Cullumber Company reported the following amounts in the stoc

Solution

Answer

S. No.

Particulars

Dr. $

Cr. $

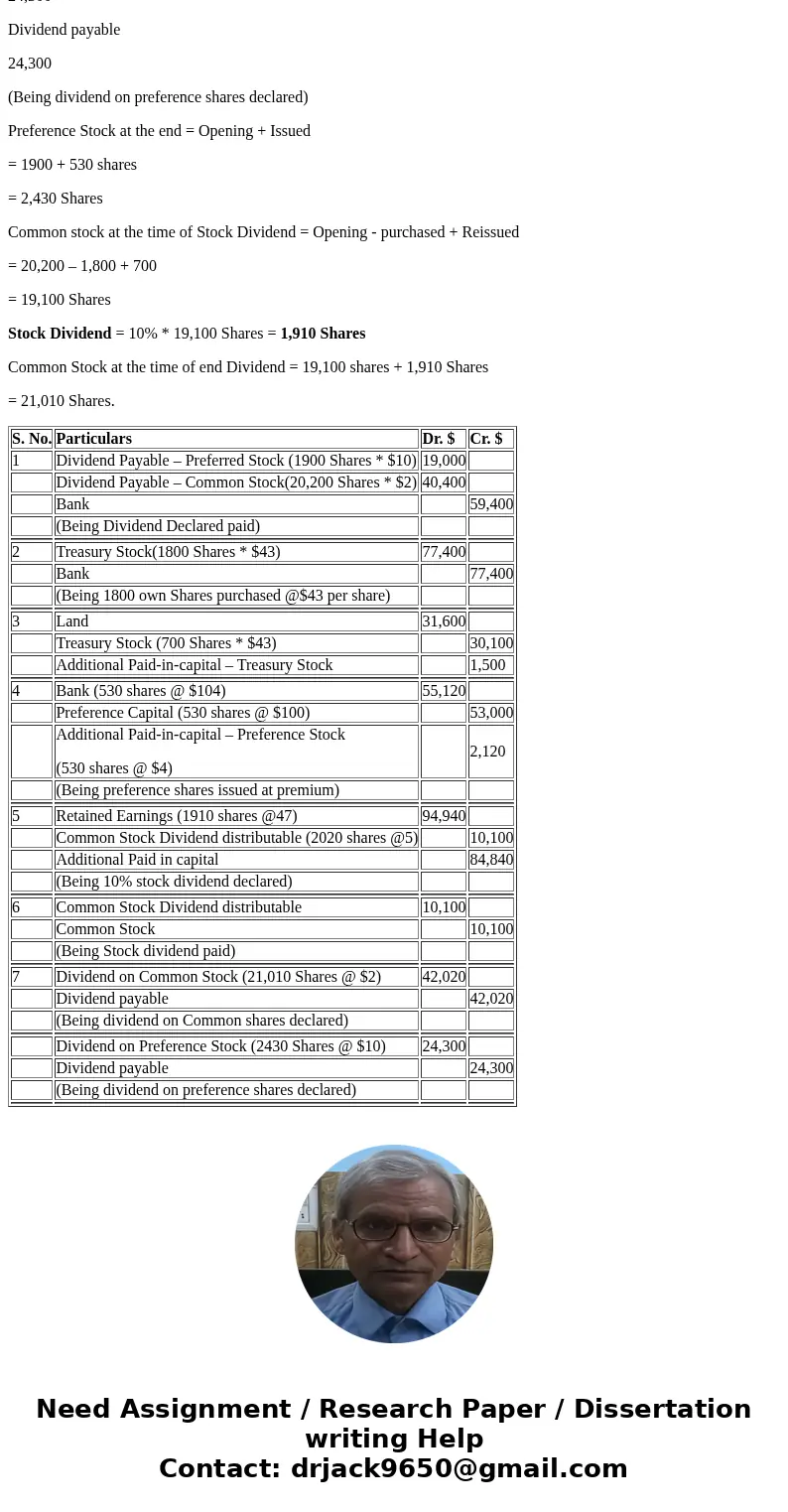

1

Dividend Payable – Preferred Stock (1900 Shares * $10)

19,000

Dividend Payable – Common Stock(20,200 Shares * $2)

40,400

Bank

59,400

(Being Dividend Declared paid)

2

Treasury Stock(1800 Shares * $43)

77,400

Bank

77,400

(Being 1800 own Shares purchased @$43 per share)

3

Land

31,600

Treasury Stock (700 Shares * $43)

30,100

Additional Paid-in-capital – Treasury Stock

1,500

4

Bank (530 shares @ $104)

55,120

Preference Capital (530 shares @ $100)

53,000

Additional Paid-in-capital – Preference Stock

(530 shares @ $4)

2,120

(Being preference shares issued at premium)

5

Retained Earnings (1910 shares @47)

94,940

Common Stock Dividend distributable (2020 shares @5)

10,100

Additional Paid in capital

84,840

(Being 10% stock dividend declared)

6

Common Stock Dividend distributable

10,100

Common Stock

10,100

(Being Stock dividend paid)

7

Dividend on Common Stock (21,010 Shares @ $2)

42,020

Dividend payable

42,020

(Being dividend on Common shares declared)

Dividend on Preference Stock (2430 Shares @ $10)

24,300

Dividend payable

24,300

(Being dividend on preference shares declared)

Preference Stock at the end = Opening + Issued

= 1900 + 530 shares

= 2,430 Shares

Common stock at the time of Stock Dividend = Opening - purchased + Reissued

= 20,200 – 1,800 + 700

= 19,100 Shares

Stock Dividend = 10% * 19,100 Shares = 1,910 Shares

Common Stock at the time of end Dividend = 19,100 shares + 1,910 Shares

= 21,010 Shares.

| S. No. | Particulars | Dr. $ | Cr. $ |

| 1 | Dividend Payable – Preferred Stock (1900 Shares * $10) | 19,000 | |

| Dividend Payable – Common Stock(20,200 Shares * $2) | 40,400 | ||

| Bank | 59,400 | ||

| (Being Dividend Declared paid) | |||

| 2 | Treasury Stock(1800 Shares * $43) | 77,400 | |

| Bank | 77,400 | ||

| (Being 1800 own Shares purchased @$43 per share) | |||

| 3 | Land | 31,600 | |

| Treasury Stock (700 Shares * $43) | 30,100 | ||

| Additional Paid-in-capital – Treasury Stock | 1,500 | ||

| 4 | Bank (530 shares @ $104) | 55,120 | |

| Preference Capital (530 shares @ $100) | 53,000 | ||

| Additional Paid-in-capital – Preference Stock (530 shares @ $4) | 2,120 | ||

| (Being preference shares issued at premium) | |||

| 5 | Retained Earnings (1910 shares @47) | 94,940 | |

| Common Stock Dividend distributable (2020 shares @5) | 10,100 | ||

| Additional Paid in capital | 84,840 | ||

| (Being 10% stock dividend declared) | |||

| 6 | Common Stock Dividend distributable | 10,100 | |

| Common Stock | 10,100 | ||

| (Being Stock dividend paid) | |||

| 7 | Dividend on Common Stock (21,010 Shares @ $2) | 42,020 | |

| Dividend payable | 42,020 | ||

| (Being dividend on Common shares declared) | |||

| Dividend on Preference Stock (2430 Shares @ $10) | 24,300 | ||

| Dividend payable | 24,300 | ||

| (Being dividend on preference shares declared) | |||

Homework Sourse

Homework Sourse