Question 15 5 p Johnson Controls has a project with a cost o

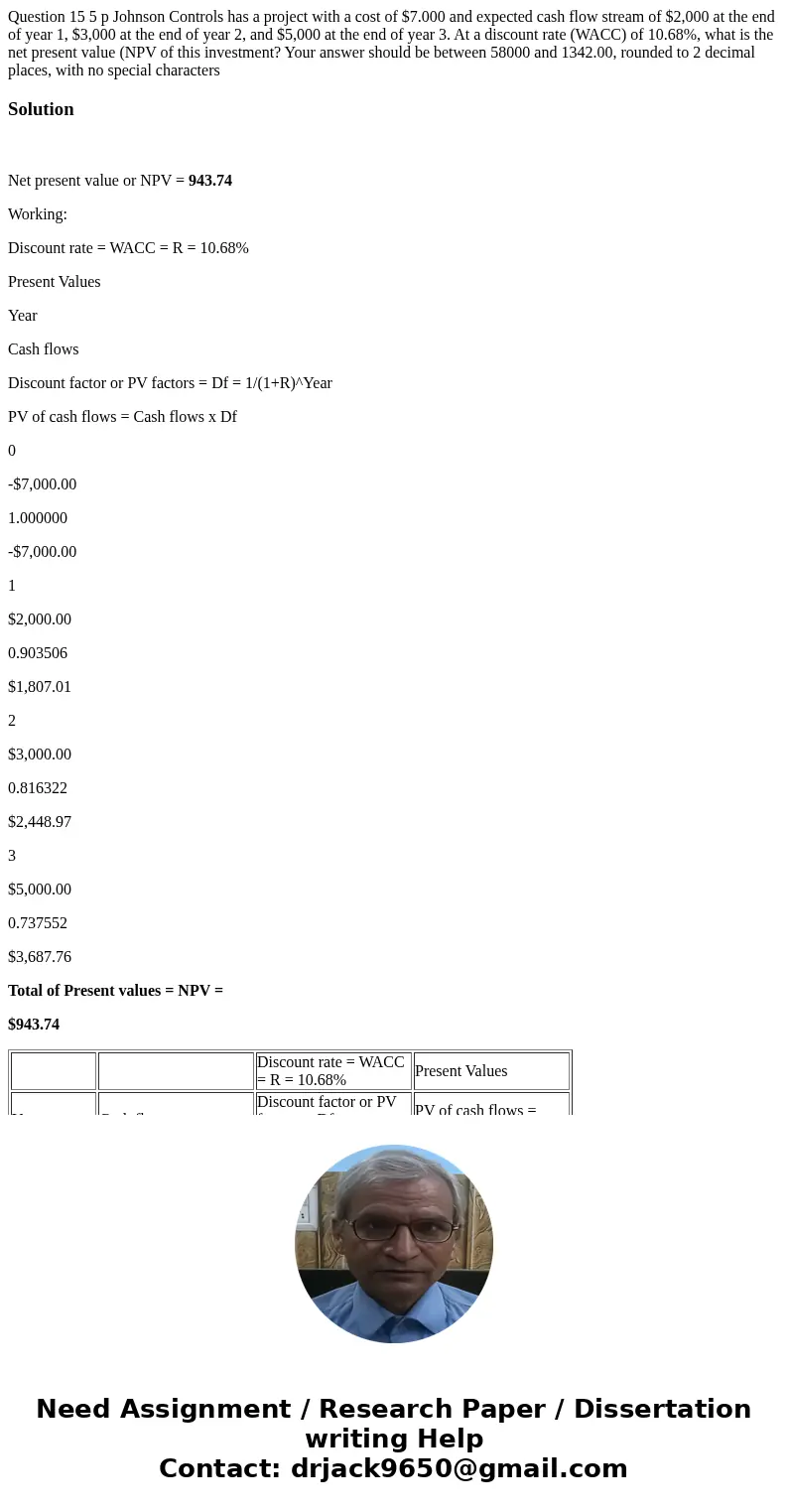

Question 15 5 p Johnson Controls has a project with a cost of $7.000 and expected cash flow stream of $2,000 at the end of year 1, $3,000 at the end of year 2, and $5,000 at the end of year 3. At a discount rate (WACC) of 10.68%, what is the net present value (NPV of this investment? Your answer should be between 58000 and 1342.00, rounded to 2 decimal places, with no special characters

Solution

Net present value or NPV = 943.74

Working:

