11 Daniel makes ice cream He currently produces 22000 ounces

11) Daniel makes ice cream. He currently produces 22,000 ounces of ice cream a month using 200 units of capital and 300 hours of labor. With his current production mix the marginal product of capital is 600 ounces and the marginal product of labor is 350 ounces of ice cream. The price of labor is $10 per hour and the price of capital is $20 per unit. Daniel wants to keep costs the same but he wants to make sure that he is maximizing output. He should

A. use less labor and more capital.

B. use more labor and less capital.

C. use less labor only, since it is not very productive.

D. use more capital only, since it is more productive.

E. do nothing, his output is maximized already.

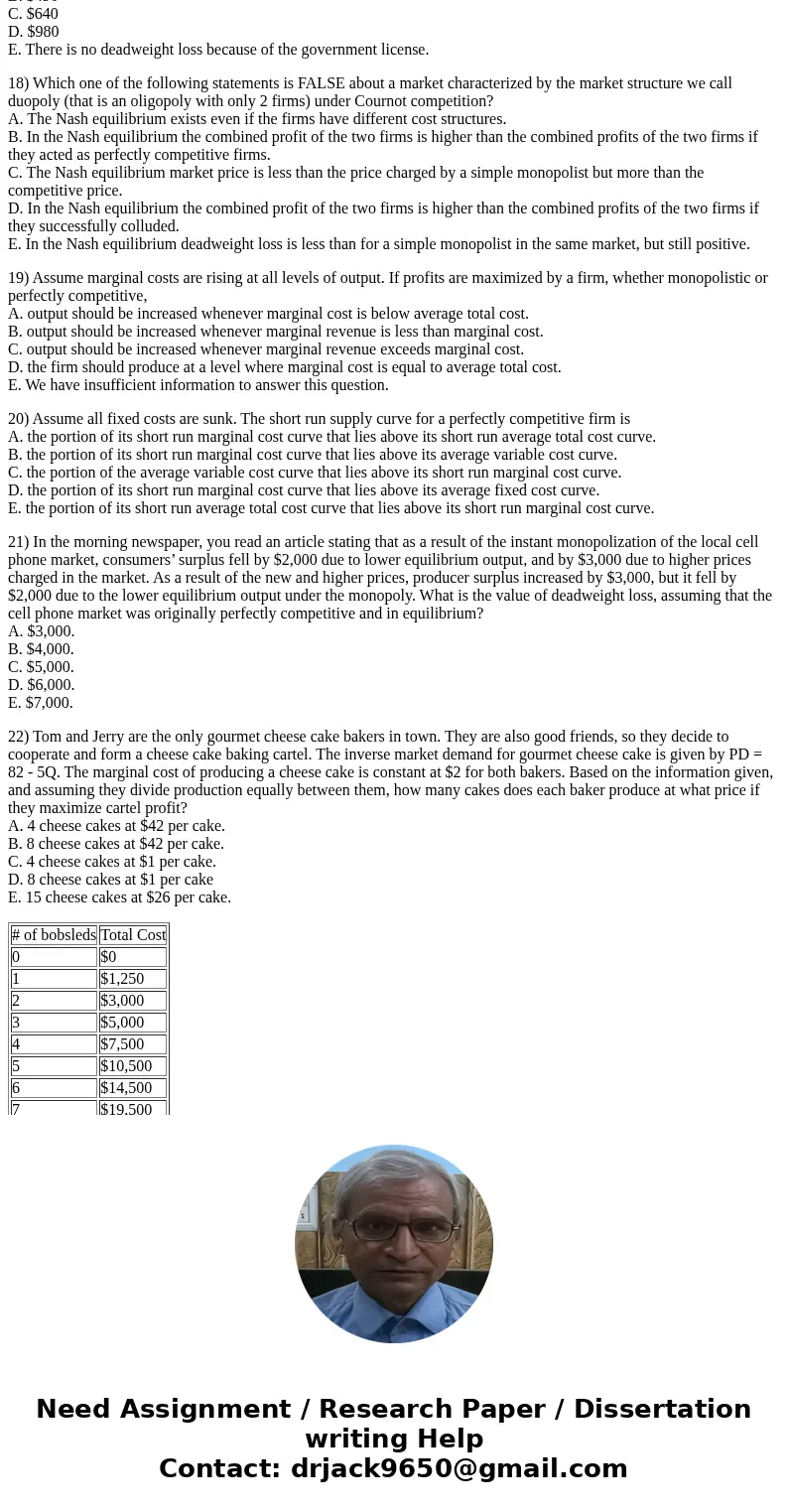

12) Bob’s sleds is a profit maximizing price-taking firm that makes bobsleds. The prevailing market price for a bobsleigh is $3,200. This

firm’s total cost information for a typical day is given in the table.

Which one of the following statements is true?

A. Bob should only make 2 bobsleds.

B. Bob needs to wait to see what his competitors do.

C. Bob can make a maximum profit of $5,500.

D. If Bob is profit maximizing his total revenue will be $22,400.

E. None of above is true.

13)Suppose the industry producing mobile phones is a perfectly competitive constant cost industry and is at its long run equilibrium in Jan 2016. In late February, an advertising campaign permanently increases demand going forward. Which one of the following predictions is most correct?

A. Firms will make profits in the short run (March) as well as in the long run (2016 and beyond).

B. In the long run the equilibrium price will be lower than the Jan 2016 price, and firms will make zero profits.

C. The long run number of firms in this market will be lower than the Jan 2016 number of firms.

D. The long run equilibrium price will be the same as the Jan 2016 price, but there will be more firms in the market.

E. There is insufficient information to answer this question.

14) Vincent and Pablo are painters and have the exact same cost structures except that Vincent paints in a house he owns but that he could rent out for $4,000/year, while Pablo paints in a house that he rents from Ithaca Realty for $4,000/year. Both Vincent and Pablo would become photographers and earn salaries of $50,000/year if they quit painting for themselves. Assume that the painting business is a perfectly competitive industry. Which one of the following is true?

