826 Zerex Paving Company purchased a hauling truck on Januar

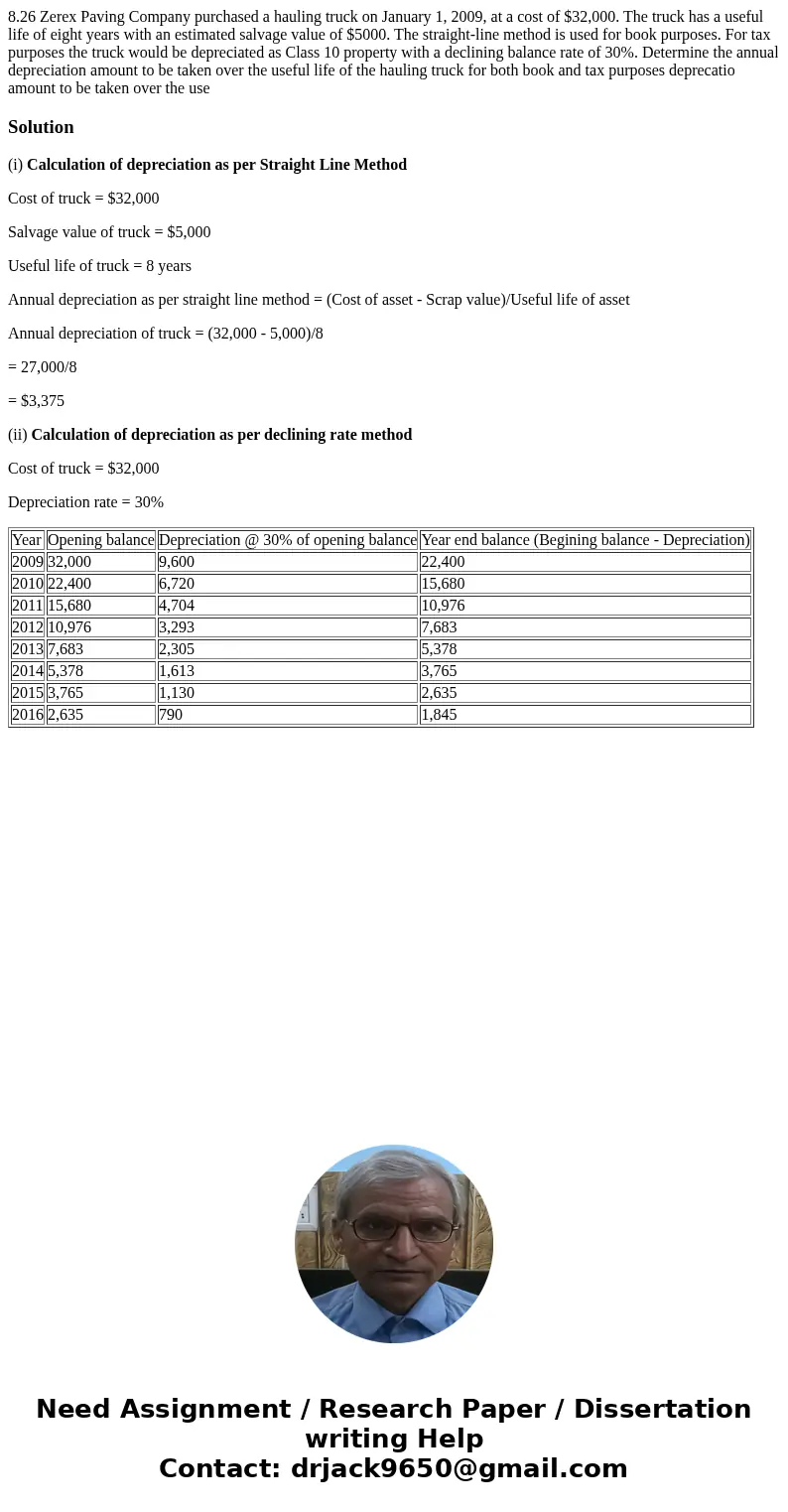

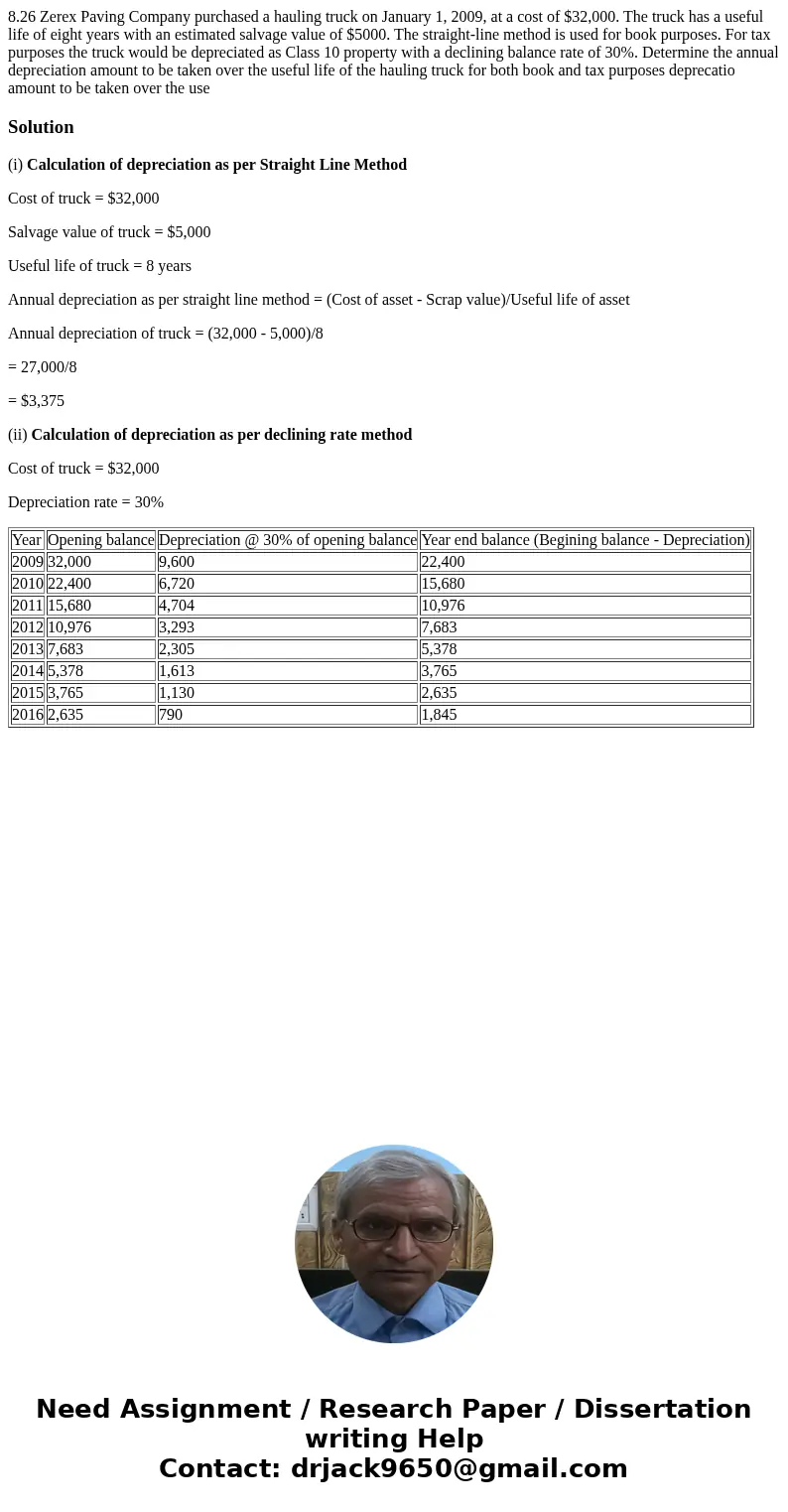

8.26 Zerex Paving Company purchased a hauling truck on January 1, 2009, at a cost of $32,000. The truck has a useful life of eight years with an estimated salvage value of $5000. The straight-line method is used for book purposes. For tax purposes the truck would be depreciated as Class 10 property with a declining balance rate of 30%. Determine the annual depreciation amount to be taken over the useful life of the hauling truck for both book and tax purposes deprecatio amount to be taken over the use

Solution

(i) Calculation of depreciation as per Straight Line Method

Cost of truck = $32,000

Salvage value of truck = $5,000

Useful life of truck = 8 years

Annual depreciation as per straight line method = (Cost of asset - Scrap value)/Useful life of asset

Annual depreciation of truck = (32,000 - 5,000)/8

= 27,000/8

= $3,375

(ii) Calculation of depreciation as per declining rate method

Cost of truck = $32,000

Depreciation rate = 30%

| Year | Opening balance | Depreciation @ 30% of opening balance | Year end balance (Begining balance - Depreciation) |

| 2009 | 32,000 | 9,600 | 22,400 |

| 2010 | 22,400 | 6,720 | 15,680 |

| 2011 | 15,680 | 4,704 | 10,976 |

| 2012 | 10,976 | 3,293 | 7,683 |

| 2013 | 7,683 | 2,305 | 5,378 |

| 2014 | 5,378 | 1,613 | 3,765 |

| 2015 | 3,765 | 1,130 | 2,635 |

| 2016 | 2,635 | 790 | 1,845 |

Homework Sourse

Homework Sourse