Discount rate = WACC = R = 10.68%

Present Values

Year

Cash flows

Discount factor or PV factors = Df = 1/(1+R)^Year

PV of cash flows = Cash flows x Df

0

-$7,000.00

1.000000

-$7,000.00

1

$2,000.00

0.903506

$1,807.01

2

$3,000.00

0.816322

$2,448.97

3

$5,000.00

0.737552

$3,687.76

Total of Present values = NPV =

$943.74

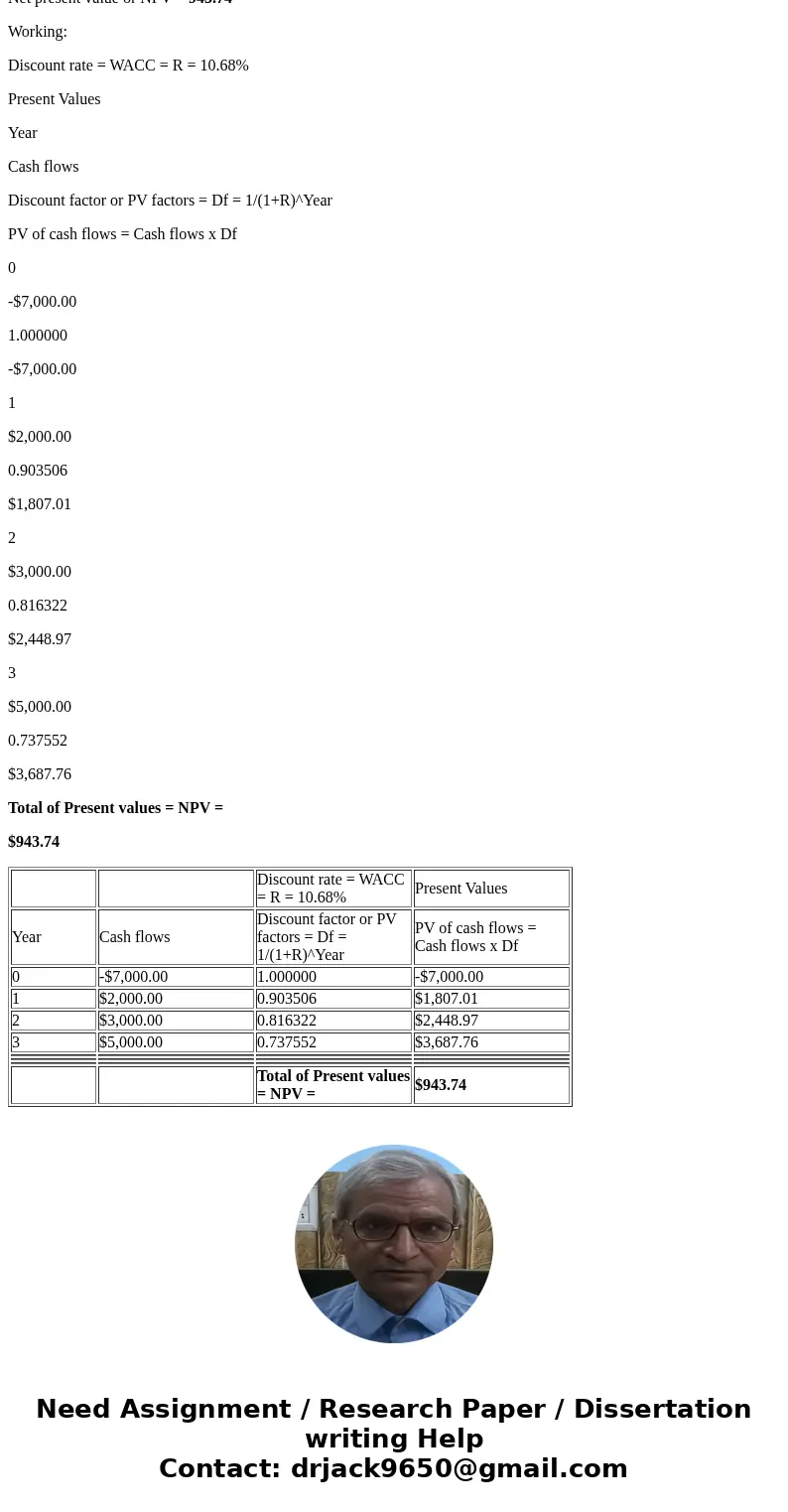

| Discount rate = WACC = R = 10.68% | Present Values | ||

| Year | Cash flows | Discount factor or PV factors = Df = 1/(1+R)^Year | PV of cash flows = Cash flows x Df |

| 0 | -$7,000.00 | 1.000000 | -$7,000.00 |

| 1 | $2,000.00 | 0.903506 | $1,807.01 |

| 2 | $3,000.00 | 0.816322 | $2,448.97 |

| 3 | $5,000.00 | 0.737552 | $3,687.76 |

| Total of Present values = NPV = | $943.74 |

Homework Sourse

Homework Sourse