Differential Analysis The Key to Decision Making EXERCISE 12

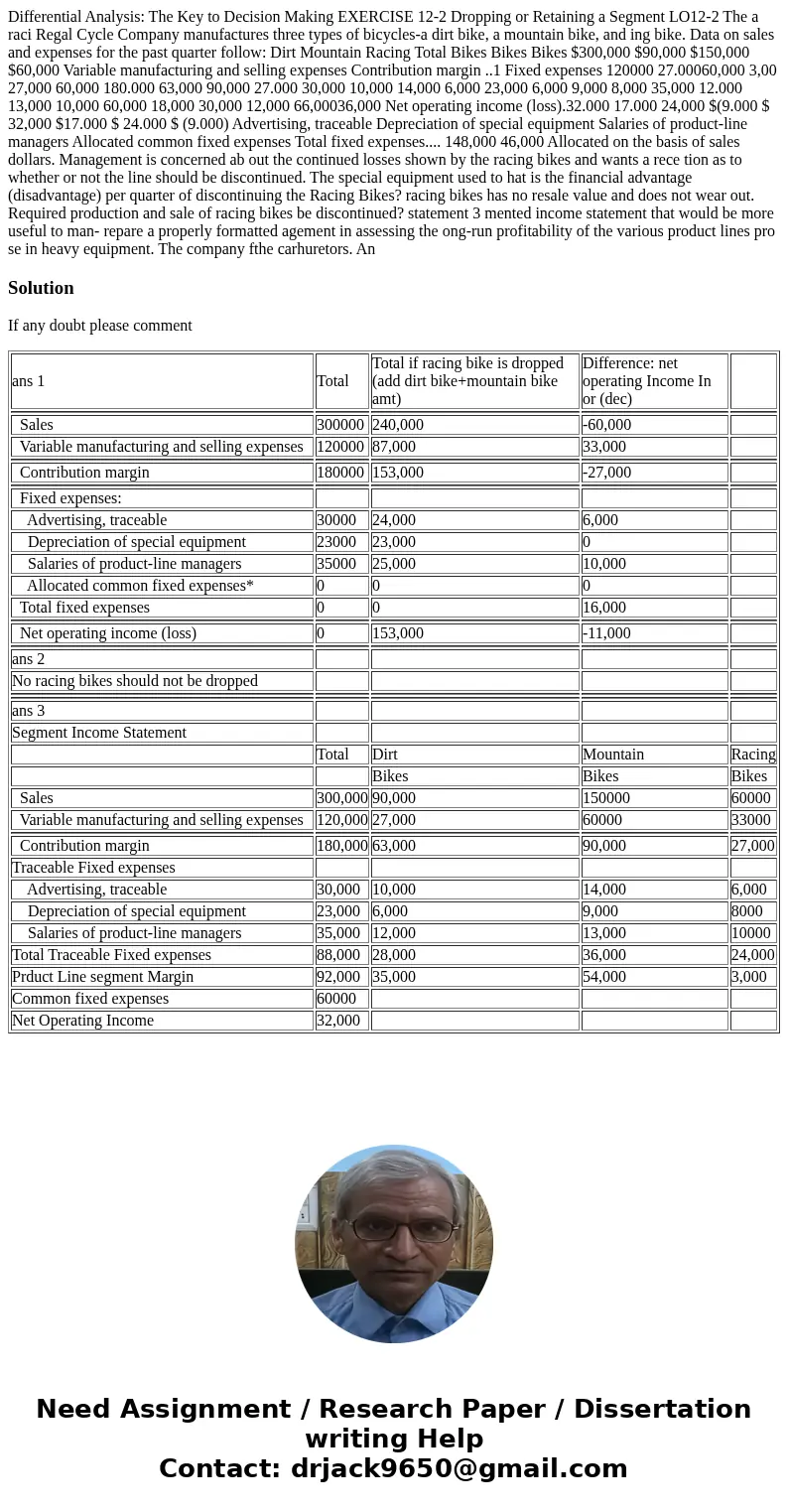

Differential Analysis: The Key to Decision Making EXERCISE 12-2 Dropping or Retaining a Segment LO12-2 The a raci Regal Cycle Company manufactures three types of bicycles-a dirt bike, a mountain bike, and ing bike. Data on sales and expenses for the past quarter follow: Dirt Mountain Racing Total Bikes Bikes Bikes $300,000 $90,000 $150,000 $60,000 Variable manufacturing and selling expenses Contribution margin ..1 Fixed expenses 120000 27.00060,000 3,00 27,000 60,000 180.000 63,000 90,000 27.000 30,000 10,000 14,000 6,000 23,000 6,000 9,000 8,000 35,000 12.000 13,000 10,000 60,000 18,000 30,000 12,000 66,00036,000 Net operating income (loss).32.000 17.000 24,000 $(9.000 $ 32,000 $17.000 $ 24.000 $ (9.000) Advertising, traceable Depreciation of special equipment Salaries of product-line managers Allocated common fixed expenses Total fixed expenses.... 148,000 46,000 Allocated on the basis of sales dollars. Management is concerned ab out the continued losses shown by the racing bikes and wants a rece tion as to whether or not the line should be discontinued. The special equipment used to hat is the financial advantage (disadvantage) per quarter of discontinuing the Racing Bikes? racing bikes has no resale value and does not wear out. Required production and sale of racing bikes be discontinued? statement 3 mented income statement that would be more useful to man- repare a properly formatted agement in assessing the ong-run profitability of the various product lines pro se in heavy equipment. The company fthe carhuretors. An

Solution

If any doubt please comment

| ans 1 | Total | Total if racing bike is dropped (add dirt bike+mountain bike amt) | Difference: net operating Income In or (dec) | |

| Sales | 300000 | 240,000 | -60,000 | |

| Variable manufacturing and selling expenses | 120000 | 87,000 | 33,000 | |

| Contribution margin | 180000 | 153,000 | -27,000 | |

| Fixed expenses: | ||||

| Advertising, traceable | 30000 | 24,000 | 6,000 | |

| Depreciation of special equipment | 23000 | 23,000 | 0 | |

| Salaries of product-line managers | 35000 | 25,000 | 10,000 | |

| Allocated common fixed expenses* | 0 | 0 | 0 | |

| Total fixed expenses | 0 | 0 | 16,000 | |

| Net operating income (loss) | 0 | 153,000 | -11,000 | |

| ans 2 | ||||

| No racing bikes should not be dropped | ||||

| ans 3 | ||||

| Segment Income Statement | ||||

| Total | Dirt | Mountain | Racing | |

| Bikes | Bikes | Bikes | ||

| Sales | 300,000 | 90,000 | 150000 | 60000 |

| Variable manufacturing and selling expenses | 120,000 | 27,000 | 60000 | 33000 |

| Contribution margin | 180,000 | 63,000 | 90,000 | 27,000 |

| Traceable Fixed expenses | ||||

| Advertising, traceable | 30,000 | 10,000 | 14,000 | 6,000 |

| Depreciation of special equipment | 23,000 | 6,000 | 9,000 | 8000 |

| Salaries of product-line managers | 35,000 | 12,000 | 13,000 | 10000 |

| Total Traceable Fixed expenses | 88,000 | 28,000 | 36,000 | 24,000 |

| Prduct Line segment Margin | 92,000 | 35,000 | 54,000 | 3,000 |

| Common fixed expenses | 60000 | |||

| Net Operating Income | 32,000 |

Homework Sourse

Homework Sourse