QUESTION 2 The following is the balance sheet statement of f

QUESTION 2 The following is the balance sheet (statement of financial position) of Valencia, a sole trader business, as at 31 January 2014 Valencia Balance sheet as at 31 January 2014 Non-current assets Motor vehicles Less: Accumulated depreciation 82,600 (30,000) 52,600 Current assets Inventories Trade receivables Cash 19,400 32,700 1.40053,500 Total assets 106.100 Equity Original Retained profit 42,000 32,300 74,300 Current liabilities Trade payables Accrual (wages) 28,200 3,600 31800 Total equity and liabilities 106,100 During the year to 31 January 2015, the following transactions took place (in no particular order) . Inventories costing £122,600 were purchased. All purchases were . Sales made during the year were £132,400, of which £6,200 were cash . Receipts from credit customers (trade receivables) totalled £120,200 . Closing inventories were initially valued at £37,500. However, one box made on credit. sales Payments to credit suppliers (trade payables) totalled £114,500 of inventory (cost £4,300) was found to be damaged, and it is estimated that it will only be sold for £2,000 ·Wages totaling £35,500 were paid during the year. At the end of the year, the business owed £2,200 of wages . The business uses the straight line method of depreciation for non- current assets. All motor vehicles are assumed to have a useful life of 5 years and no residual value. There were no additions or disposals to non-current assets during the year PTO

Solution

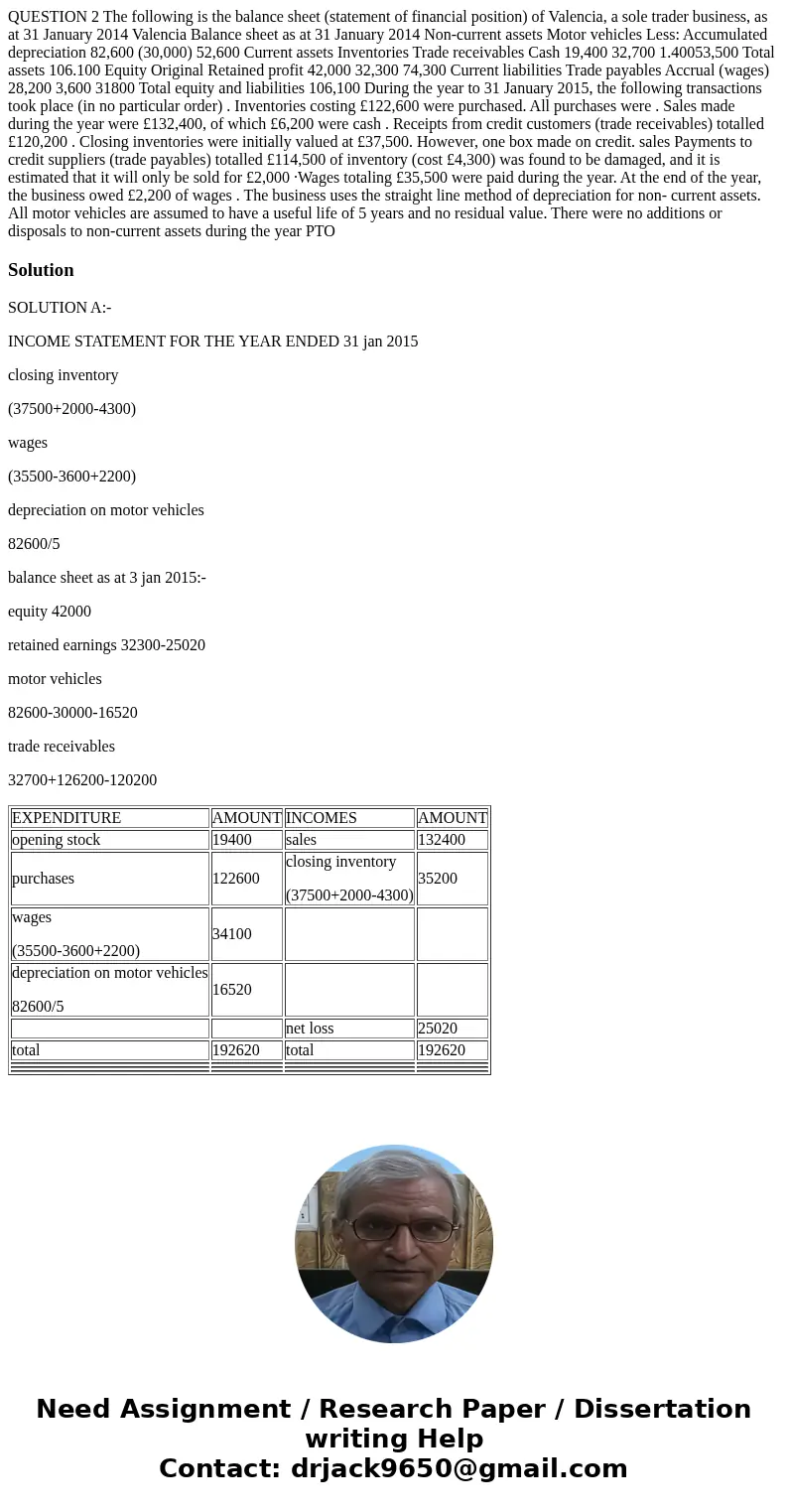

SOLUTION A:-

INCOME STATEMENT FOR THE YEAR ENDED 31 jan 2015

closing inventory

(37500+2000-4300)

wages

(35500-3600+2200)

depreciation on motor vehicles

82600/5

balance sheet as at 3 jan 2015:-

equity 42000

retained earnings 32300-25020

motor vehicles

82600-30000-16520

trade receivables

32700+126200-120200

| EXPENDITURE | AMOUNT | INCOMES | AMOUNT |

| opening stock | 19400 | sales | 132400 |

| purchases | 122600 | closing inventory (37500+2000-4300) | 35200 |

| wages (35500-3600+2200) | 34100 | ||

| depreciation on motor vehicles 82600/5 | 16520 | ||

| net loss | 25020 | ||

| total | 192620 | total | 192620 |

Homework Sourse

Homework Sourse