Chapter 1 Applying Excel Data Sales Variable costs 12000 Cos

Solution

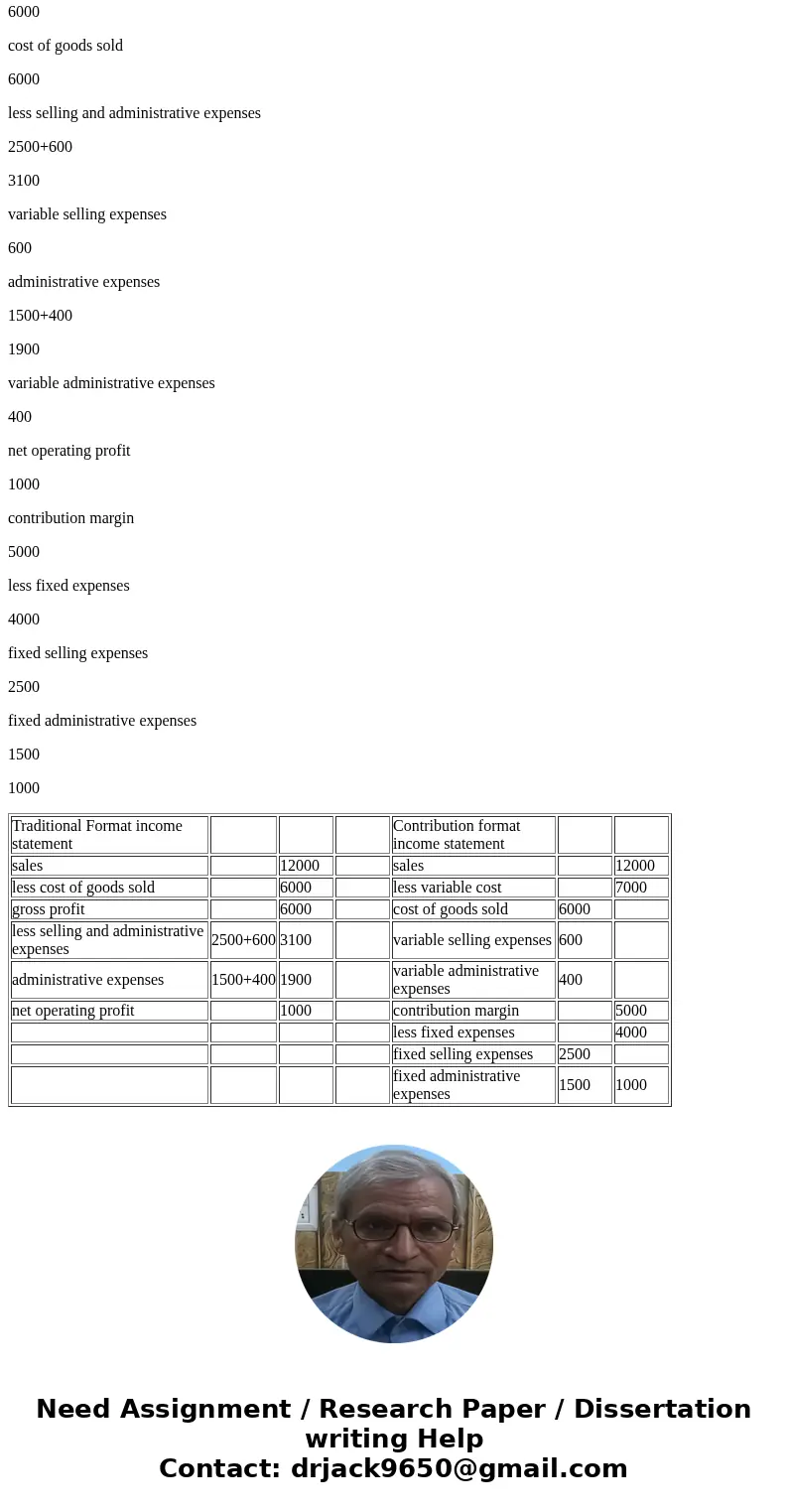

Traditional Format income statement

Contribution format income statement

sales

12000

sales

12000

less cost of goods sold

6000

less variable cost

7000

gross profit

6000

cost of goods sold

6000

less selling and administrative expenses

2500+600

3100

variable selling expenses

600

administrative expenses

1500+400

1900

variable administrative expenses

400

net operating profit

1000

contribution margin

5000

less fixed expenses

4000

fixed selling expenses

2500

fixed administrative expenses

1500

1000

| Traditional Format income statement | Contribution format income statement | |||||

| sales | 12000 | sales | 12000 | |||

| less cost of goods sold | 6000 | less variable cost | 7000 | |||

| gross profit | 6000 | cost of goods sold | 6000 | |||

| less selling and administrative expenses | 2500+600 | 3100 | variable selling expenses | 600 | ||

| administrative expenses | 1500+400 | 1900 | variable administrative expenses | 400 | ||

| net operating profit | 1000 | contribution margin | 5000 | |||

| less fixed expenses | 4000 | |||||

| fixed selling expenses | 2500 | |||||

| fixed administrative expenses | 1500 | 1000 |

Homework Sourse

Homework Sourse