Is the overhaul costs suppose to be accounted for when calcu

Is the overhaul costs suppose to be accounted for when calculating the payback period???

Step-1: Calculation of payback period:

Particulars

Alternative-A (in $)

Alternative-B (in $)

Alternative-C (in $)

Initial Investment

Cost

10,00,000

12,50,000

20,00,000

Setup Cost

0

50,000

50,000

Training cost

10,000

25,000

35,000

Total Initial Investment

10,10,000

13,25,000

20,85,000

Net Annual Cash Inflows

Annual savings

1,25,000

1,90,000

2,25,000

Annual Labor Savingd

25,000

0

40,000

Total savings (A)

1,50,000

1,90,000

2,65,000

Annual maintenance cost (B)

10,000

15,000

16,000

Net Annual Cash Inflows (A)-(B)

1,40,000

1,75,000

2,49,000

Payback Period

=Net investment/Annual Cash flow

7.21

7.57

8.37

Ranking

1

2

3

Step-2: Calculation of Net Present value

Particulars

Alternative-A (in $)

Alternative-B (in $)

Alternative-C (in $)

Initial Cash Outflow (Step-1)

10,10,000

13,25,000

20,85,000

Overahall expesnes in 4th year

45,000

50,000

35,000

PVF @ 12%

0.636

0.636

0.636

PV of ovehall expenses

28,620

31,800

22,260

PV of total cash outflows

10,38,620

13,56,000

21,07,260

PV of Net cash Inflows

Net Annual Cash Inflows (Step-1) (A)

1,40,000

1,75,000

2,49,000

No of Years

8

8

7

PVAF @12% (B)

4.967

4.967

4.564

PV of cash in flows (A)*(B)

6,95,380

8,69,225

11,36,436

Net Present value=PV of cash inflows-PV of cash outflows

(3,43,240)

(4,86,775)

(9,70,824)

Ranking

1

2

3

Step-3: Calculation of Accounting rate of return:

Particulars

Alternative-A (in $)

Alternative-B (in $)

Alternative-C (in $)

Average Annual Profit:

Annual Cash Inflows

1,40,000

1,75,000

2,49,000

No of Years

8

9

7

Total Inflow over period

11,20,000

15,75,000

17,43,000

Less: Overhaul cost

45,000

50,000

35,000

Less: Depreciation

(No salvage value)

10,10,000

13,25,000

20,85,000

Total Profit/(loss) of project

65,000

2,00,000

(3,77,000)

Useful life

8

9

7

Average Annual Profit

8125

22,222

Nil

Average Investment

Initial Investment

10,10,000

13,25,000

20,85,000

At the end salvage value

0

0

0

Average Investment=(initial investment+ At the end salvage value)/2

5,05,000

6,62,500

10,42,500

Accounting rate of return=Average Annual Profit/Average investment

1.6%

3.35%

O%

Ranking

2

1

3

Step-4: Internal Rate of Return:

Particulars

Alternative-A (in $)

Alternative-B (in $)

Alternative-C (in $)

NPV @ 10%

Initial Outflows

10,10,000

13,25,000

20,85,000

Overhall expense at the end of 4th year

45,000

50,000

35,000

PVF @10%

.683

0.683

0.683

PV of Overhall expense

30,735

34,150

23,905

Total Initial outflows

10,40,735

13,59,150

21,08,905

Net annual cash flows

1,40,000

1,75,000

2,49,000

Annuity factor@10%

5.3349

5.7590

4.8684

Annuity cashflows

7,46,886

1007825

12,12231

NPV @10%

(293849)

(351325)

(8,96,674)

NPV @12%

(3,43,240)

(4,86,775)

(9,70,824)

IRR=10%+NPV1*(R2-R1)/(NPV1-NPV2)

10.93%

10.83%

10.96%

Ranking

2

3

1

Step-5: Analysis Table (Ranking Table)

