19 A company needs an increase in working capital of 20000 i

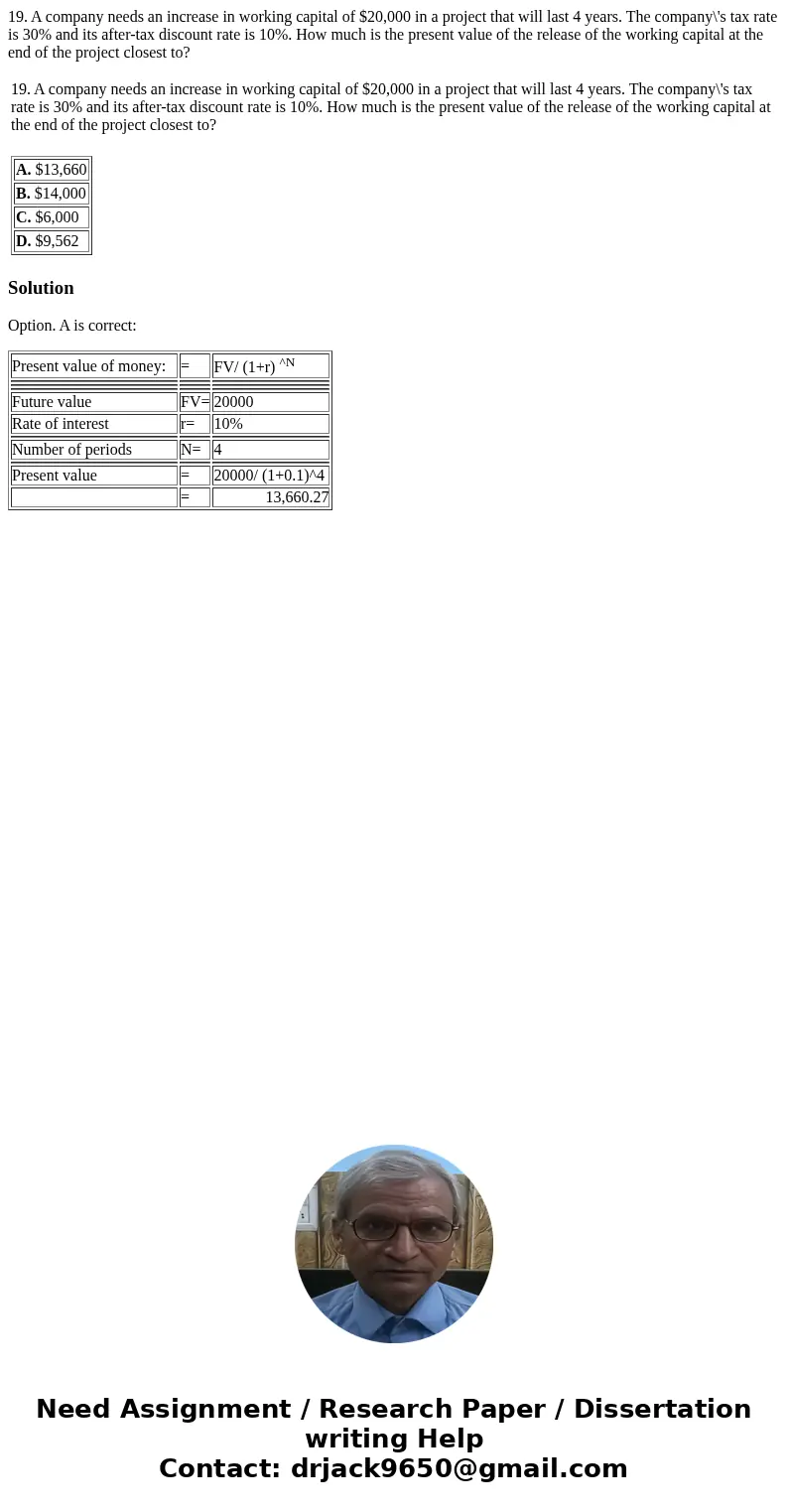

19. A company needs an increase in working capital of $20,000 in a project that will last 4 years. The company\'s tax rate is 30% and its after-tax discount rate is 10%. How much is the present value of the release of the working capital at the end of the project closest to?

| 19. A company needs an increase in working capital of $20,000 in a project that will last 4 years. The company\'s tax rate is 30% and its after-tax discount rate is 10%. How much is the present value of the release of the working capital at the end of the project closest to? | ||||

|

Solution

Option. A is correct:

| Present value of money: | = | FV/ (1+r) ^N |

| Future value | FV= | 20000 |

| Rate of interest | r= | 10% |

| Number of periods | N= | 4 |

| Present value | = | 20000/ (1+0.1)^4 |

| = | 13,660.27 |

Homework Sourse

Homework Sourse