Both a call and a put currently are traded on stock XYZ both

Both a call and a put currently are traded on stock XYZ; both have strike prices of $42 and maturities of six months. a. What will be the profit/loss to an investor who buys the call for $4.30 in the following scenarios for stock prices in six months? (Loss amounts should be indicated by a minus sign. Round your answers to 2 decimal places.) Stock Price Profit/Loss a. $32 $ b. 37 c. 42 d. 47 e. 52 b. What will be the profit/loss in each scenario to an investor who buys the put for $7.80? (Loss amounts should be indicated by a minus sign. Round your answers to 2 decimal places.) Stock Price Profit/Loss a. $32 $ b. 37 c. 42 d. 47 e. 52

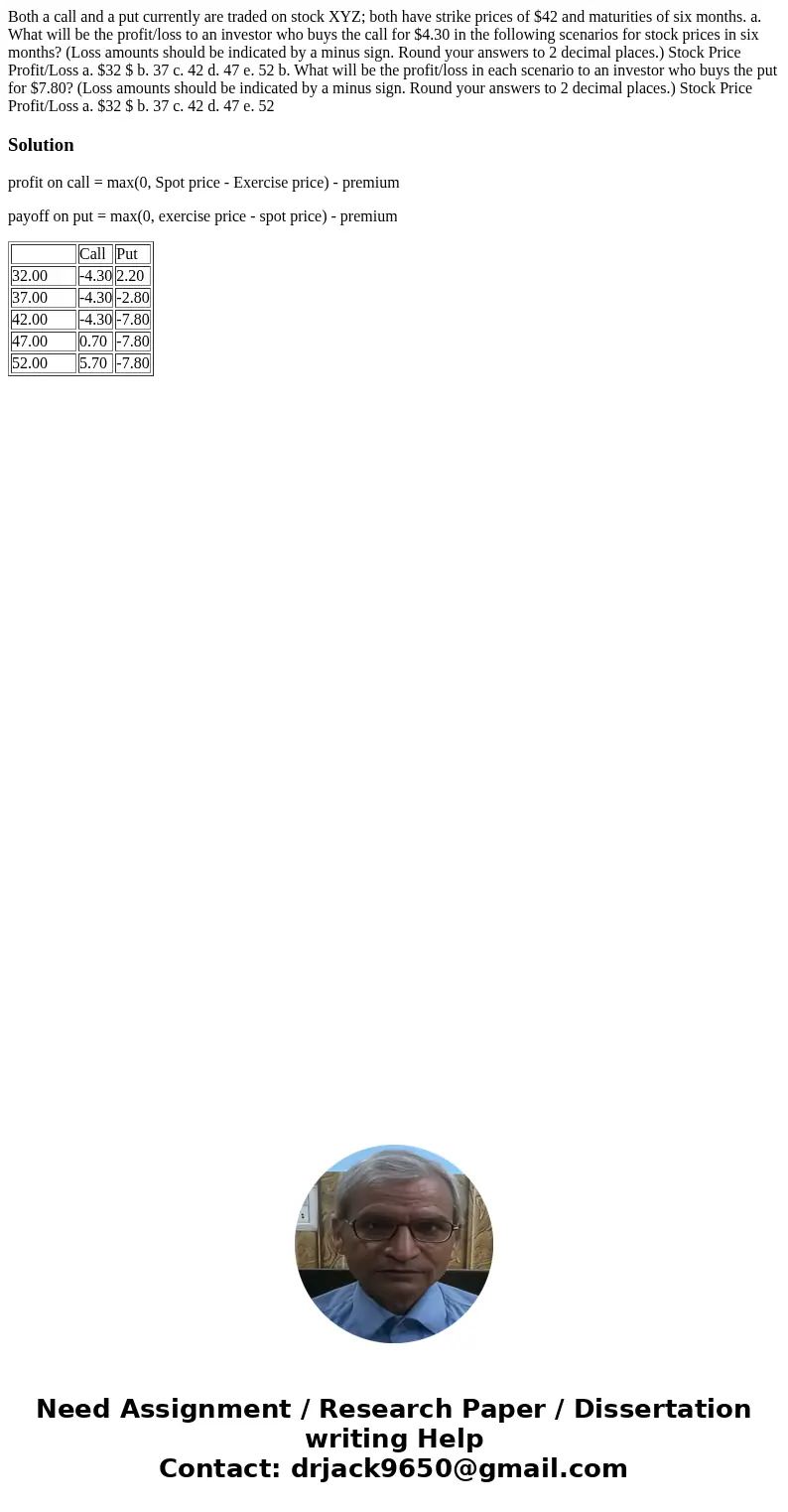

Solution

profit on call = max(0, Spot price - Exercise price) - premium

payoff on put = max(0, exercise price - spot price) - premium

| Call | Put | |

| 32.00 | -4.30 | 2.20 |

| 37.00 | -4.30 | -2.80 |

| 42.00 | -4.30 | -7.80 |

| 47.00 | 0.70 | -7.80 |

| 52.00 | 5.70 | -7.80 |

Homework Sourse

Homework Sourse