Particular

Alternative-A

Alternative-B

Alternative-C

Payback Period

1

2

3

NPV

1

2

3

Accounting rate of return

2

1

3

Internal Rate of return

2

3

1

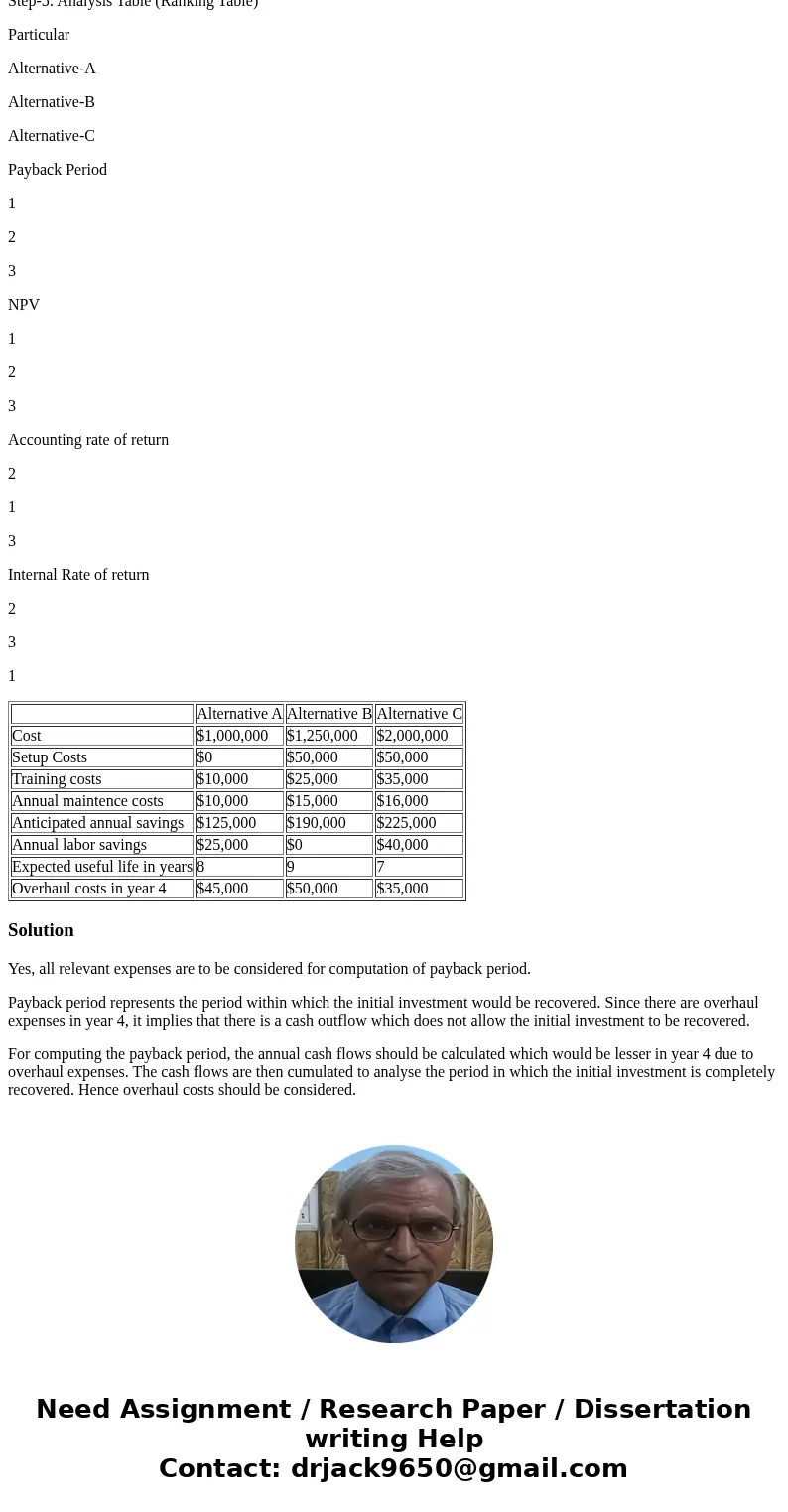

| Alternative A | Alternative B | Alternative C | |

| Cost | $1,000,000 | $1,250,000 | $2,000,000 |

| Setup Costs | $0 | $50,000 | $50,000 |

| Training costs | $10,000 | $25,000 | $35,000 |

| Annual maintence costs | $10,000 | $15,000 | $16,000 |

| Anticipated annual savings | $125,000 | $190,000 | $225,000 |

| Annual labor savings | $25,000 | $0 | $40,000 |

| Expected useful life in years | 8 | 9 | 7 |

| Overhaul costs in year 4 | $45,000 | $50,000 | $35,000 |

Solution

Yes, all relevant expenses are to be considered for computation of payback period.

Payback period represents the period within which the initial investment would be recovered. Since there are overhaul expenses in year 4, it implies that there is a cash outflow which does not allow the initial investment to be recovered.

For computing the payback period, the annual cash flows should be calculated which would be lesser in year 4 due to overhaul expenses. The cash flows are then cumulated to analyse the period in which the initial investment is completely recovered. Hence overhaul costs should be considered.

Homework Sourse

Homework Sourse