A. Vincent earns more accounting profit and more economic profit than Pablo does.

B. Vincent earns the same accounting profit and more economic profit as Pablo does.

C. Vincent earns the same accounting profit and the same economic profit as Pablo does.

D. Vincent earns more accounting profit and the same economic profit as Pablo does.

E. Vincent earns less accounting profit and less economic profit than Pablo does.

15) A main difference between a monopolistic firm and a competitive firm is that

A. we assume the monopolistic firm maximizes profits but the competitive firm does not.

B. the monopolistic firm uses MR=MC to maximize its profits but the competitive firm does not follow the MR=MC rule, instead it sets P=MC.

C. the monopolistic firm’s MC is always increasing, whereas the competitive firm usually has a constant MC.

D. the monopolistic firm always makes positive profits, whereas the competitive firm always makes zero profits.

E. the monopolistic firm faces a downward sloping demand curve for its output, whereas the competitive firm faces a horizontal demand curve for its output.

16) The private local water utility company is a simple monopolist. Its marginal cost is constant and equal to $0.20 per gallon. Its demand curve is Q = 1,500 – 500 P. Yearly upkeep cost are $500. The company needs a license from the local government to operate. What is the most that the government can charge the utility yearly for this license without impacting the amount of water provided?

A. $480.

B. $980.

C. $624.70.

D. $1,120.

E. Nothing. Any amount the government charges will change the monopolist’s behavior.

17) Suppose the government charges the maximum it can for the water license in the previous question.

What is the deadweight loss in this market?

A. $1280

B. $490

C. $640

D. $980

E. There is no deadweight loss because of the government license.

18) Which one of the following statements is FALSE about a market characterized by the market structure we call duopoly (that is an oligopoly with only 2 firms) under Cournot competition?

A. The Nash equilibrium exists even if the firms have different cost structures.

B. In the Nash equilibrium the combined profit of the two firms is higher than the combined profits of the two firms if they acted as perfectly competitive firms.

C. The Nash equilibrium market price is less than the price charged by a simple monopolist but more than the competitive price.

D. In the Nash equilibrium the combined profit of the two firms is higher than the combined profits of the two firms if they successfully colluded.

