Sirius Radio SIRI has had the following returns this month C

Sirius Radio (SIRI) has had the following returns this month. Calculate the average return as well as the standard deviation of the return of this horizon. (35 points)

Date Daily Return

14-Oct-14 1.88%

13-Oct-14 0.63%

10-Oct-14 -3.35%

9-Oct-14 -3.81%

8-Oct-14 1.49%

7-Oct-14 -1.18%

6-Oct-14 -0.58%

3-Oct-14 0.88%

2-Oct-14 -0.88%

1-Oct-14 -2.01%

Average Return:______________________ Standard Deviation:_______________________

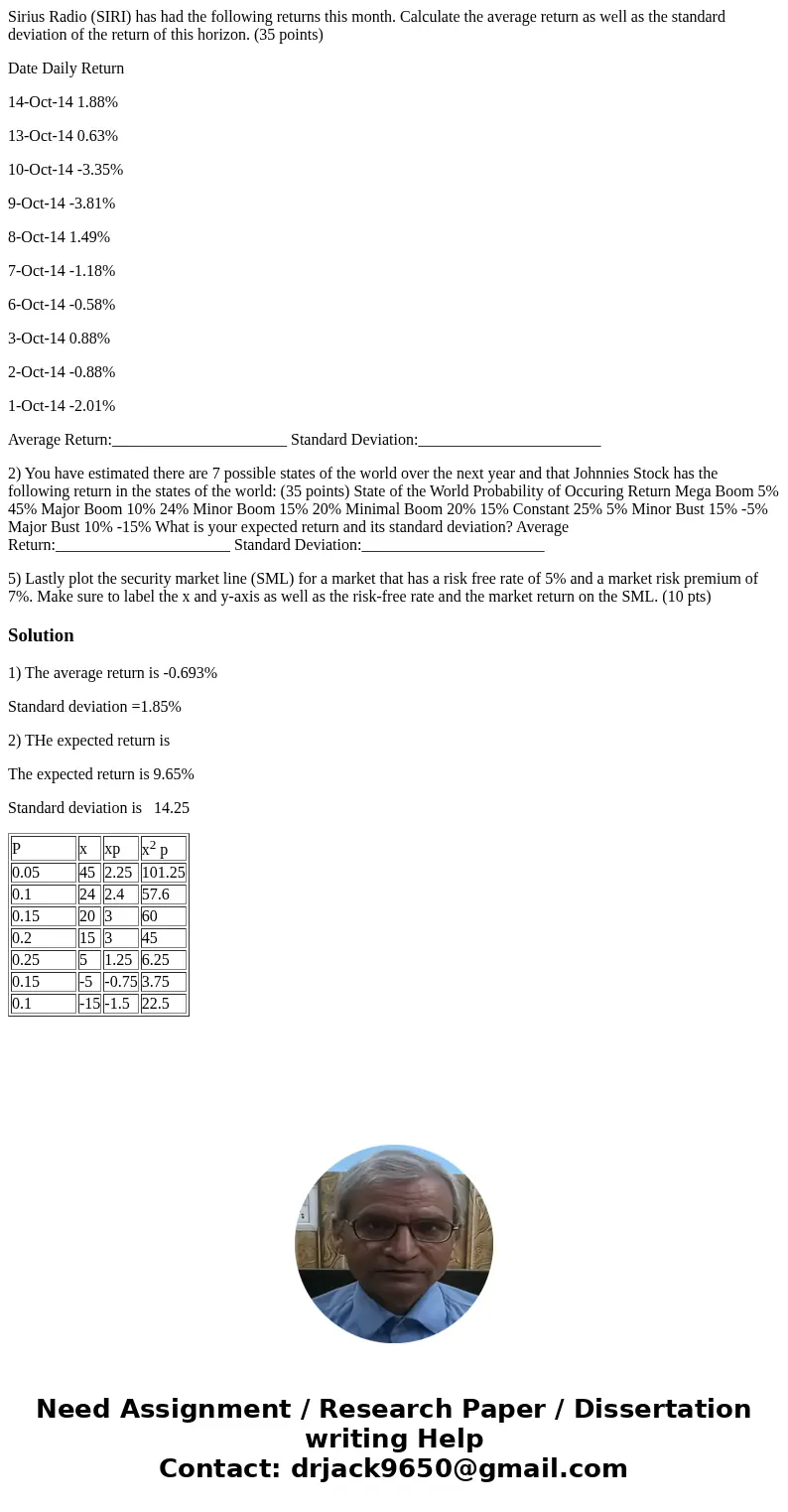

2) You have estimated there are 7 possible states of the world over the next year and that Johnnies Stock has the following return in the states of the world: (35 points) State of the World Probability of Occuring Return Mega Boom 5% 45% Major Boom 10% 24% Minor Boom 15% 20% Minimal Boom 20% 15% Constant 25% 5% Minor Bust 15% -5% Major Bust 10% -15% What is your expected return and its standard deviation? Average Return:______________________ Standard Deviation:_______________________

5) Lastly plot the security market line (SML) for a market that has a risk free rate of 5% and a market risk premium of 7%. Make sure to label the x and y-axis as well as the risk-free rate and the market return on the SML. (10 pts)

Solution

1) The average return is -0.693%

Standard deviation =1.85%

2) THe expected return is

The expected return is 9.65%

Standard deviation is 14.25

| P | x | xp | x2 p |

| 0.05 | 45 | 2.25 | 101.25 |

| 0.1 | 24 | 2.4 | 57.6 |

| 0.15 | 20 | 3 | 60 |

| 0.2 | 15 | 3 | 45 |

| 0.25 | 5 | 1.25 | 6.25 |

| 0.15 | -5 | -0.75 | 3.75 |

| 0.1 | -15 | -1.5 | 22.5 |

Homework Sourse

Homework Sourse