Luke Unlimited Companys account balances on November 1 are a

Solution

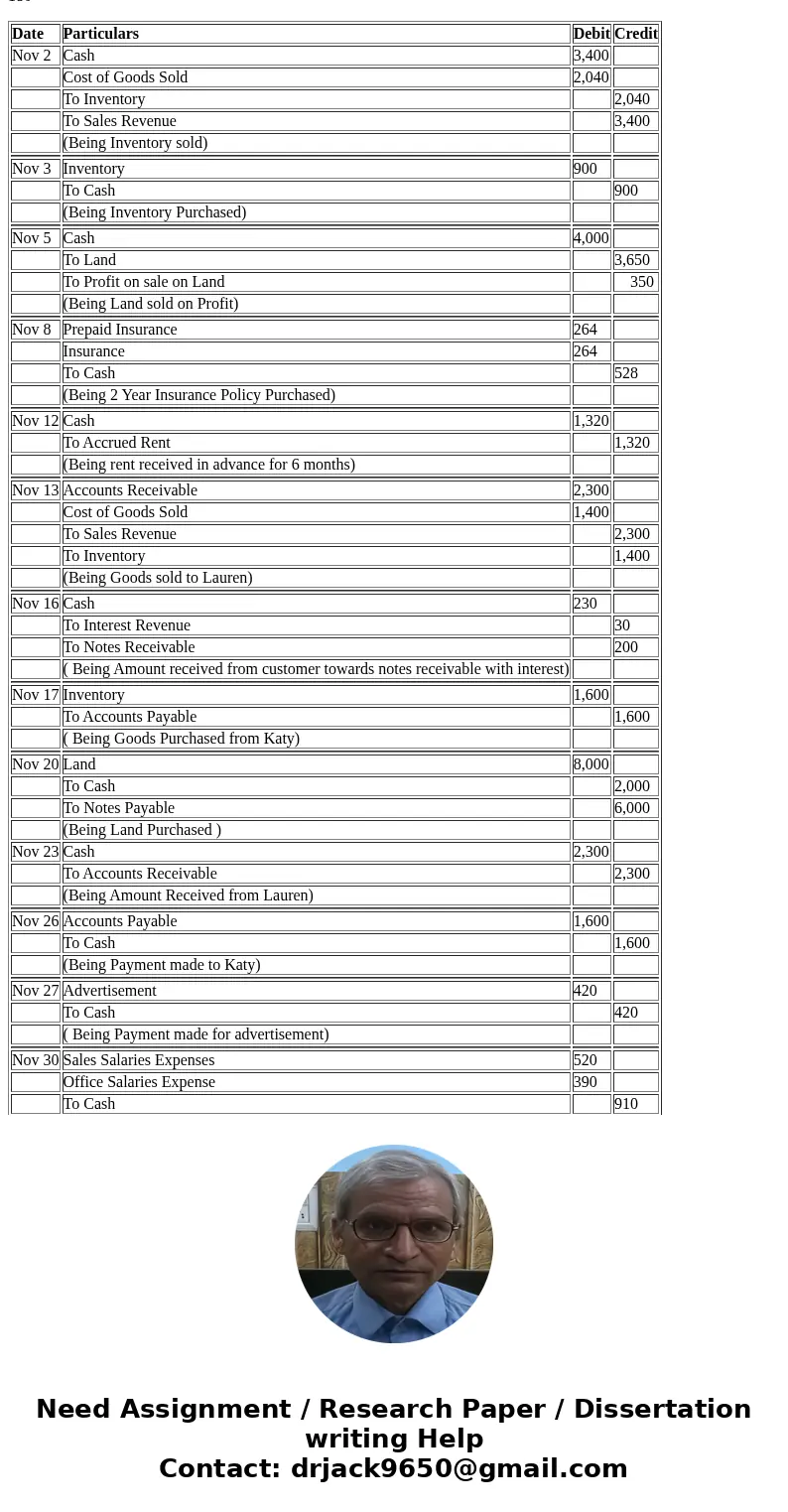

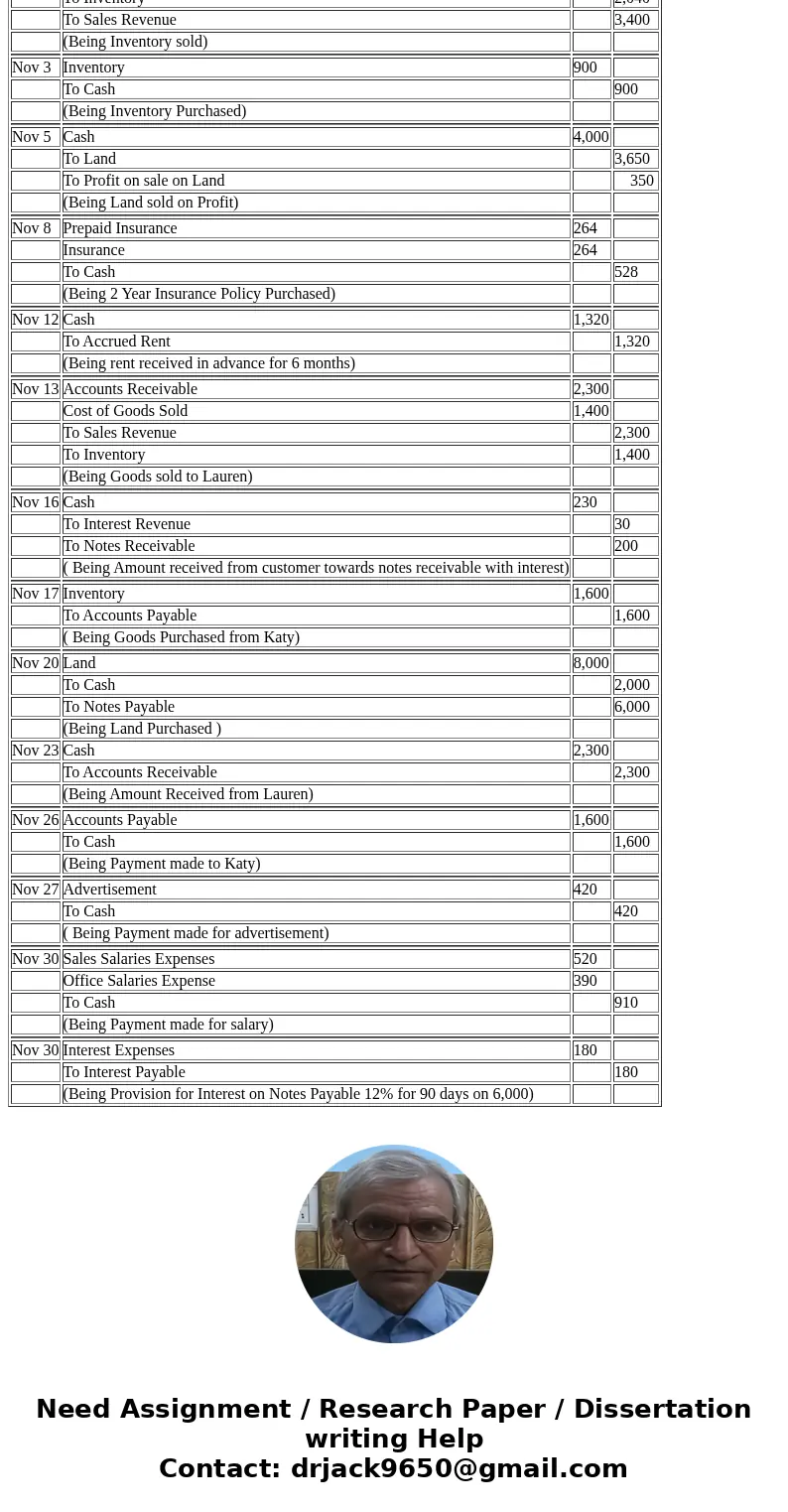

1.Journal Entries in the books of Luke Unlimited Company (Amount in $)

Date

Particulars

Debit

Credit

Nov 2

Cash

3,400

Cost of Goods Sold

2,040

To Inventory

2,040

To Sales Revenue

3,400

(Being Inventory sold)

Nov 3

Inventory

900

To Cash

900

(Being Inventory Purchased)

Nov 5

Cash

4,000

To Land

3,650

To Profit on sale on Land

350

(Being Land sold on Profit)

Nov 8

Prepaid Insurance

264

Insurance

264

To Cash

528

(Being 2 Year Insurance Policy Purchased)

