July 1 Purchased merchandise from Boden Company for 6100 und

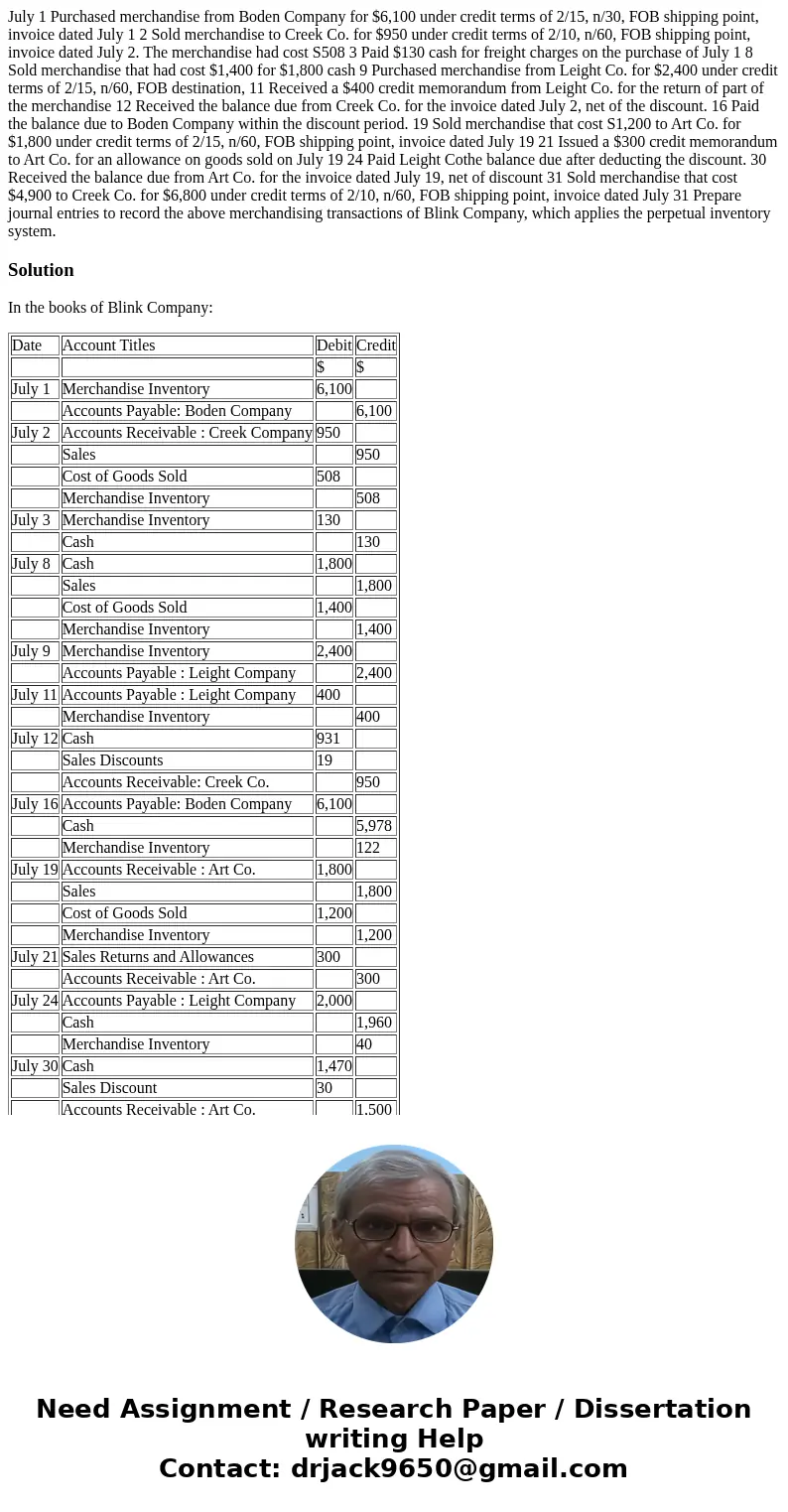

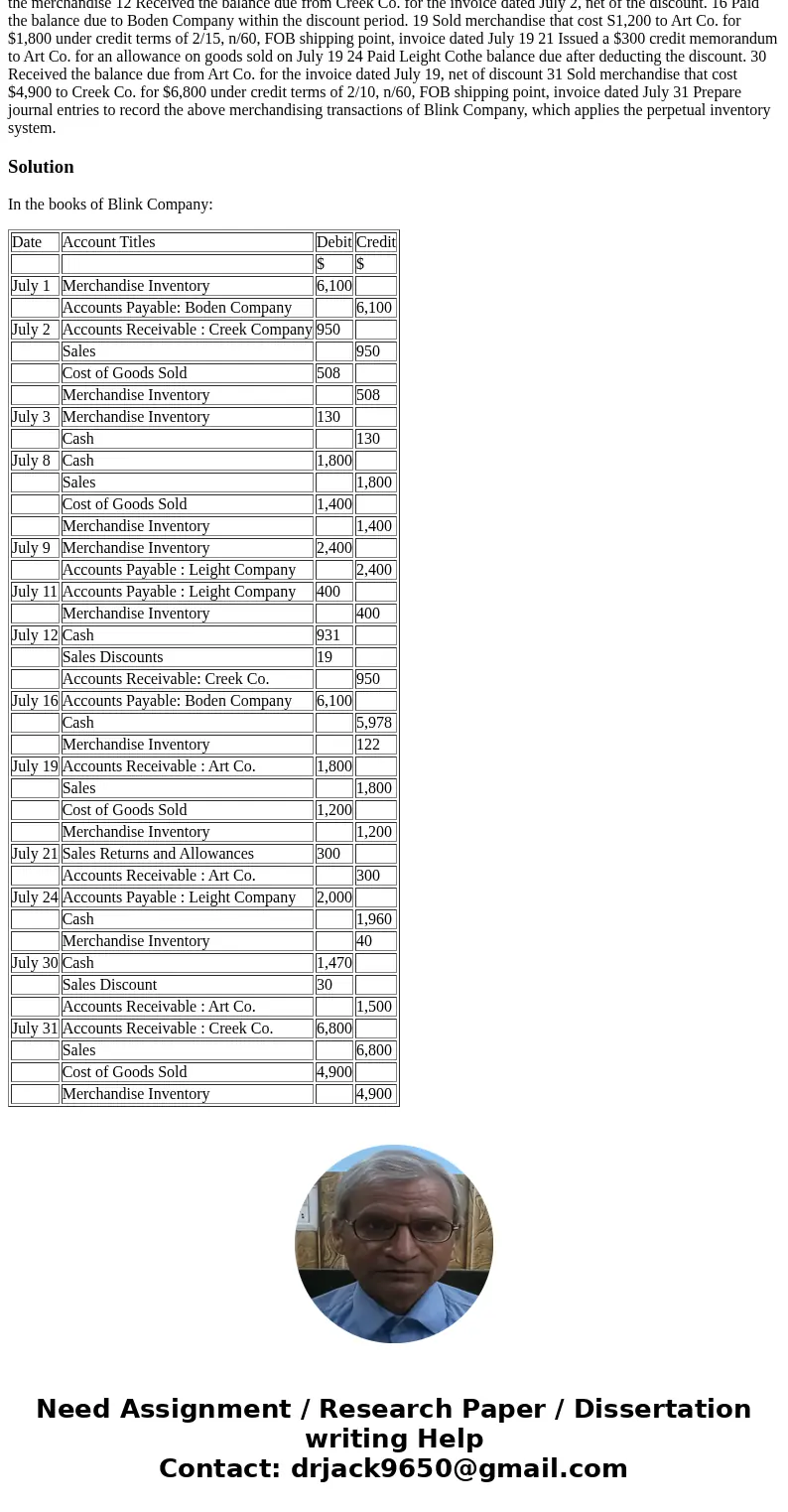

July 1 Purchased merchandise from Boden Company for $6,100 under credit terms of 2/15, n/30, FOB shipping point, invoice dated July 1 2 Sold merchandise to Creek Co. for $950 under credit terms of 2/10, n/60, FOB shipping point, invoice dated July 2. The merchandise had cost S508 3 Paid $130 cash for freight charges on the purchase of July 1 8 Sold merchandise that had cost $1,400 for $1,800 cash 9 Purchased merchandise from Leight Co. for $2,400 under credit terms of 2/15, n/60, FOB destination, 11 Received a $400 credit memorandum from Leight Co. for the return of part of the merchandise 12 Received the balance due from Creek Co. for the invoice dated July 2, net of the discount. 16 Paid the balance due to Boden Company within the discount period. 19 Sold merchandise that cost S1,200 to Art Co. for $1,800 under credit terms of 2/15, n/60, FOB shipping point, invoice dated July 19 21 Issued a $300 credit memorandum to Art Co. for an allowance on goods sold on July 19 24 Paid Leight Cothe balance due after deducting the discount. 30 Received the balance due from Art Co. for the invoice dated July 19, net of discount 31 Sold merchandise that cost $4,900 to Creek Co. for $6,800 under credit terms of 2/10, n/60, FOB shipping point, invoice dated July 31 Prepare journal entries to record the above merchandising transactions of Blink Company, which applies the perpetual inventory system.

Solution

