This problem illustrates how costs of two corporate support

This problem illustrates how costs of two corporate support departments are allocated to operating divisions using a dual-rate method. Fixed costs are allocated using budgeted costs and budgeted hours used by other departments. Variable costs are allocated using actual costs and actual hours used by other departments.

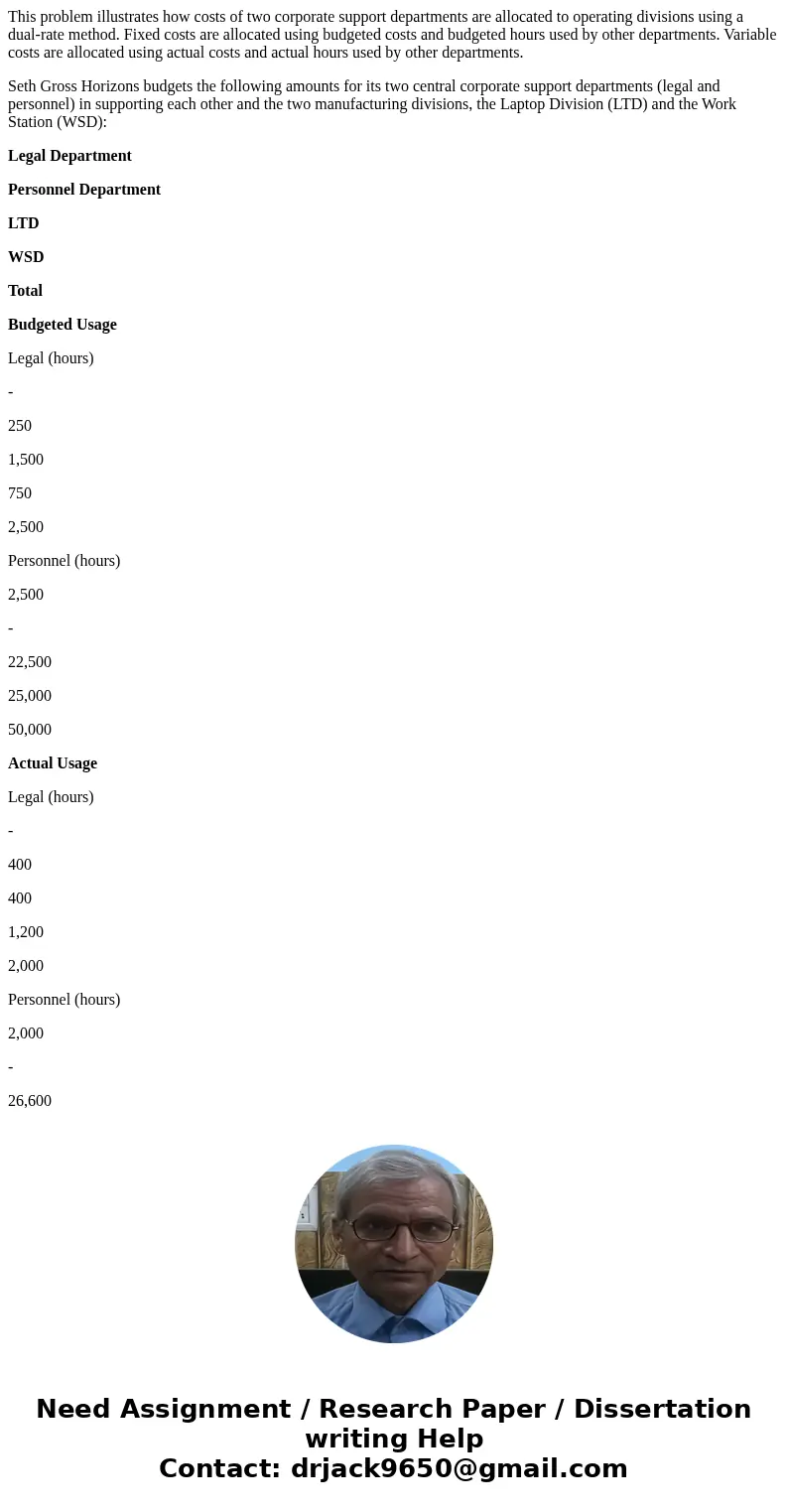

Seth Gross Horizons budgets the following amounts for its two central corporate support departments (legal and personnel) in supporting each other and the two manufacturing divisions, the Laptop Division (LTD) and the Work Station (WSD):