Nov 12

Cash

1,320

To Accrued Rent

1,320

(Being rent received in advance for 6 months)

Nov 13

Accounts Receivable

2,300

Cost of Goods Sold

1,400

To Sales Revenue

2,300

To Inventory

1,400

(Being Goods sold to Lauren)

Nov 16

Cash

230

To Interest Revenue

30

To Notes Receivable

200

( Being Amount received from customer towards notes receivable with interest)

Nov 17

Inventory

1,600

To Accounts Payable

1,600

( Being Goods Purchased from Katy)

Nov 20

Land

8,000

To Cash

2,000

To Notes Payable

6,000

(Being Land Purchased )

Nov 23

Cash

2,300

To Accounts Receivable

2,300

(Being Amount Received from Lauren)

Nov 26

Accounts Payable

1,600

To Cash

1,600

(Being Payment made to Katy)

Nov 27

Advertisement

420

To Cash

420

( Being Payment made for advertisement)

Nov 30

Sales Salaries Expenses

520

Office Salaries Expense

390

To Cash

910

(Being Payment made for salary)

Nov 30

Interest Expenses

180

To Interest Payable

180

(Being Provision for Interest on Notes Payable 12% for 90 days on 6,000)

2. Posting General Ledger to T-Accounts

Cash

Debit

Credit

Date

Particular

Amount

Date

Particular

Amount

Nov 1

Balance

7,800

Nov 3

Inventory

2,040

Nov 2

Sales Revenue

3,400

Nov 8

Insurance

264

Nov 5

Land

3,650

Nov 8

Prepaid Insurance

264

Nov 5

Profit on sale of Land

350

Nov 20

Land

2,000

Nov 12

Accrued Rent

1,320

Nov 26

Accounts Payable

1,600

Nov 16

Interest Revenue

30

Nov 27

Advertisement

420

Nov 16

Notes Receivable

200

Nov 30

Sales Salaries Expenses

520

Nov 23

Accounts Receivable

1,600

Nov 30

Office Salaries Expenses

390

Balance C/f

10,852

18,350

18,350

Cost of Goods Sold

Debit

Credit

Date

Particular

Amount

Date

Particular

Amount

Nov 1

Balance

32,000

Nov 2

Inventory

2,040

Nov 13

Inventory

1,400

Balance C/F

35,440

35,440

35,440

Inventory

Debit

Credit

Date

Particular

Amount

Date

Particular

Amount

Nov 1

Balance

25,121

Nov 2

Cost of goods sold

2,040

Nov 3

Cash

900

Nov 13

Cost of goods sold

1,400

Nov 17

Accounts Payable

1,600

Balance C/F

24,181

27,621

27,621

Sales Revenue

Debit

Credit

Date

Particular

Amount

Date

Particular

Amount

Balance C/F

42,533

Nov 1

Balance

36,833

Nov 2

Cash

3,400

Nov 13

Accounts Receivable

2,300

42,533

42,533

Land

Debit

Credit

Date

Particular

Amount

Date

Particular

Amount

Nov 1

Balance

74,350

Nov 5

Cash

4,000

Nov 20

Cash

2,000

Balance C/F

78,350

Nov 20

Notes Payable

6,000

82,350

82,350

Profit on sale on Land

Debit

Credit

Date

Particular

Amount

Date

Particular

Amount

Balance C/F

350

Nov 5

Cash

350

350

350

Prepaid Insurance

Debit

Credit

Date

Particular

Amount

Date

Particular

Amount

Nov 1

Balance

840

Balance C/F

1104

Nov 8

Cash

264

1104

1104

Insurance Expenses

Debit

Credit

Date

Particular

Amount

Date

Particular

Amount

Balance C/F

264

Nov 8

Cash

264

264

Accrued Rent

Debit

Credit

Date

Particular

Amount

Date

Particular

Amount

Balance

1,320

Nov 12

To Cash

1,320

1,320

1,320

Accounts Receivable

Debit

Credit

Date

Particular

Amount

Date

Particular

Amount

Nov 1

Balance

12,530

Nov 23

Cash

2,300

Nov 13

Sales Revenue

2,300

Balance

12,530

14,830

14,830

Interest Revenue

Debit

Credit

Date

Particular