In the books of Blink Company:

| Date | Account Titles | Debit | Credit |

| $ | $ | ||

| July 1 | Merchandise Inventory | 6,100 | |

| Accounts Payable: Boden Company | 6,100 | ||

| July 2 | Accounts Receivable : Creek Company | 950 | |

| Sales | 950 | ||

| Cost of Goods Sold | 508 | ||

| Merchandise Inventory | 508 | ||

| July 3 | Merchandise Inventory | 130 | |

| Cash | 130 | ||

| July 8 | Cash | 1,800 | |

| Sales | 1,800 | ||

| Cost of Goods Sold | 1,400 | ||

| Merchandise Inventory | 1,400 | ||

| July 9 | Merchandise Inventory | 2,400 | |

| Accounts Payable : Leight Company | 2,400 | ||

| July 11 | Accounts Payable : Leight Company | 400 | |

| Merchandise Inventory | 400 | ||

| July 12 | Cash | 931 | |

| Sales Discounts | 19 | ||

| Accounts Receivable: Creek Co. | 950 | ||

| July 16 | Accounts Payable: Boden Company | 6,100 | |

| Cash | 5,978 | ||

| Merchandise Inventory | 122 | ||

| July 19 | Accounts Receivable : Art Co. | 1,800 | |

| Sales | 1,800 | ||

| Cost of Goods Sold | 1,200 | ||

| Merchandise Inventory | 1,200 | ||

| July 21 | Sales Returns and Allowances | 300 | |

| Accounts Receivable : Art Co. | 300 | ||

| July 24 | Accounts Payable : Leight Company | 2,000 | |

| Cash | 1,960 | ||

| Merchandise Inventory | 40 | ||

| July 30 | Cash | 1,470 | |

| Sales Discount | 30 | ||

| Accounts Receivable : Art Co. | 1,500 | ||

| July 31 | Accounts Receivable : Creek Co. | 6,800 | |

| Sales | 6,800 | ||

| Cost of Goods Sold | 4,900 | ||

| Merchandise Inventory | 4,900 |

Homework Sourse

Homework Sourse