E. In the Nash equilibrium deadweight loss is less than for a simple monopolist in the same market, but still positive.

19) Assume marginal costs are rising at all levels of output. If profits are maximized by a firm, whether monopolistic or perfectly competitive,

A. output should be increased whenever marginal cost is below average total cost.

B. output should be increased whenever marginal revenue is less than marginal cost.

C. output should be increased whenever marginal revenue exceeds marginal cost.

D. the firm should produce at a level where marginal cost is equal to average total cost.

E. We have insufficient information to answer this question.

20) Assume all fixed costs are sunk. The short run supply curve for a perfectly competitive firm is

A. the portion of its short run marginal cost curve that lies above its short run average total cost curve.

B. the portion of its short run marginal cost curve that lies above its average variable cost curve.

C. the portion of the average variable cost curve that lies above its short run marginal cost curve.

D. the portion of its short run marginal cost curve that lies above its average fixed cost curve.

E. the portion of its short run average total cost curve that lies above its short run marginal cost curve.

21) In the morning newspaper, you read an article stating that as a result of the instant monopolization of the local cell phone market, consumers’ surplus fell by $2,000 due to lower equilibrium output, and by $3,000 due to higher prices charged in the market. As a result of the new and higher prices, producer surplus increased by $3,000, but it fell by $2,000 due to the lower equilibrium output under the monopoly. What is the value of deadweight loss, assuming that the cell phone market was originally perfectly competitive and in equilibrium?

A. $3,000.

B. $4,000.

C. $5,000.

D. $6,000.

E. $7,000.

22) Tom and Jerry are the only gourmet cheese cake bakers in town. They are also good friends, so they decide to cooperate and form a cheese cake baking cartel. The inverse market demand for gourmet cheese cake is given by PD = 82 - 5Q. The marginal cost of producing a cheese cake is constant at $2 for both bakers. Based on the information given, and assuming they divide production equally between them, how many cakes does each baker produce at what price if they maximize cartel profit?

A. 4 cheese cakes at $42 per cake.

B. 8 cheese cakes at $42 per cake.

C. 4 cheese cakes at $1 per cake.

D. 8 cheese cakes at $1 per cake

E. 15 cheese cakes at $26 per cake.

| # of bobsleds | Total Cost |

| 0 | $0 |

| 1 | $1,250 |

| 2 | $3,000 |

| 3 | $5,000 |

| 4 | $7,500 |

| 5 | $10,500 |

| 6 | $14,500 |

| 7 | $19,500 |

Solution

(11) (A)

Marginal product of capital / Price of capital = Marginal product of labor / Price of labor, under equilibrium.

Here,

Marginal product of capital / Price of capital = 600 /20 = 30

Marginal product of labor / Price of labor = 350 / 10 = 35 > 30

So, he will use less labor and more capital until the equilibrium condition is satisfied.

(12) (C)

Profit = Revenue - Cost = (P x Q) - Cost = (3,200 x Q) - TC

When Q = 5, Profit is maximum at 5,500

(13) (C)

In a perfectly competitive industry in long-run equilibrium, P = LAC = LMC.

When demand increases, price also increases, resulting in short run economic profit for existing firms.

But in long run (beyond 2016), firms will be attracted by excess profit and will enter the market. New entrants will reduce existing firms\' demand, the market supply will increase and so, price will reduce. This process will continue until all firms produce zero economic profits.

(14) (D)

The lost rental income of $4,000 is an opportunity cost for Vincent.

Economic cost for Vincent = Total opportunity cost = $(4,000 + 50,000) = $54,000

Economic cost for Pablo = Accounting cost + Implicit cost = $4,000 + $50,000 = $54,000

So, Pablo has higher accounting cost than Vincent, so Pablo has lower accounting profit than Vincent (or, Vincent has more accounting profit than Pablo). Both have same economic profit.

(15) (B)

For a competitive firm, it\'s a price taker and so, market price is equal to demand curve equal to MR curve.

So it sets P = MC (Since its P = MR)

NOTE: First 5 questions have been answered. Please don\'t club so many questions together.

Homework Sourse

Homework Sourse