Amount

Date

Particular

Amount

Balance C/F

580

Nov 1

Balance

550

Nov 16

Cash

30

580

580

Notes Receivable

Debit

Credit

Date

Particular

Amount

Date

Particular

Amount

Nov 1

Balance

6,000

Nov 16

Cash

200

Balance C/F

5,800

6,000

6,000

Accounts Payable

Debit

Credit

Date

Particular

Amount

Date

Particular

Amount

Nov 26

Cash

1,600

Nov 1

Balance

38,750

Balance C/F

38,750

Nov 17

Inventory

1,600

40,350

40,350

Notes Payable

Debit

Credit

Date

Particular

Amount

Date

Particular

Amount

Balance C/f

8,400

Nov 1

Balance

2,400

Nov 20

Land

6,000

8,400

8,400

Advertisement

Debit

Credit

Date

Particular

Amount

Date

Particular

Amount

Nov 1

Balance

1,250

Nov 27

Cash

420

Balance C/f

1,670

1,670

1,670

Sales Salaries Expenses

Debit

Credit

Date

Particular

Amount

Date

Particular

Amount

Nov 1

Balance

6,200

Balance C/F

6,720

Nov 30

Cash

520

6,720

6,720

Office Salaries Expenses

Debit

Credit

Date

Particular

Amount

Date

Particular

Amount

Nov 1

Balance

4,300

Balance C/F

4,690

Nov 30

Cash

390

4,690

4,690

Interest Expenses

Debit

Credit

Date

Particular

Amount

Date

Particular

Amount

Nov 1

Balance

210

Balance C/F

390

Nov 30

Interest Payable

180

390

390

Interest Payable

Debit

Credit

Date

Particular

Amount

Date

Particular

Amount

Balance C/F

180

Nov 30

Interest Expenses

180

180

180

| Date | Particulars | Debit | Credit |

| Nov 2 | Cash | 3,400 | |

| Cost of Goods Sold | 2,040 | ||

| To Inventory | 2,040 | ||

| To Sales Revenue | 3,400 | ||

| (Being Inventory sold) | |||

| Nov 3 | Inventory | 900 | |

| To Cash | 900 | ||

| (Being Inventory Purchased) | |||

| Nov 5 | Cash | 4,000 | |

| To Land | 3,650 | ||

| To Profit on sale on Land | 350 | ||

| (Being Land sold on Profit) | |||

| Nov 8 | Prepaid Insurance | 264 | |

| Insurance | 264 | ||

| To Cash | 528 | ||

| (Being 2 Year Insurance Policy Purchased) | |||

| Nov 12 | Cash | 1,320 | |

| To Accrued Rent | 1,320 | ||

| (Being rent received in advance for 6 months) | |||

| Nov 13 | Accounts Receivable | 2,300 | |

| Cost of Goods Sold | 1,400 | ||

| To Sales Revenue | 2,300 | ||

| To Inventory | 1,400 | ||

| (Being Goods sold to Lauren) | |||

| Nov 16 | Cash | 230 | |

| To Interest Revenue | 30 | ||

| To Notes Receivable | 200 | ||

| ( Being Amount received from customer towards notes receivable with interest) | |||

| Nov 17 | Inventory | 1,600 | |

| To Accounts Payable | 1,600 | ||

| ( Being Goods Purchased from Katy) | |||

| Nov 20 | Land | 8,000 | |

| To Cash | 2,000 | ||

| To Notes Payable | 6,000 | ||

| (Being Land Purchased ) | |||

| Nov 23 | Cash | 2,300 | |

| To Accounts Receivable | 2,300 | ||

| (Being Amount Received from Lauren) | |||

| Nov 26 | Accounts Payable | 1,600 | |

| To Cash | 1,600 | ||

| (Being Payment made to Katy) | |||

| Nov 27 | Advertisement | 420 | |

| To Cash | 420 | ||

| ( Being Payment made for advertisement) | |||

| Nov 30 | Sales Salaries Expenses | 520 | |

| Office Salaries Expense | 390 | ||

| To Cash | 910 | ||

| (Being Payment made for salary) | |||

| Nov 30 | Interest Expenses | 180 | |

| To Interest Payable | 180 | ||

| (Being Provision for Interest on Notes Payable 12% for 90 days on 6,000) |

Homework Sourse

Homework Sourse