E connect Yousef Sherhan FIN4710 Advanced Investment Analysi

E connect Yousef Sherhan FIN4710 Advanced Investment Analysis Summer 2018 FINANCE Homework #4 instructions help Question 2 (of 5) | Save & Exit | | Submit value 10.00 points You purchase one Facebook October 170 put contract for a premium of $9.25. What is your maximum possible profit? Assume each contract is for 100 units. Potential profit References eBook & Resources Worksheet Learning Objective: 15-01 Calculate the profit to various option positions as a function of ultimate security prices.

Solution

Problem 2:

Max profit of put option = Strike price - put premium

Max profit of put option = 170 - 9.25 = $160.75

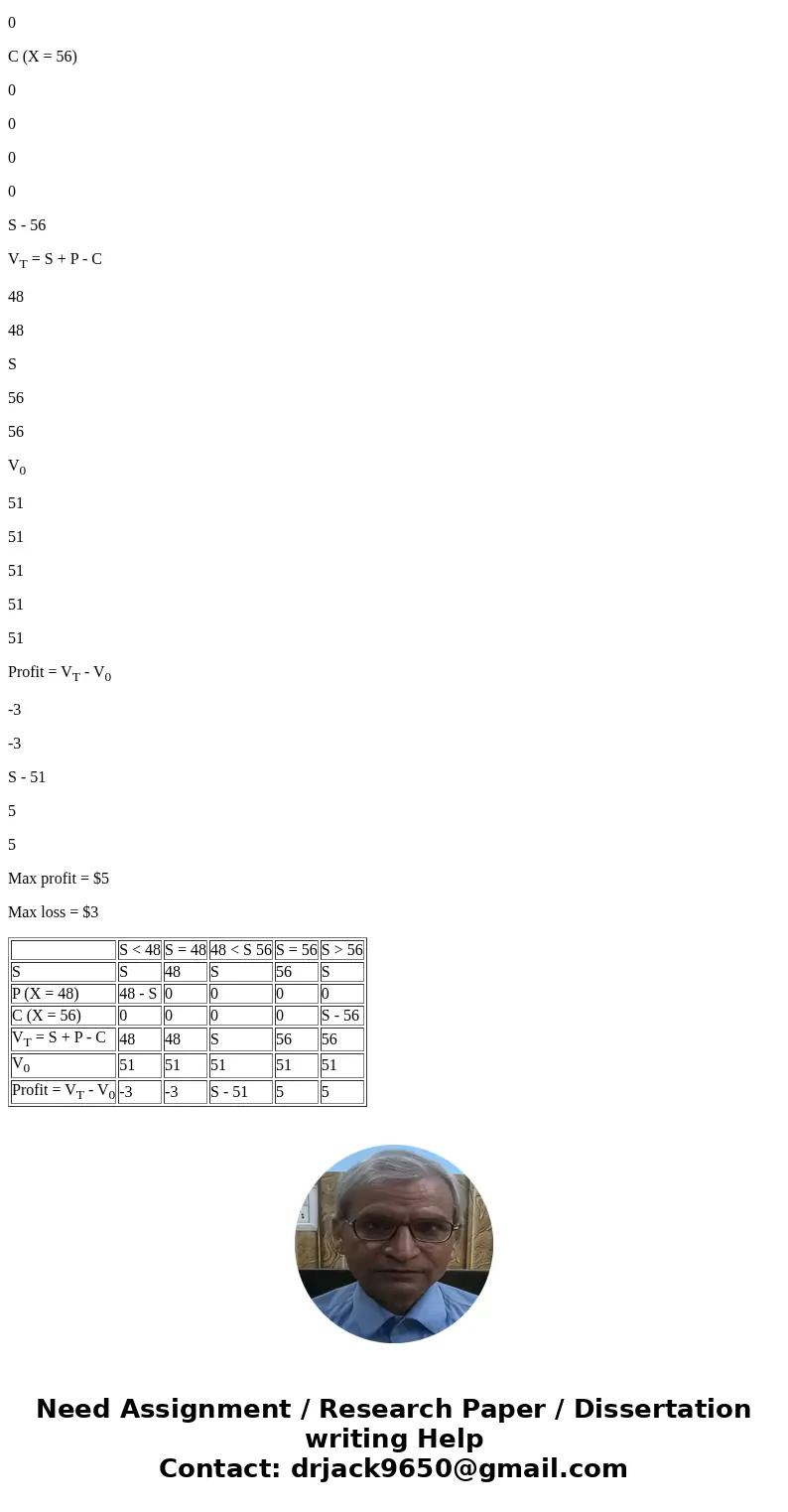

Problem 5:

Portfolio: V = S + P (X = 48) - C (X = 56)

This is a Collar.

V0 = 51 + 0.55 - 0.55 = 51

S < 48

S = 48

48 < S 56

S = 56

S > 56

S

S

48

S

56

S

P (X = 48)

48 - S

0

0

0

0

C (X = 56)

0

0

0

0

S - 56

VT = S + P - C

48

48

S

56

56

V0

51

51

51

51

51

Profit = VT - V0

-3

-3

S - 51

5

5

Max profit = $5

Max loss = $3

| S < 48 | S = 48 | 48 < S 56 | S = 56 | S > 56 | |

| S | S | 48 | S | 56 | S |

| P (X = 48) | 48 - S | 0 | 0 | 0 | 0 |

| C (X = 56) | 0 | 0 | 0 | 0 | S - 56 |

| VT = S + P - C | 48 | 48 | S | 56 | 56 |

| V0 | 51 | 51 | 51 | 51 | 51 |

| Profit = VT - V0 | -3 | -3 | S - 51 | 5 | 5 |

Homework Sourse

Homework Sourse