150 Click the icon to view the interest factors for discrete

$150 Click the icon to view the interest factors for discrete compounding when ,-12% per year More Info The equivalent annual worth is S(Round to the nearest cent.) Compound Present Compound Sinking Present Worth Factor (P/A, ?N) 0.8929 Amount Factor (FP, ?N) 1.1200 1.2544 1.4049 1.5735 1.7623 Worth Factor (PF, i, N) 0.8929 0.7972 0.7118 0.6355 0.5674 Factor (FIA, ?N) 1.0000 2.1200 3.3744 4.7793 6.3528 Fund Factor (AF, i, N) 1.0000 0.4717 0.2963 0.2092 0.1574 Capital Recovery Factor (AP, i, N) 1.1200 0.5917 0.4163 0.3292 0.2774 1.6901 2.4018 3.0373 3.6048 1.9738 2.2107 2.4760 2.7731 3.1058 0.5066 0.4523 0.4039 0.3606 0.3220 8.1152 10.0890 12.2997 14.7757 17.5487 0.1232 0.0991 0.0813 0.0677 0.0570 4.1114 4.5638 4.9676 5.3282 5.6502 0.2432 0.2191 0.2013 0.1877 0.1770 Enter your answer in the answer box and then click Check Answer 10

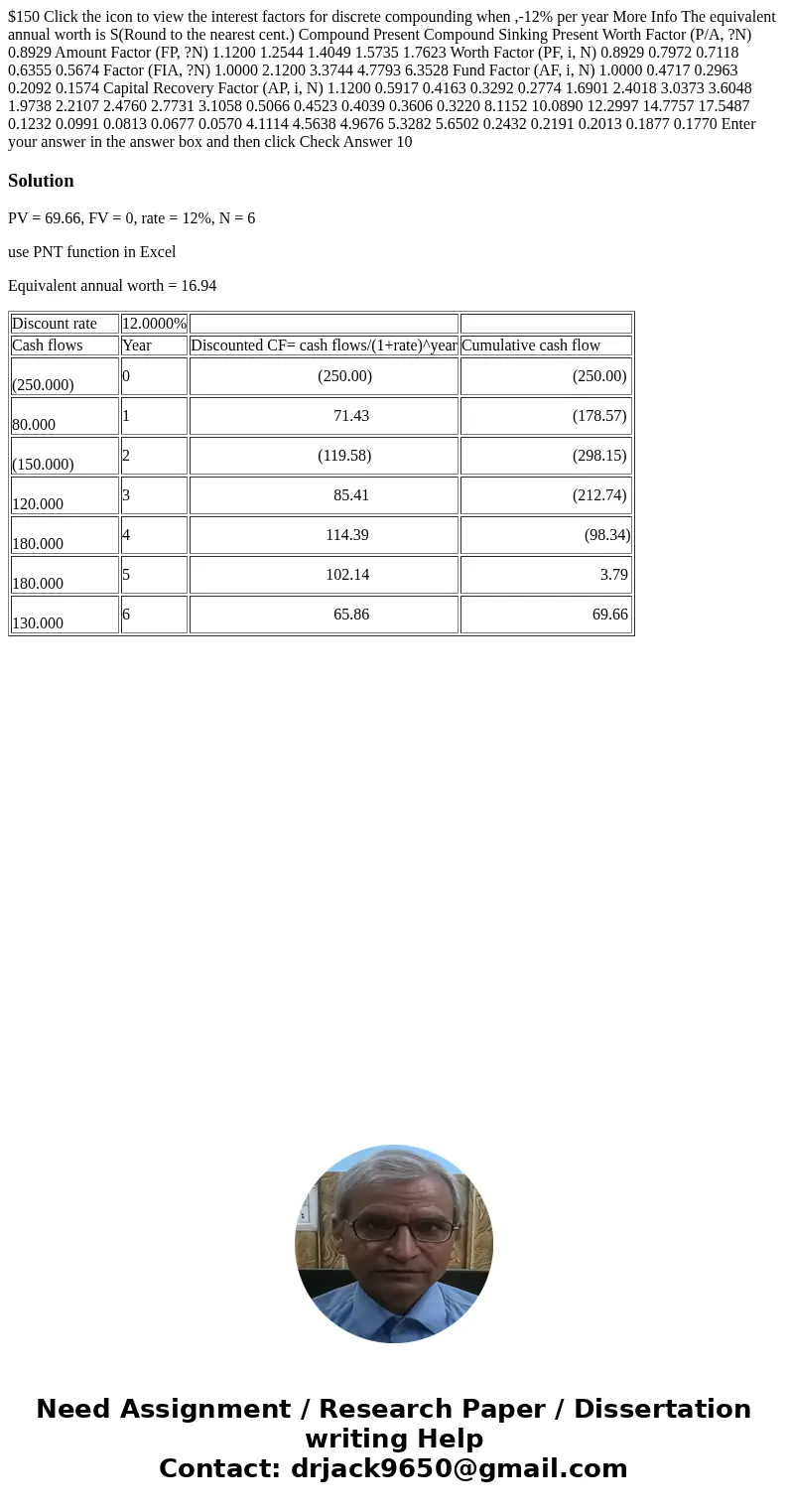

Solution

PV = 69.66, FV = 0, rate = 12%, N = 6

use PNT function in Excel

Equivalent annual worth = 16.94

| Discount rate | 12.0000% | ||

| Cash flows | Year | Discounted CF= cash flows/(1+rate)^year | Cumulative cash flow |

| (250.000) | 0 | (250.00) | (250.00) |

| 80.000 | 1 | 71.43 | (178.57) |

| (150.000) | 2 | (119.58) | (298.15) |

| 120.000 | 3 | 85.41 | (212.74) |

| 180.000 | 4 | 114.39 | (98.34) |

| 180.000 | 5 | 102.14 | 3.79 |

| 130.000 | 6 | 65.86 | 69.66 |

Homework Sourse

Homework Sourse