ces Mailings Review View AaBbCcDdE AaBbCcDdE AaBbCcDdEe AaBb

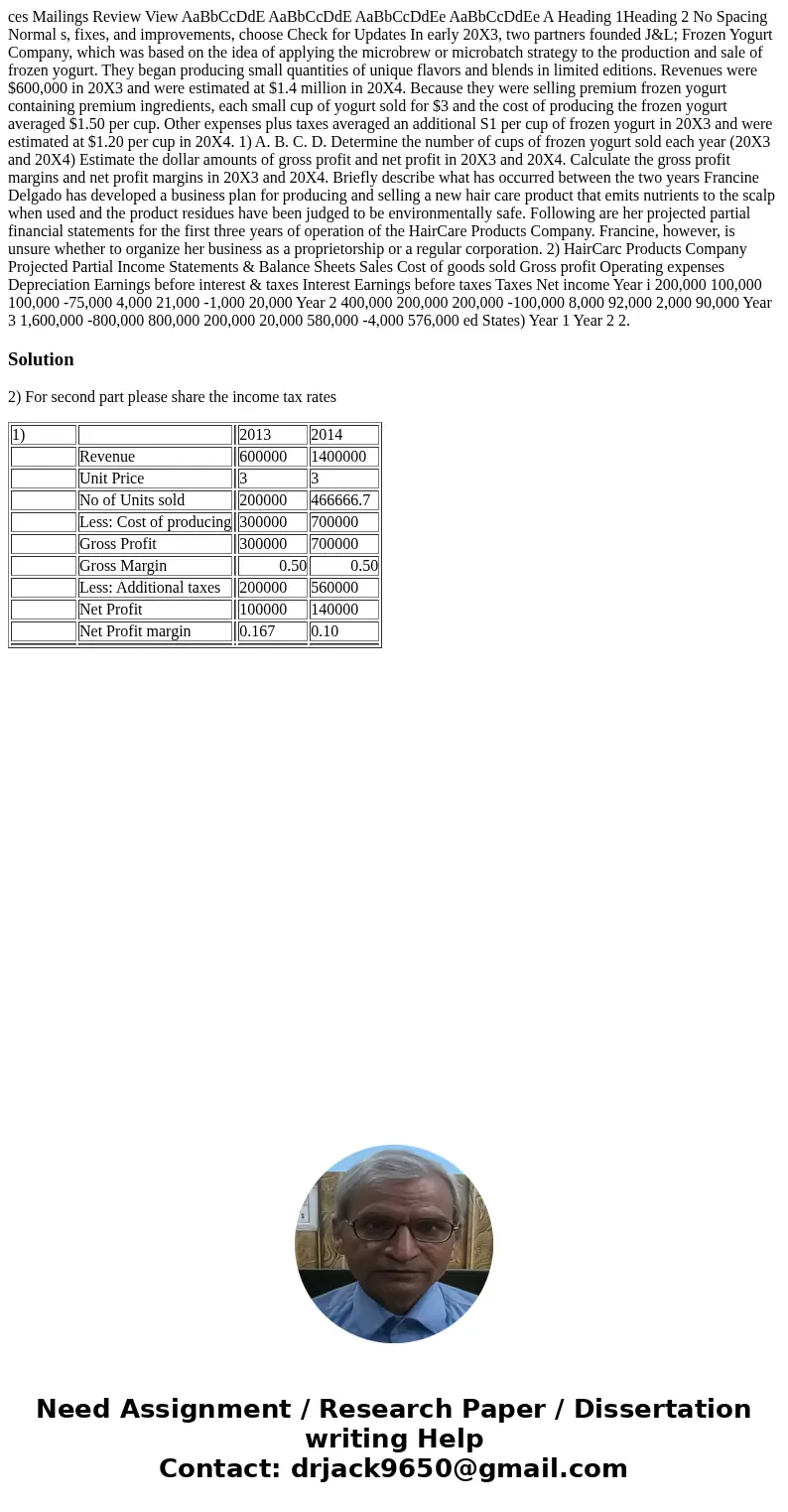

ces Mailings Review View AaBbCcDdE AaBbCcDdE AaBbCcDdEe AaBbCcDdEe A Heading 1Heading 2 No Spacing Normal s, fixes, and improvements, choose Check for Updates In early 20X3, two partners founded J&L; Frozen Yogurt Company, which was based on the idea of applying the microbrew or microbatch strategy to the production and sale of frozen yogurt. They began producing small quantities of unique flavors and blends in limited editions. Revenues were $600,000 in 20X3 and were estimated at $1.4 million in 20X4. Because they were selling premium frozen yogurt containing premium ingredients, each small cup of yogurt sold for $3 and the cost of producing the frozen yogurt averaged $1.50 per cup. Other expenses plus taxes averaged an additional S1 per cup of frozen yogurt in 20X3 and were estimated at $1.20 per cup in 20X4. 1) A. B. C. D. Determine the number of cups of frozen yogurt sold each year (20X3 and 20X4) Estimate the dollar amounts of gross profit and net profit in 20X3 and 20X4. Calculate the gross profit margins and net profit margins in 20X3 and 20X4. Briefly describe what has occurred between the two years Francine Delgado has developed a business plan for producing and selling a new hair care product that emits nutrients to the scalp when used and the product residues have been judged to be environmentally safe. Following are her projected partial financial statements for the first three years of operation of the HairCare Products Company. Francine, however, is unsure whether to organize her business as a proprietorship or a regular corporation. 2) HairCarc Products Company Projected Partial Income Statements & Balance Sheets Sales Cost of goods sold Gross profit Operating expenses Depreciation Earnings before interest & taxes Interest Earnings before taxes Taxes Net income Year i 200,000 100,000 100,000 -75,000 4,000 21,000 -1,000 20,000 Year 2 400,000 200,000 200,000 -100,000 8,000 92,000 2,000 90,000 Year 3 1,600,000 -800,000 800,000 200,000 20,000 580,000 -4,000 576,000 ed States) Year 1 Year 2 2.

Solution

2) For second part please share the income tax rates

| 1) | 2013 | 2014 | ||

| Revenue | 600000 | 1400000 | ||

| Unit Price | 3 | 3 | ||

| No of Units sold | 200000 | 466666.7 | ||

| Less: Cost of producing | 300000 | 700000 | ||

| Gross Profit | 300000 | 700000 | ||

| Gross Margin | 0.50 | 0.50 | ||

| Less: Additional taxes | 200000 | 560000 | ||

| Net Profit | 100000 | 140000 | ||

| Net Profit margin | 0.167 | 0.10 | ||

Homework Sourse

Homework Sourse