Suppose that you undertook an investment project with the fo

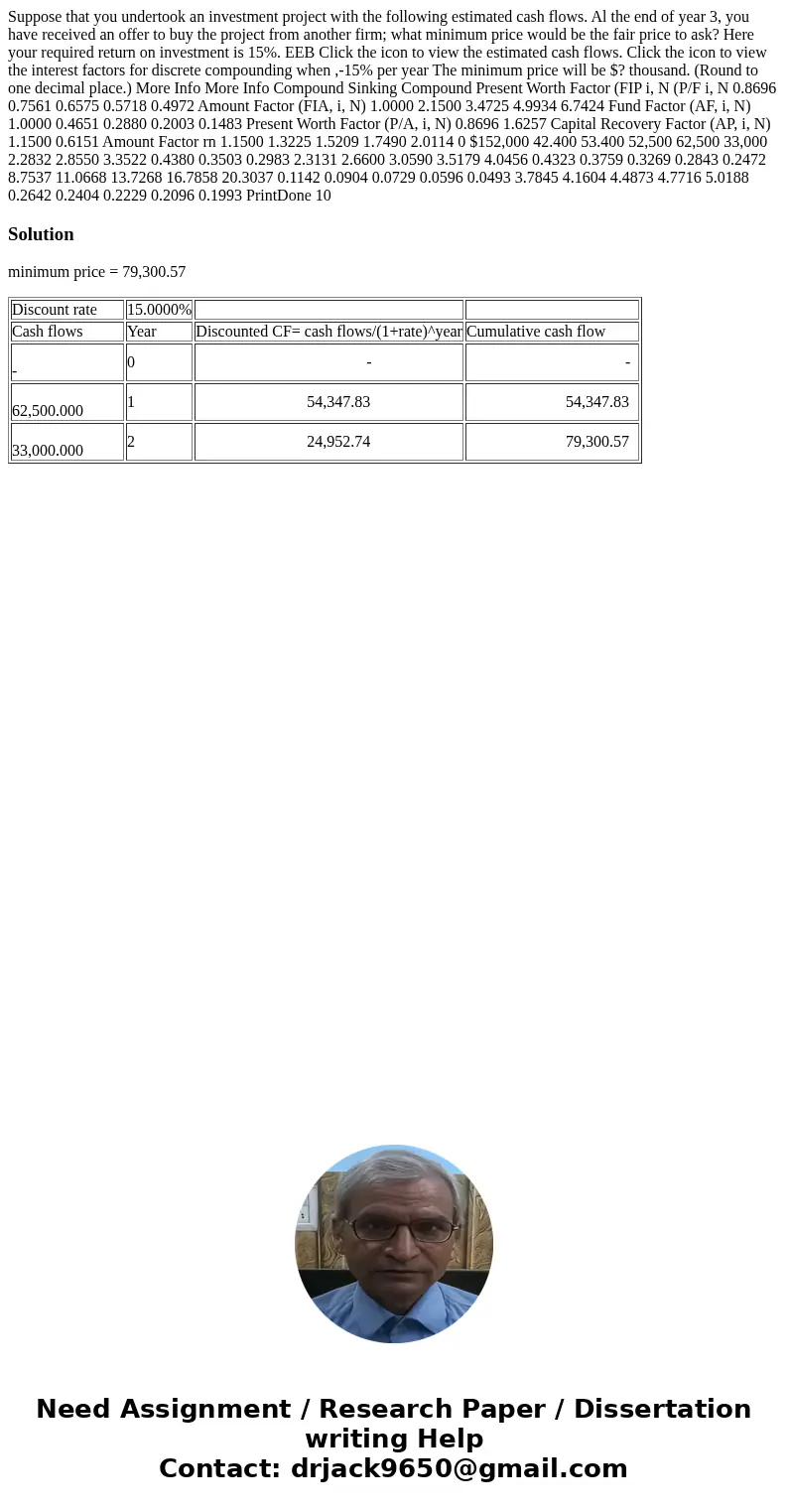

Suppose that you undertook an investment project with the following estimated cash flows. Al the end of year 3, you have received an offer to buy the project from another firm; what minimum price would be the fair price to ask? Here your required return on investment is 15%. EEB Click the icon to view the estimated cash flows. Click the icon to view the interest factors for discrete compounding when ,-15% per year The minimum price will be $? thousand. (Round to one decimal place.) More Info More Info Compound Sinking Compound Present Worth Factor (FIP i, N (P/F i, N 0.8696 0.7561 0.6575 0.5718 0.4972 Amount Factor (FIA, i, N) 1.0000 2.1500 3.4725 4.9934 6.7424 Fund Factor (AF, i, N) 1.0000 0.4651 0.2880 0.2003 0.1483 Present Worth Factor (P/A, i, N) 0.8696 1.6257 Capital Recovery Factor (AP, i, N) 1.1500 0.6151 Amount Factor rn 1.1500 1.3225 1.5209 1.7490 2.0114 0 $152,000 42.400 53.400 52,500 62,500 33,000 2.2832 2.8550 3.3522 0.4380 0.3503 0.2983 2.3131 2.6600 3.0590 3.5179 4.0456 0.4323 0.3759 0.3269 0.2843 0.2472 8.7537 11.0668 13.7268 16.7858 20.3037 0.1142 0.0904 0.0729 0.0596 0.0493 3.7845 4.1604 4.4873 4.7716 5.0188 0.2642 0.2404 0.2229 0.2096 0.1993 PrintDone 10

Solution

minimum price = 79,300.57

| Discount rate | 15.0000% | ||

| Cash flows | Year | Discounted CF= cash flows/(1+rate)^year | Cumulative cash flow |

| - | 0 | - | - |

| 62,500.000 | 1 | 54,347.83 | 54,347.83 |

| 33,000.000 | 2 | 24,952.74 | 79,300.57 |

Homework Sourse

Homework Sourse