Consider the following information Rate of Return if State O

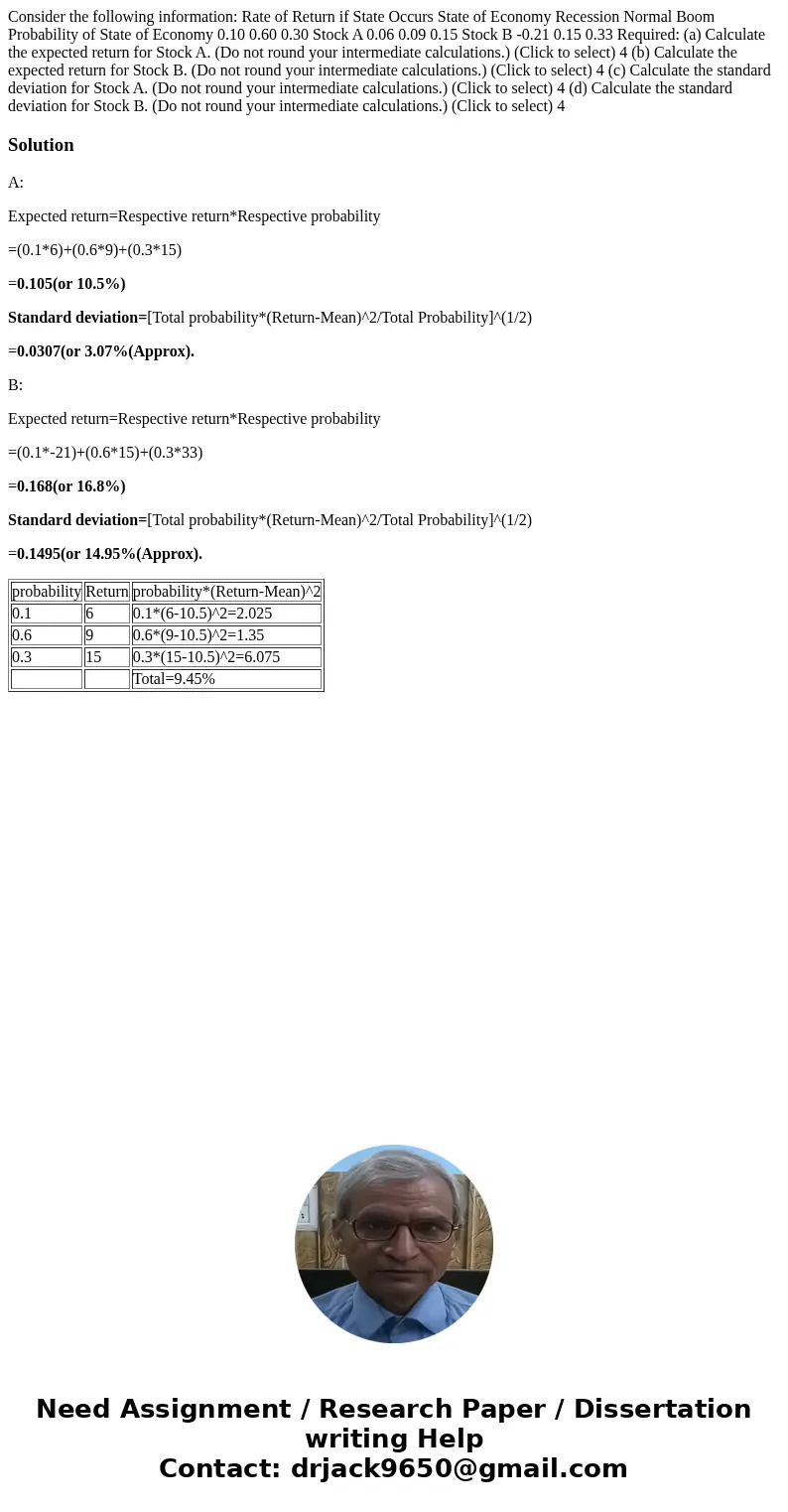

Consider the following information: Rate of Return if State Occurs State of Economy Recession Normal Boom Probability of State of Economy 0.10 0.60 0.30 Stock A 0.06 0.09 0.15 Stock B -0.21 0.15 0.33 Required: (a) Calculate the expected return for Stock A. (Do not round your intermediate calculations.) (Click to select) 4 (b) Calculate the expected return for Stock B. (Do not round your intermediate calculations.) (Click to select) 4 (c) Calculate the standard deviation for Stock A. (Do not round your intermediate calculations.) (Click to select) 4 (d) Calculate the standard deviation for Stock B. (Do not round your intermediate calculations.) (Click to select) 4

Solution

A:

Expected return=Respective return*Respective probability

=(0.1*6)+(0.6*9)+(0.3*15)

=0.105(or 10.5%)

Standard deviation=[Total probability*(Return-Mean)^2/Total Probability]^(1/2)

=0.0307(or 3.07%(Approx).

B:

Expected return=Respective return*Respective probability

=(0.1*-21)+(0.6*15)+(0.3*33)

=0.168(or 16.8%)

Standard deviation=[Total probability*(Return-Mean)^2/Total Probability]^(1/2)

=0.1495(or 14.95%(Approx).

| probability | Return | probability*(Return-Mean)^2 |

| 0.1 | 6 | 0.1*(6-10.5)^2=2.025 |

| 0.6 | 9 | 0.6*(9-10.5)^2=1.35 |

| 0.3 | 15 | 0.3*(15-10.5)^2=6.075 |

| Total=9.45% |

Homework Sourse

Homework Sourse