Legal Department

Personnel Department

LTD

WSD

Total

Budgeted Usage

Legal (hours)

-

250

1,500

750

2,500

Personnel (hours)

2,500

-

22,500

25,000

50,000

Actual Usage

Legal (hours)

-

400

400

1,200

2,000

Personnel (hours)

2,000

-

26,600

11,400

40,000

Budgeted fixed Overhead

$360,000

$475,000

-

-

$835,000

Actual variable Overhead

$200,000

$600,000

-

-

$800,000

Required:

1. What amount of support-department costs for legal and personnel will be allocated to LTD and WSD using (a) the direct method, (b) the step-down method, and (c) the reciprocal method? Must be done in Excel.

2. Comment on your results.

| Legal Department | Personnel Department | LTD | WSD | Total | ||

| Budgeted Usage | ||||||

| Legal (hours) | - | 250 | 1,500 | 750 | 2,500 | |

| Personnel (hours) | 2,500 | - | 22,500 | 25,000 | 50,000 | |

| Actual Usage | ||||||

| Legal (hours) | - | 400 | 400 | 1,200 | 2,000 | |

| Personnel (hours) | 2,000 | - | 26,600 | 11,400 | 40,000 | |

| Budgeted fixed Overhead | $360,000 | $475,000 | - | - | $835,000 | |

| Actual variable Overhead | $200,000 | $600,000 | - | - | $800,000 |

Solution

a) Direct method: Legal Department Personnel Department LTD WSD Total Fixed overhead 360000 475000 Legal (1500/2250,750/2250) -360000 240000 120000 Personnel (22500/47500,25000/47500) -475000 225000 250000 Cost allocated 0 0 465000 370000 835000 Variable overhead 200000 600000 Legal (400/1600,1200/1600) -200000 50000 150000 Personnel (26600/38000,11400/38000) -600000 420000 180000 Cost allocated 0 0 470000 330000 800000 b) Step down method: Legal Department Personnel Department LTD WSD Total Fixed overhead 360000 475000 Legal (250/2500,1500/2500,750/2500) -360000 36000 216000 108000 Personnel (22500/47500,25000/47500) -511000 242053 268947 Cost allocated 0 0 458053 376947 835000 Variable overhead 200000 600000 Legal (400/2000,400/2000,1200/2000) -200000 40000 40000 120000 Personnel (26600/38000,11400/38000) -640000 448000 192000 Cost allocated 0 0 488000 312000 800000 c) Reciprocal method: Legal Department Personnel Department LTD WSD Total Fixed overhead 360000 475000 Legal (250/2500,1500/2500,750/2500) -385678 38568 231407 115703 Personnel (2500/50000,22500/50000,25000/50000) 25678 -513568 231106 256784 Cost allocated 0 0 462512 372487 835000 Variable overhead 200000 600000 Legal (400/2000,400/2000,1200/2000) -232323 46465 46465 139394 Personnel (2000/40000,26600/40000,11400/40000) 32323 -646465 429899 184243 Cost allocated 0 0 476364 323636 800000 Notes: Reciprocal method: Let legal department cost be x Let personnel department cost be y Fixed overhead allocation: x=360000+(2500/50000)*y x=360000+0.05y……………… (1) y=475000+(250/2500)*x y=475000+0.10x………………(2) Apply (2) in (1) x=360000+0.05*(475000+0.10x) x=385678 y=475000+0.10*385678=513568 Variable overhead allocation: x=200000+(2000/40000)*y x=200000+0.05y……………… (1) y=600000+(400/2000)*x y=600000+0.20x………………(2) Apply (2) in (1) x=200000+0.05*(600000+0.20x) x=232323 y=600000+0.20*232323=646465 2 For LTD Fixed Variable Total Direct method 465000 470000 935000 Step-Down method 458053 488000 946053 Reciprocal method 462513 476364 938877 For WSD Fixed Variable Total Direct method 370000 330000 700000 Step-Down method 376947 312000 688947 Reciprocal method 372487 323636 696123 For LTD,Higher cost is under step down method.Lower cost under Direct method For WSD,Higher cost is under Direct method.Lower cost under step down method

Homework Sourse

Homework Sourse