The graph shows a rough representation of the aggregate mark

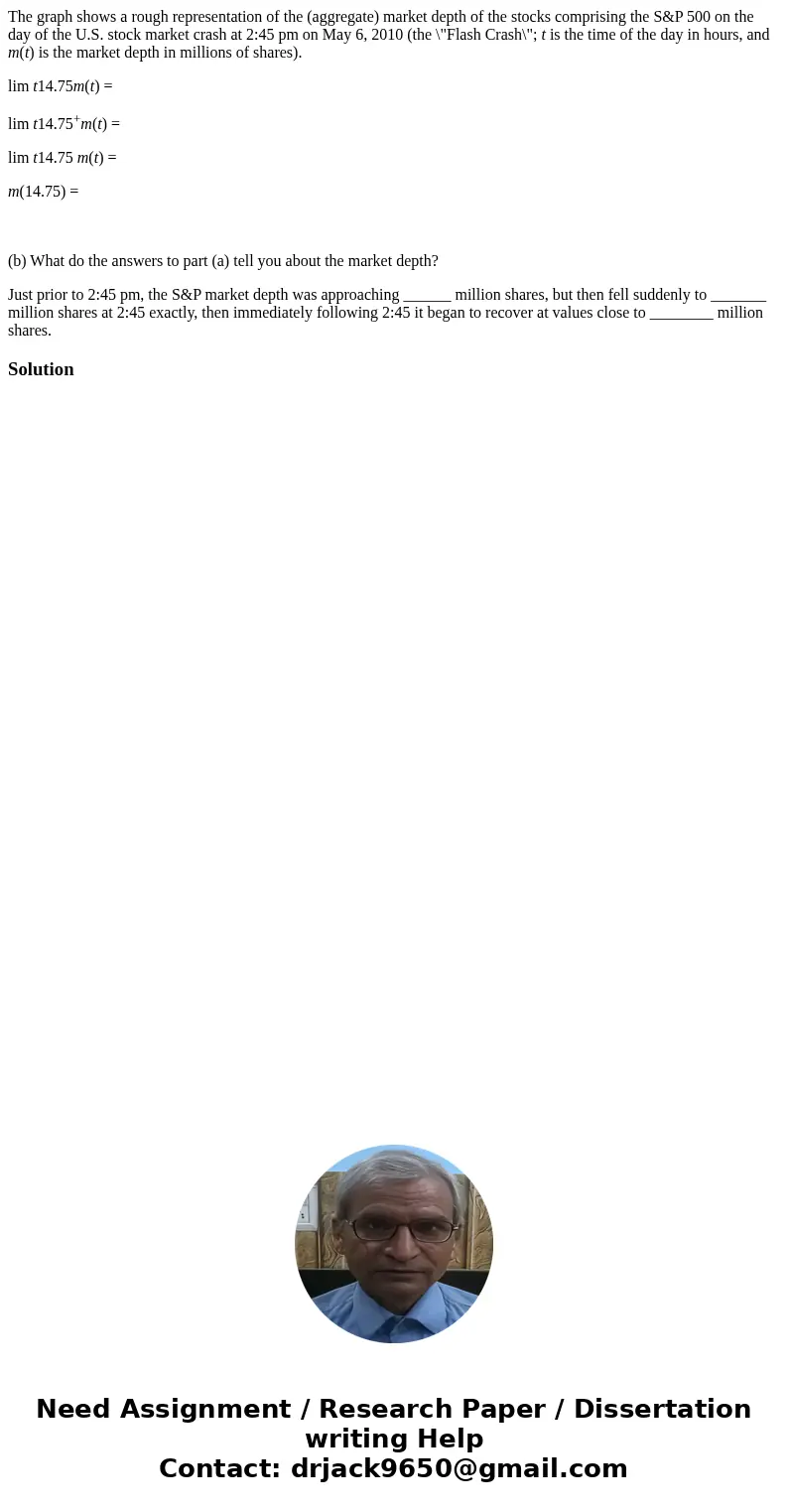

The graph shows a rough representation of the (aggregate) market depth of the stocks comprising the S&P 500 on the day of the U.S. stock market crash at 2:45 pm on May 6, 2010 (the \"Flash Crash\"; t is the time of the day in hours, and m(t) is the market depth in millions of shares).

lim t14.75m(t) =

lim t14.75+m(t) =

lim t14.75 m(t) =

m(14.75) =

(b) What do the answers to part (a) tell you about the market depth?

Just prior to 2:45 pm, the S&P market depth was approaching ______ million shares, but then fell suddenly to _______ million shares at 2:45 exactly, then immediately following 2:45 it began to recover at values close to ________ million shares.

Solution

Homework Sourse

Homework Sourse