INCOME STATEMENT Edmonds Industries is forecasting the follo

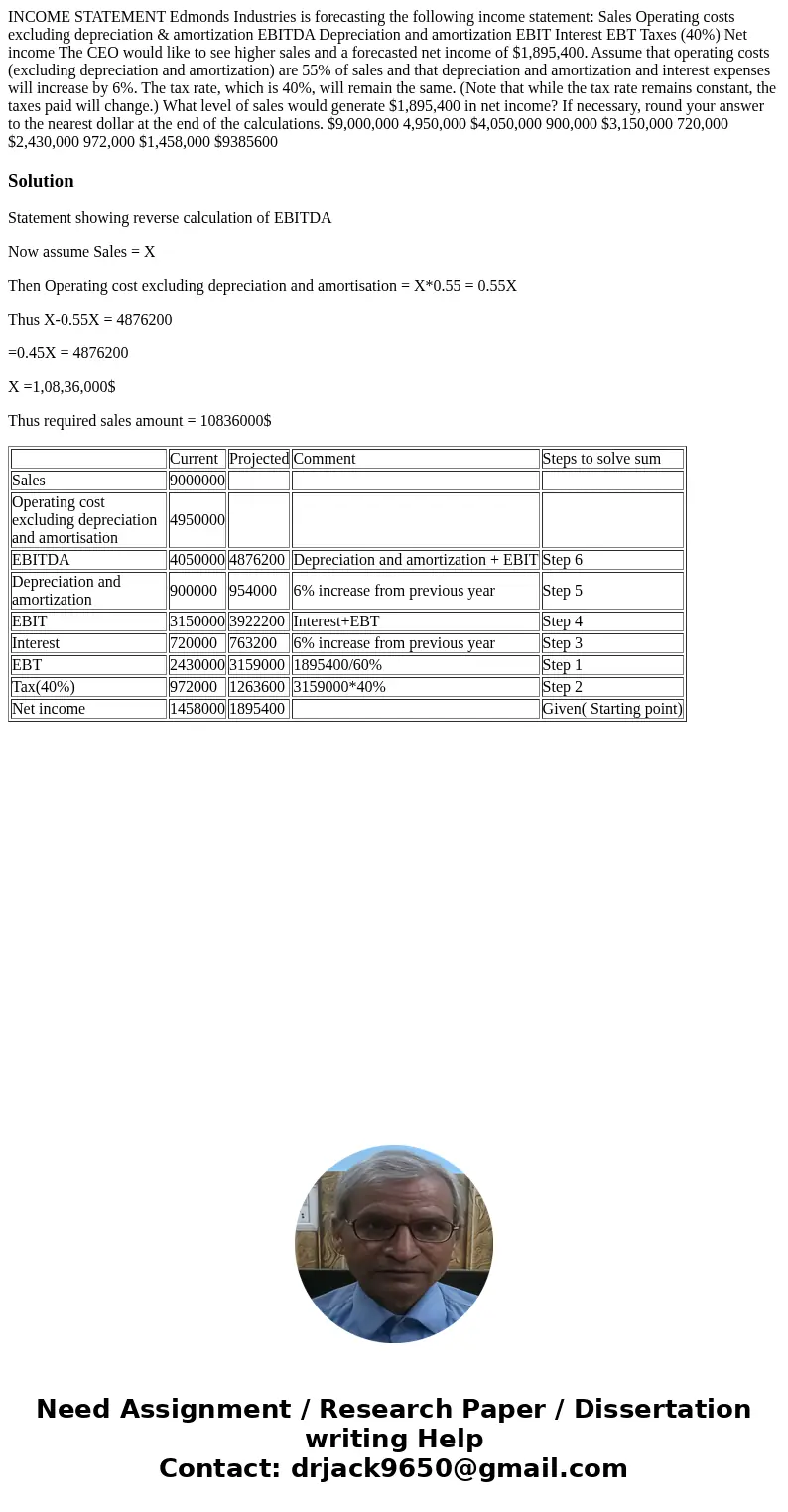

INCOME STATEMENT Edmonds Industries is forecasting the following income statement: Sales Operating costs excluding depreciation & amortization EBITDA Depreciation and amortization EBIT Interest EBT Taxes (40%) Net income The CEO would like to see higher sales and a forecasted net income of $1,895,400. Assume that operating costs (excluding depreciation and amortization) are 55% of sales and that depreciation and amortization and interest expenses will increase by 6%. The tax rate, which is 40%, will remain the same. (Note that while the tax rate remains constant, the taxes paid will change.) What level of sales would generate $1,895,400 in net income? If necessary, round your answer to the nearest dollar at the end of the calculations. $9,000,000 4,950,000 $4,050,000 900,000 $3,150,000 720,000 $2,430,000 972,000 $1,458,000 $9385600

Solution

Statement showing reverse calculation of EBITDA

Now assume Sales = X

Then Operating cost excluding depreciation and amortisation = X*0.55 = 0.55X

Thus X-0.55X = 4876200

=0.45X = 4876200

X =1,08,36,000$

Thus required sales amount = 10836000$

| Current | Projected | Comment | Steps to solve sum | |

| Sales | 9000000 | |||

| Operating cost excluding depreciation and amortisation | 4950000 | |||

| EBITDA | 4050000 | 4876200 | Depreciation and amortization + EBIT | Step 6 |

| Depreciation and amortization | 900000 | 954000 | 6% increase from previous year | Step 5 |

| EBIT | 3150000 | 3922200 | Interest+EBT | Step 4 |

| Interest | 720000 | 763200 | 6% increase from previous year | Step 3 |

| EBT | 2430000 | 3159000 | 1895400/60% | Step 1 |

| Tax(40%) | 972000 | 1263600 | 3159000*40% | Step 2 |

| Net income | 1458000 | 1895400 | Given( Starting point) |

Homework Sourse

Homework Sourse