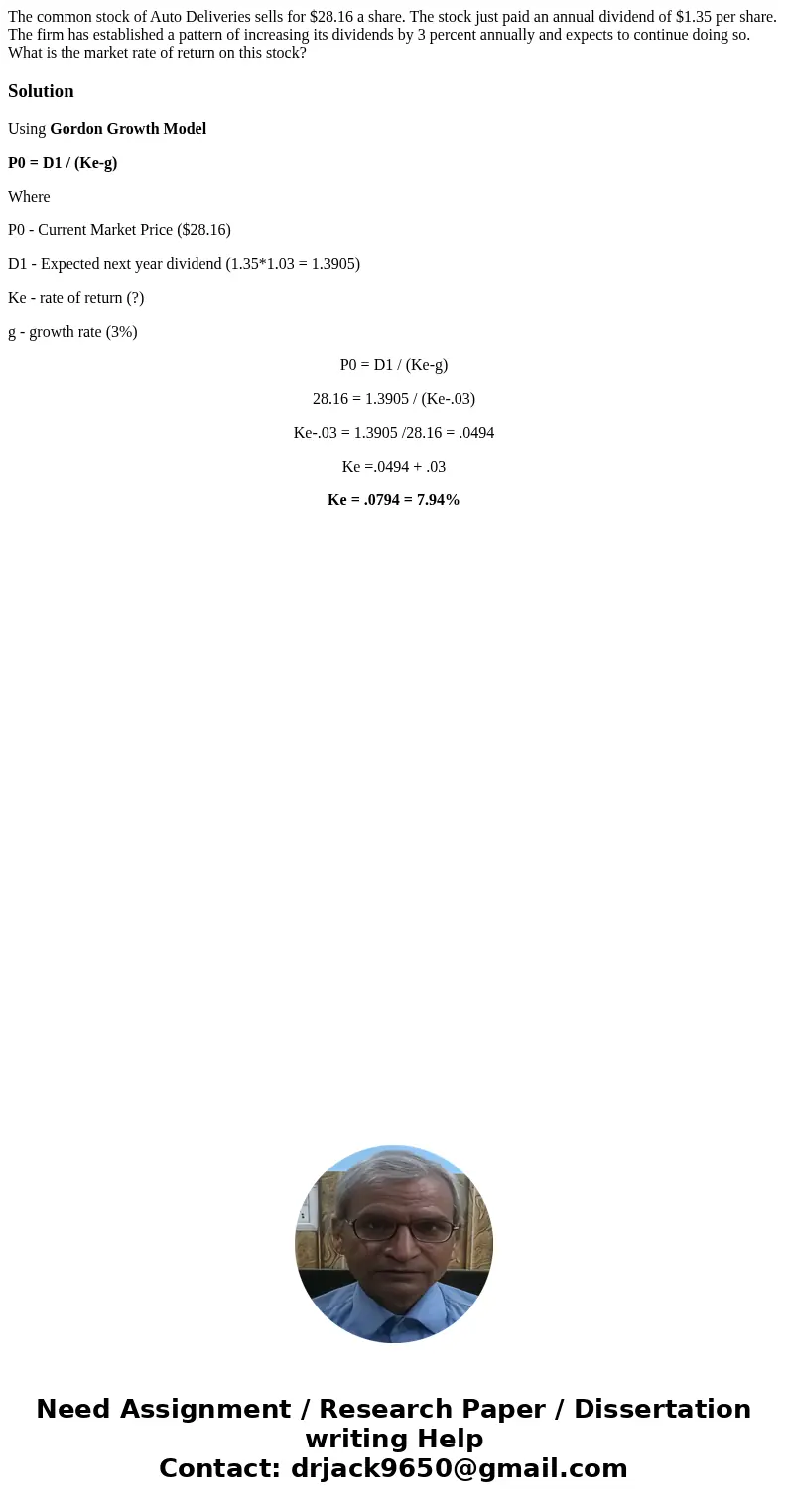

The common stock of Auto Deliveries sells for $28.16 a share. The stock just paid an annual dividend of $1.35 per share. The firm has established a pattern of increasing its dividends by 3 percent annually and expects to continue doing so. What is the market rate of return on this stock?

Solution

Using Gordon Growth Model

P0 = D1 / (Ke-g)

Where

P0 - Current Market Price ($28.16)

D1 - Expected next year dividend (1.35*1.03 = 1.3905)

Ke - rate of return (?)

g - growth rate (3%)

P0 = D1 / (Ke-g)

28.16 = 1.3905 / (Ke-.03)

Ke-.03 = 1.3905 /28.16 = .0494

Ke =.0494 + .03

Ke = .0794 = 7.94%

Homework Sourse

Homework Sourse