Rolston Music Company is considering the sale of a new sound

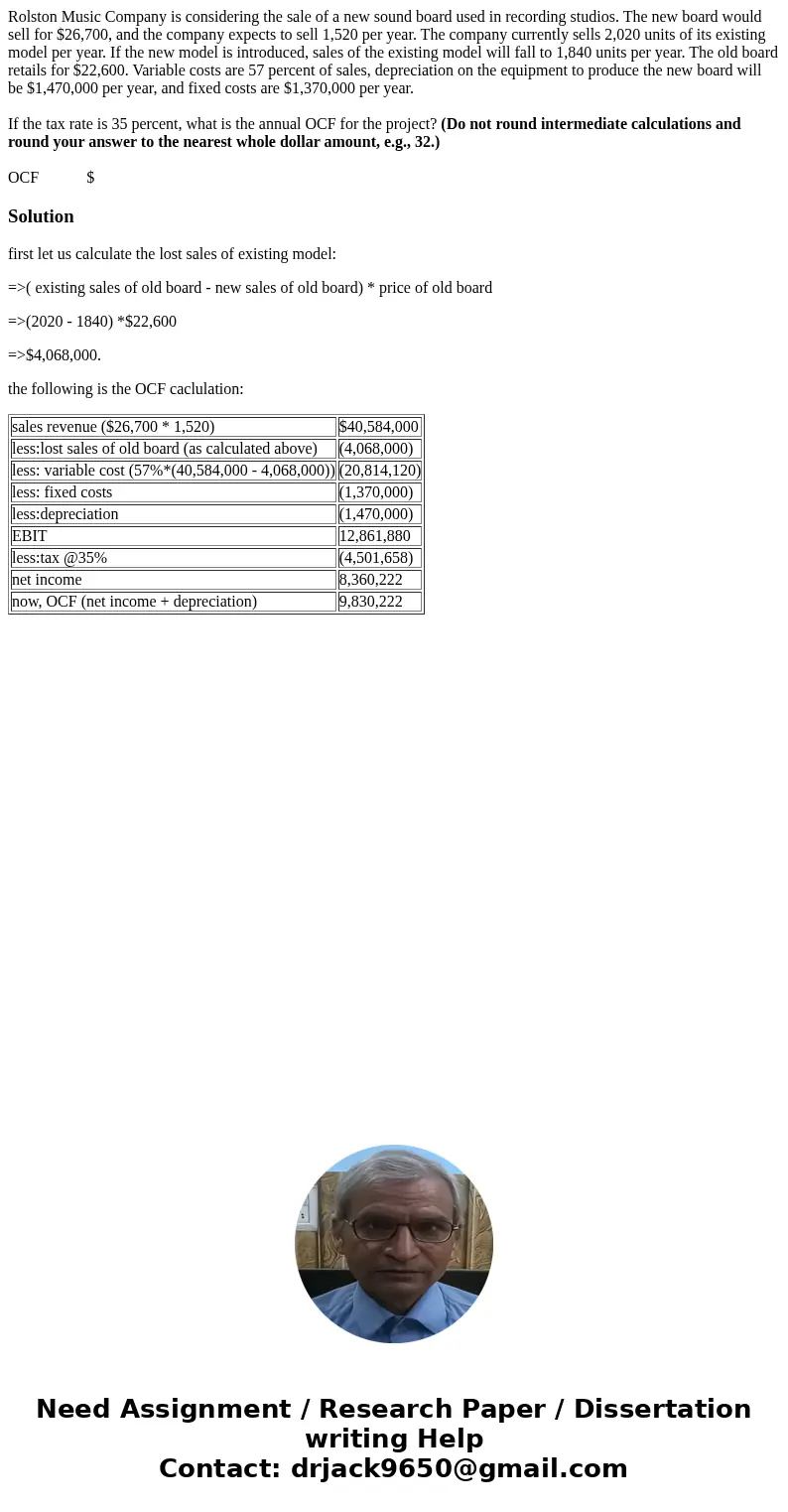

Rolston Music Company is considering the sale of a new sound board used in recording studios. The new board would sell for $26,700, and the company expects to sell 1,520 per year. The company currently sells 2,020 units of its existing model per year. If the new model is introduced, sales of the existing model will fall to 1,840 units per year. The old board retails for $22,600. Variable costs are 57 percent of sales, depreciation on the equipment to produce the new board will be $1,470,000 per year, and fixed costs are $1,370,000 per year.

If the tax rate is 35 percent, what is the annual OCF for the project? (Do not round intermediate calculations and round your answer to the nearest whole dollar amount, e.g., 32.)

OCF $

Solution

first let us calculate the lost sales of existing model:

=>( existing sales of old board - new sales of old board) * price of old board

=>(2020 - 1840) *$22,600

=>$4,068,000.

the following is the OCF caclulation:

| sales revenue ($26,700 * 1,520) | $40,584,000 |

| less:lost sales of old board (as calculated above) | (4,068,000) |

| less: variable cost (57%*(40,584,000 - 4,068,000)) | (20,814,120) |

| less: fixed costs | (1,370,000) |

| less:depreciation | (1,470,000) |

| EBIT | 12,861,880 |

| less:tax @35% | (4,501,658) |

| net income | 8,360,222 |

| now, OCF (net income + depreciation) | 9,830,222 |

Homework Sourse

Homework Sourse