Joe Holden owns a small publishing company The business is i

Solution

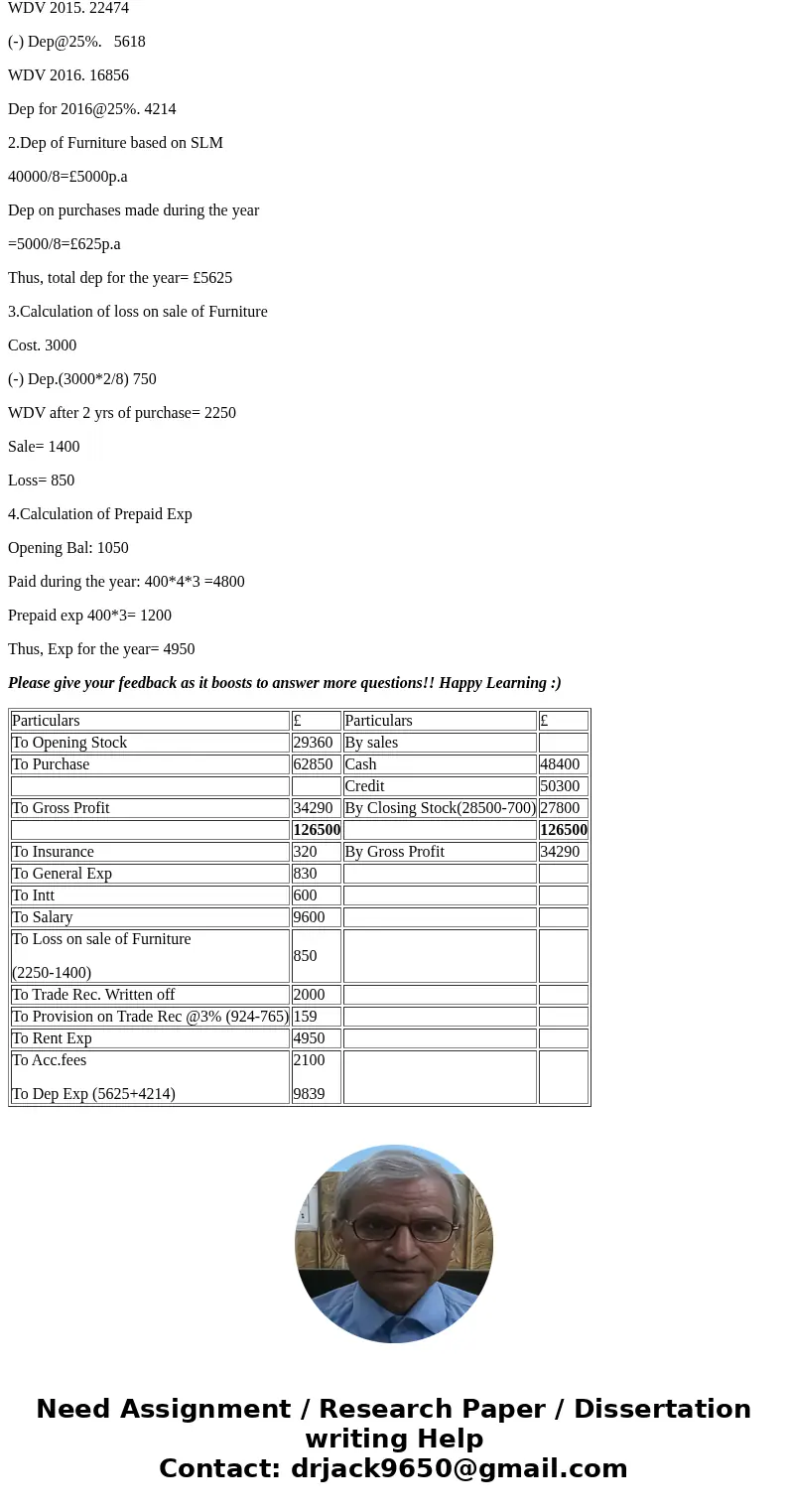

Income Statement for the year ending 31 Dec 2016

Dr. Cr.

To Loss on sale of Furniture

(2250-1400)

To Acc.fees

To Dep Exp (5625+4214)

2100

9839

Balance Sheet as at 31st Dec 2016

Working Notes:

1.Calculation of dep on Machine

Cost 2012: 53273

(-) Dep @ 25% 13318

WDV 2013. 39955

(-)Dep@25%. 9989

WDV 2014. 29966

(-) Dep@25%. 7492

WDV 2015. 22474

(-) Dep@25%. 5618

WDV 2016. 16856

Dep for 2016@25%. 4214

2.Dep of Furniture based on SLM

40000/8=£5000p.a

Dep on purchases made during the year

=5000/8=£625p.a

Thus, total dep for the year= £5625

3.Calculation of loss on sale of Furniture

Cost. 3000

(-) Dep.(3000*2/8) 750

WDV after 2 yrs of purchase= 2250

Sale= 1400

Loss= 850

4.Calculation of Prepaid Exp

Opening Bal: 1050

Paid during the year: 400*4*3 =4800

Prepaid exp 400*3= 1200

Thus, Exp for the year= 4950

Please give your feedback as it boosts to answer more questions!! Happy Learning :)

| Particulars | £ | Particulars | £ |

| To Opening Stock | 29360 | By sales | |

| To Purchase | 62850 | Cash | 48400 |

| Credit | 50300 | ||

| To Gross Profit | 34290 | By Closing Stock(28500-700) | 27800 |

| 126500 | 126500 | ||

| To Insurance | 320 | By Gross Profit | 34290 |

| To General Exp | 830 | ||

| To Intt | 600 | ||

| To Salary | 9600 | ||

| To Loss on sale of Furniture (2250-1400) | 850 | ||

| To Trade Rec. Written off | 2000 | ||

| To Provision on Trade Rec @3% (924-765) | 159 | ||

| To Rent Exp | 4950 | ||

| To Acc.fees To Dep Exp (5625+4214) | 2100 9839 |

Homework Sourse

Homework Sourse